Malignant

-

Audio Recording by George Hahn

Last week President Biden issued an executive order to forgive billions of dollars in student loan debt. It was met with mixed reviews. For some, it’s a miracle, others think it’s a “bailout for the wealthy.” Representative Lauren Boebert believes it’s “robbing hard-working Americans to pay for Karen’s daughter’s degree in lesbian dance theory.” She says that like it’s a bad thing. At UCLA I took (no joke) Ellingtonia: The Study of Duke Ellington.

As with most political conversations, this one lacks nuance. Upon initial review, Biden’s act bothered me. However, like most things in life, the closer you look … the more shades of gray appear. What the executive order does:

- Forgives $10,000 in federal student debt to any borrower who earns less than $125,000 per year ($250,000 for a household of two or more). Pell Grant recipients get an additional $10,000 forgiven.

- Extends the pause on current student loan payments through to the end of the calendar year.

- Reduces the existing cap on monthly loan repayments from 10% of the borrower’s discretionary income to 5%.

Diagnosis

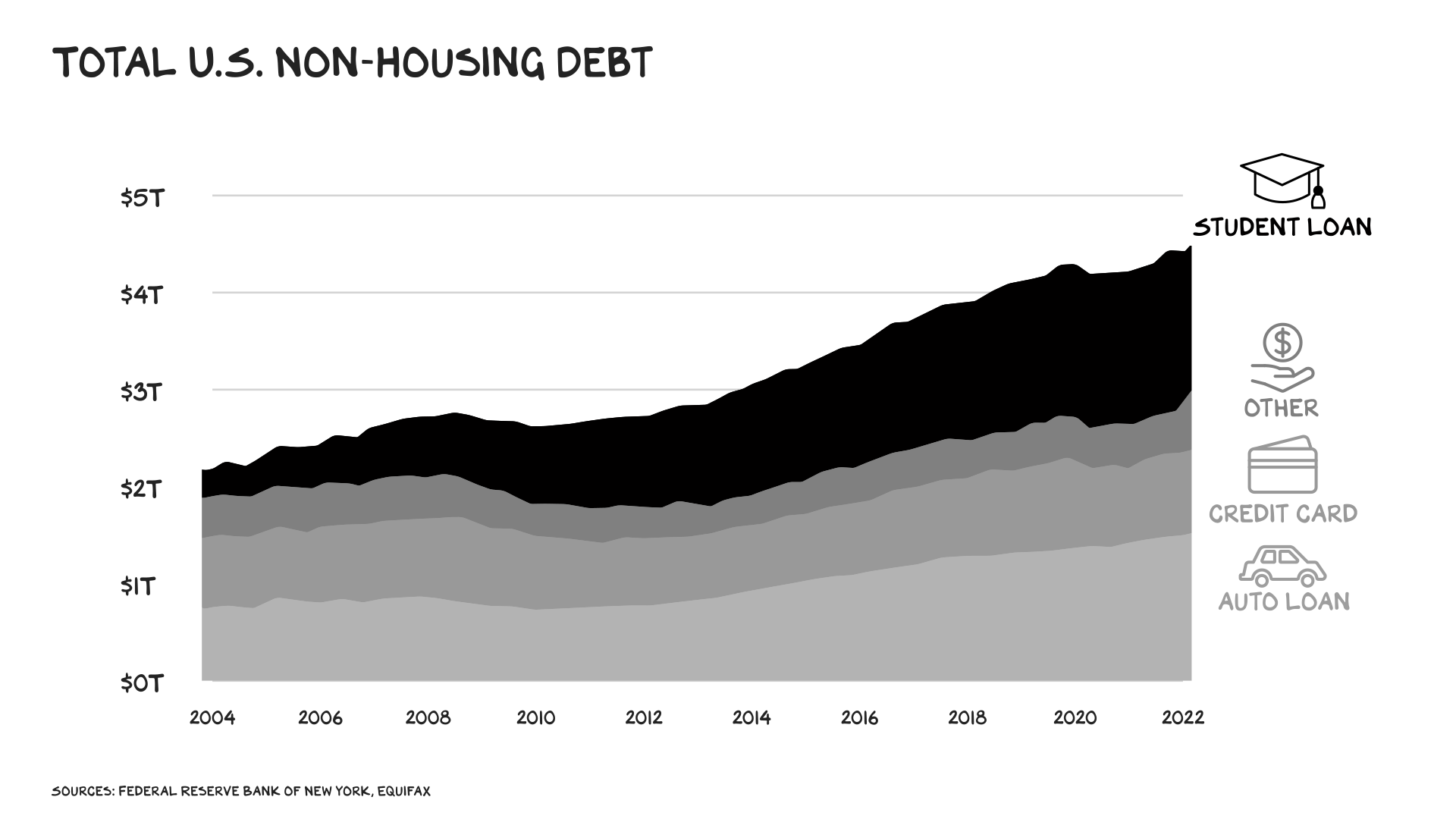

The tumor of student debt, initially benign, swelled into a malignant mass. We’re now dealing with a $1.6 trillion student debt load that affects 45 million people. More money is owed on student loans than credit cards, car loans, or any other consumer debt. It now accounts for 36% of all non-housing debt in America — up from 12% in 2004.

That debt is burdensome. Before the pandemic moratorium on loan payments, 7 million people had defaulted on their student loans — 1 in every 5 borrowers. Of those, 70% hadn’t completed college. Put another way, a tenth of people who took out student loans don’t have a degree, just debt.

Treatment

In isolation, Biden’s plan is a good one: Shrink the size of the tumor — by 20%-40%.

Estimates of the cost of treatment range between $300 billion and $1 trillion. However, many of these estimates don’t account for the additional payments to Pell Grant recipients, or the $125,000 income cut off. When you price in other factors, including the moratorium extension and the 5% income cap, the bill is roughly $600 billion over 10 years. This is real cabbage. Implementing universal pre-K and extending the child tax credit would have cost $350 billion and $545 billion over 10 years, respectively. Fun fact: Neither made it into the Inflation Reduction Act, as — unlike college attendees, old people, and private equity partners — kids don’t vote. Breaks my heart. But I digress. Many taxpayers, including the nearly two thirds of Americans who didn’t go to college or those who already paid off their loans, are understandably unhappy.

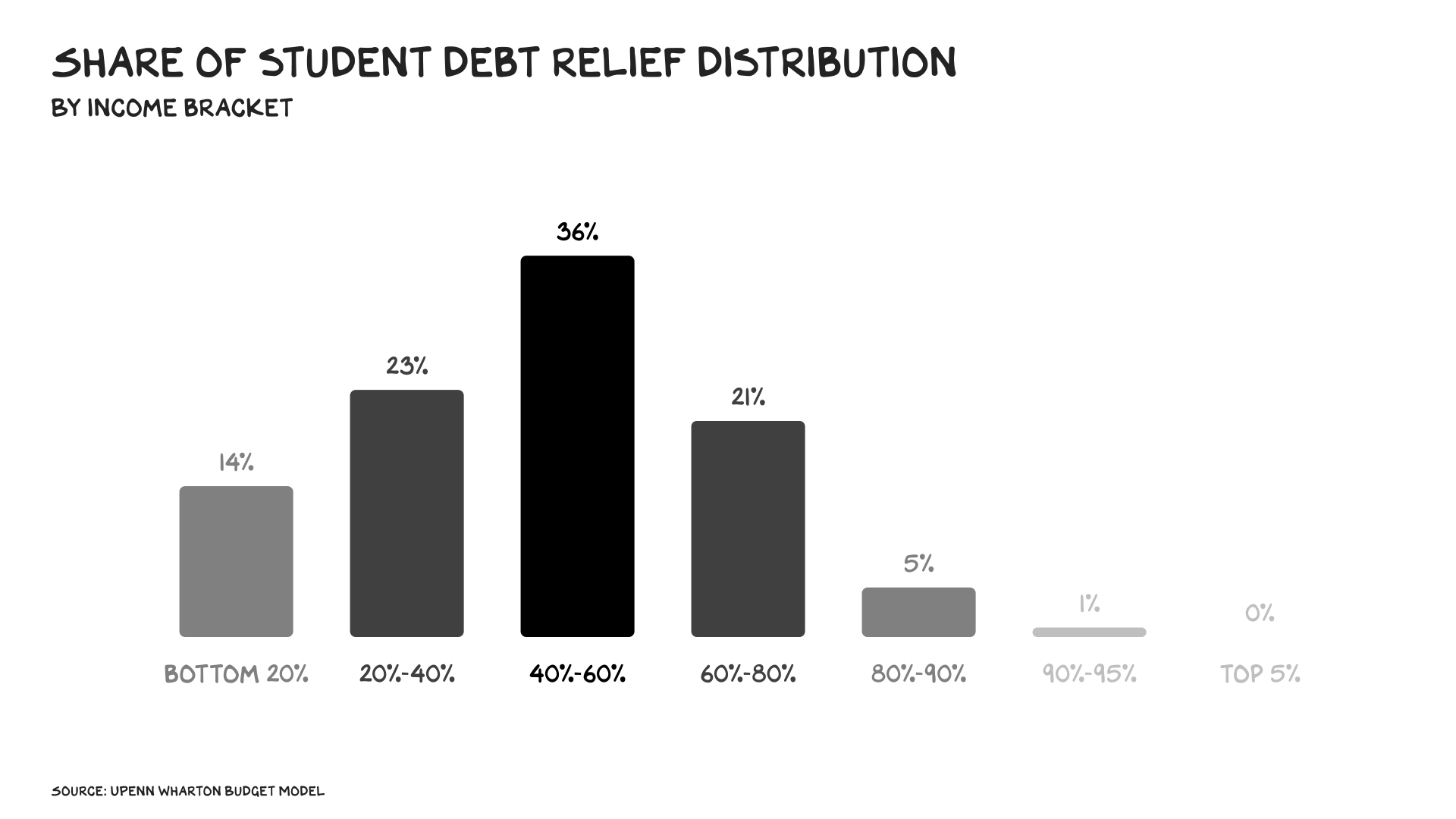

Also, college grads are rich(er), no? Well, maybe … in general, the demographic makeup of student loan borrowers is not affluent. Sixty percent of borrowers are Pell Grant recipients — and two thirds of those recipients come from households making less than $30,000 per year. In sum, 90% of relief dollars will go to people earning less than $75,000 per year. Some people who don’t really need relief will receive it — but they will be a statistical anomaly, and a pin drop compared to the share who are struggling. As for the burden of paying for this debt relief, even the National Taxpayers Union, a research group opposed to Biden’s plan, estimates it will cost taxpayers who make less than $50,000 per year a modest $190 in taxes; the long-term tax burden on those making more than $200,000 per year will be about $12,000. As for inflation, the impact is expected to be negligible: Moody’s estimates it’ll increase inflation by 0.08%; Goldman Sachs expects it’ll increase GDP by 0.1% and affect inflation only “slightly.”

Cancer

The bad news: We’ve treated the symptom but not the disease. When dealing with a malignant tumor, standard procedure is first to shrink it. But cancer is the underlying disease, and the day after the debt is forgiven, this tumor will resume its growth.

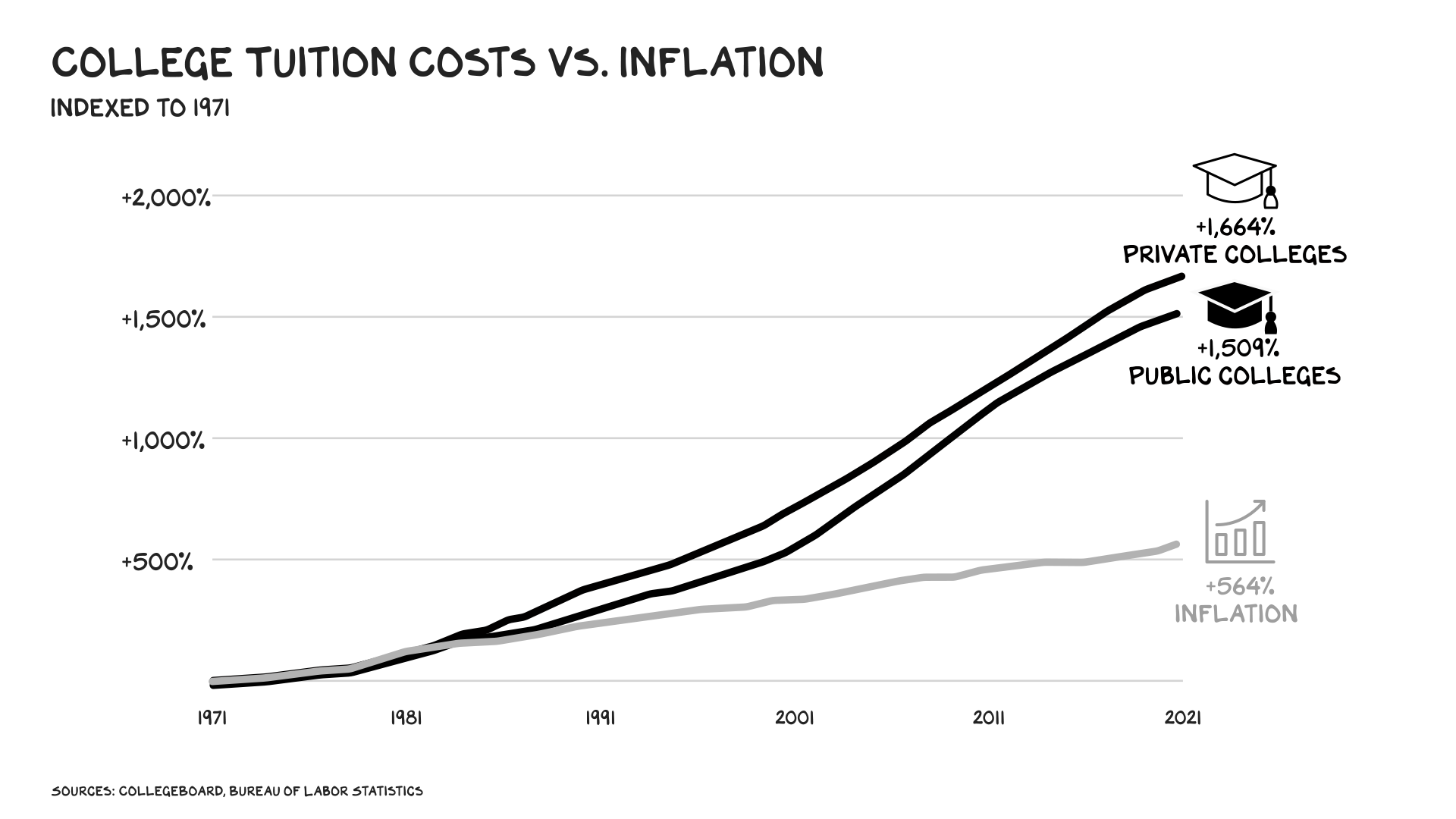

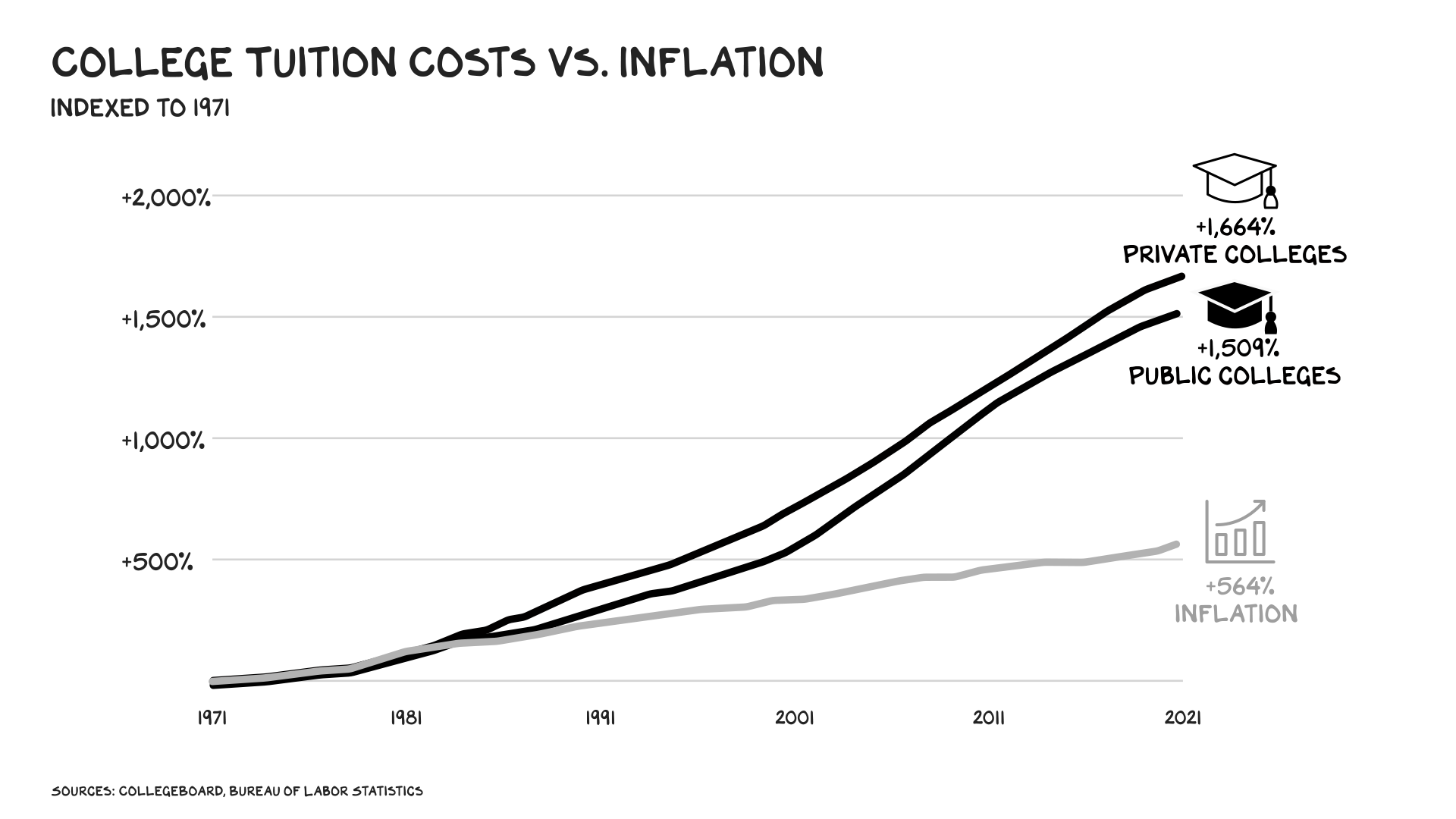

In the past five decades, the price of college has accelerated three times faster than inflation. Pell Grants used to cover 80% of tuition costs, now it’s 30%. Since 1990, tuition has risen three times faster than U.S. college enrollment. Higher ed has become a luxury good subsidized by BNPL-like loans that prey on young people and parents who’ve been taught to believe if their kids don’t graduate from college they’ve failed … on a cosmic level. I’ve railed against this system again, and again, and again, and again, and again, and again, and again.

I am also complicit. At NYU, we charge students more than $74,000 per year, making us one of the most expensive schools in the nation. Many of our students can afford it; most can’t. NYU parents and graduates have borrowed $3.5 billion in federal loans — more than at any other university in America. And in 4 out of 5 graduate programs, our students have borrowed more than they earned two years out of school. The median NYU loan size is the price of entry: $74,000. The dynamic is best summarized by the great philosopher Otter from Animal House: “You [the student] fucked up, you trusted us [NYU].” Note: There are exceptional leaders and donors at NYU committed to changing this.

Despite exorbitant price hikes, the product hasn’t changed materially. You’re still paying for a four-year tour of auditoriums and projectors, and access has barely increased. Critics of the debt relief plan argue that whatever the cost of higher ed, students chose to take out the loans, so why should we bail them out? I’m sympathetic to that view, but my experience inside higher ed tempers it. The truth is, we (universities, employers, society) haven’t held up our side of the deal.

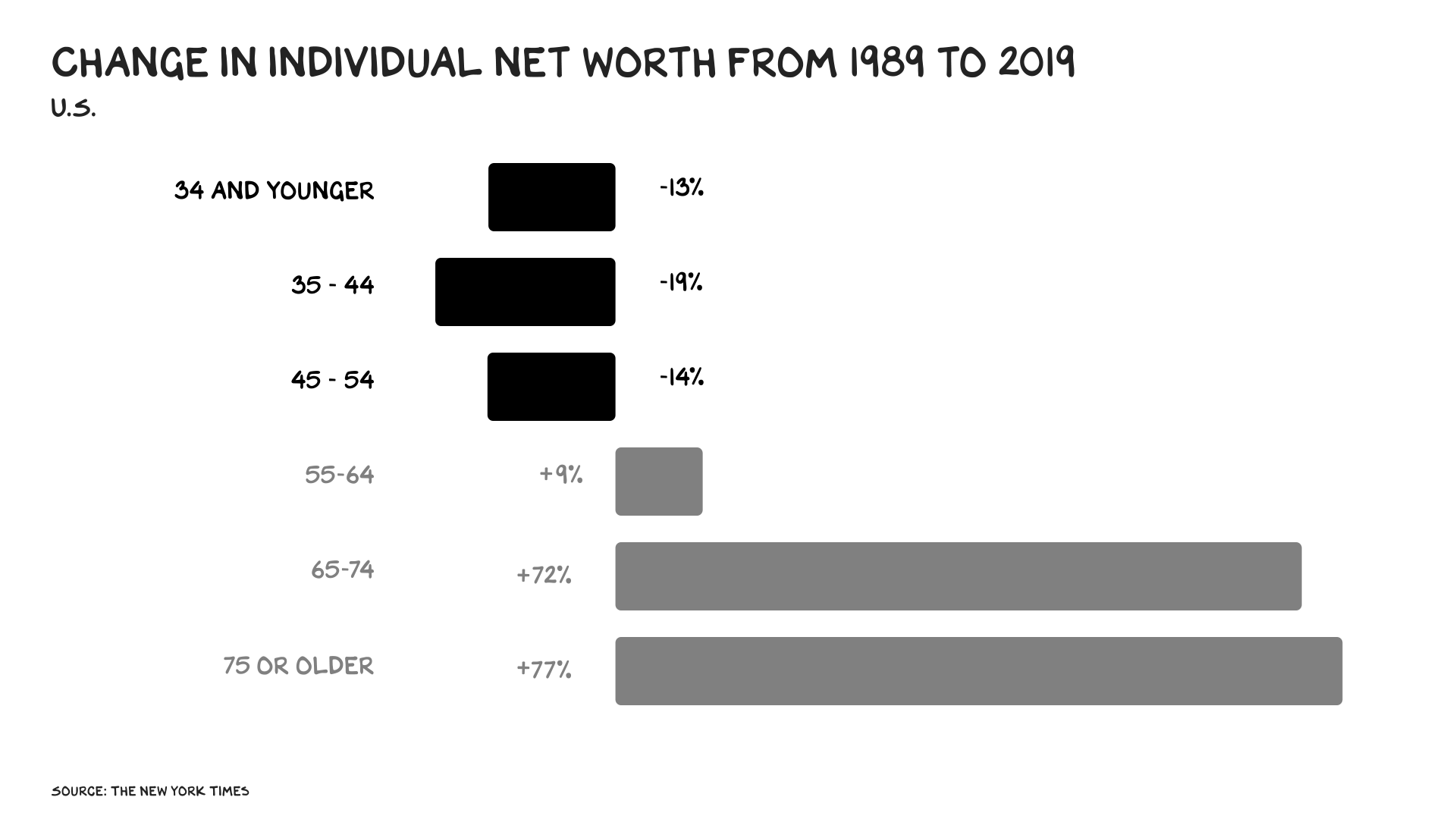

When I applied to UCLA (for the second time) in 1982, the acceptance rate was 74%. Today, it’s 9%. My Pell Grants covered all of my tuition and much of my living expenses. Fast forward, we have embraced an exclusionary, rejectionist culture such that the beneficiaries of great public education and infrastructure can entrench their own wealth and influence and limit new entrants into the market. The problem of income inequality in America is well documented. What gets less attention is age inequality. In sum, my generation has earned the moniker “the greediest generation.” In terms of wealth by age, there’s never been a more unfortunate time to be young in America — or a more fortunate time to be old. The average 75-year-old today is 77% wealthier than the average 75-year-old 30 years ago; the average 35-year-old is 19% poorer.

Cure

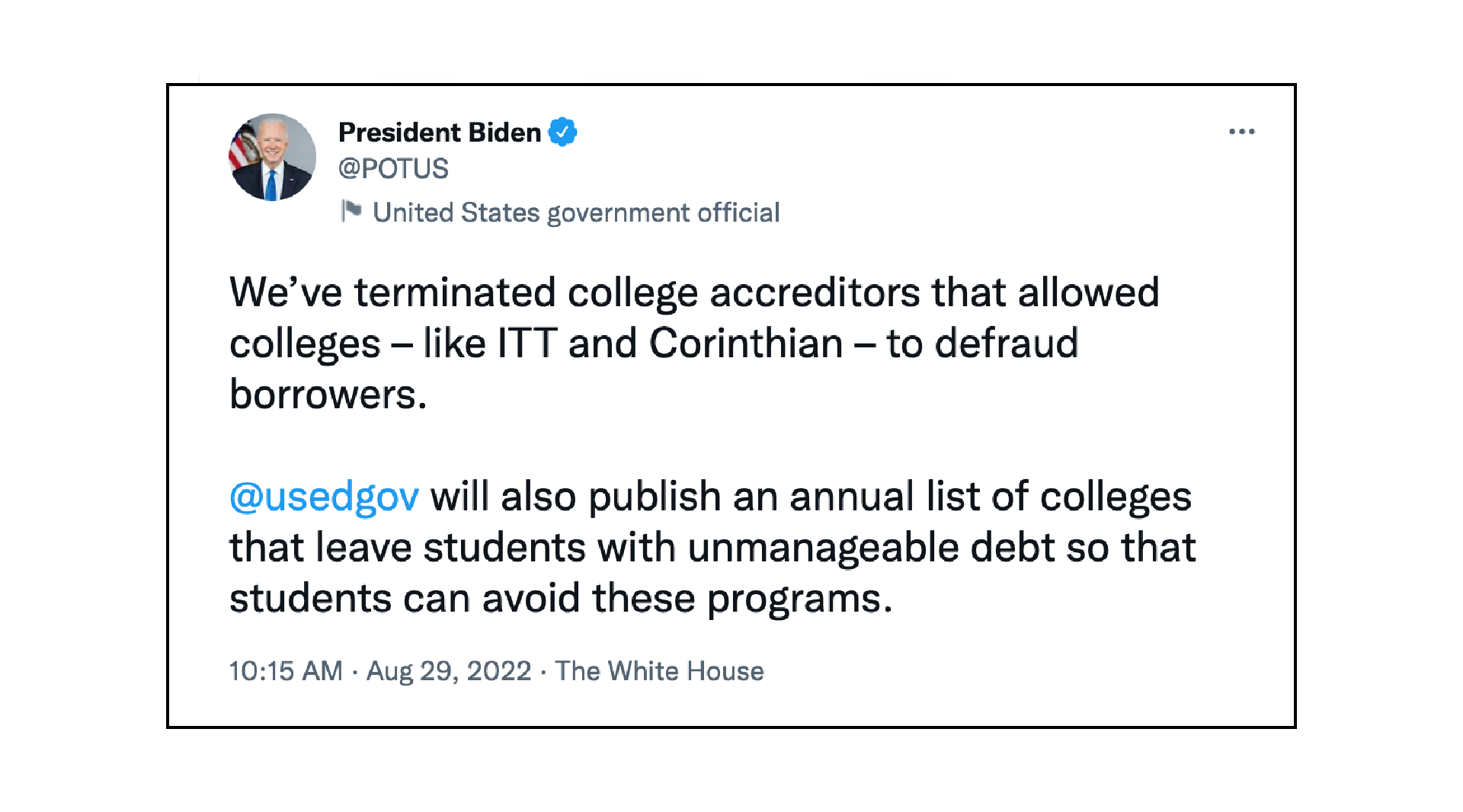

So, leveling up a younger generation that has seen its wealth as a percentage of GDP cut in half over the past 40 years is a worthy objective. After we’ve treated the tumor (debt), we have to cure the cancer (costs). Biden’s addressed the tumor, but he has no real plan for a cure. On Monday, the president tweeted he’s “holding colleges accountable for jacking up costs without delivering value to students.” How? He’s going to create … a naughty list. However, Mr. President, I can confirm we (university faculty and leadership) no longer see ourselves as public servants, but Birkin bags … and we have no shame. The last class I taught, at the peak of Covid, was 300 NYU Stern students (all via Zoom). We charged each student $7,000 to take the class. That’s $2.1 million (much of it in debt) for 36 hours of bad Netflix.

It’s true Biden did right by terminating federal loans for fraudulent for-profit college institutions, including Corinthian Colleges. But the notion that defunct for-profit colleges are the only institutions guilty of defrauding students is laughable. There are more than 1,800 colleges across the U.S. with student loan default rates of 15% or higher. The national average is 14%. Aunt Becky wasn’t sent to prison for fraud, but for cheaping out. (If she’d paid $1 million to USC directly vs. $500,000 to a middleman, her kids would have gotten in and she’d have stayed out of prison.) Similarly, for-profit universities have been punished as they are not part of the cartel and don’t charge enough to have tenured faculty and “ethics” centers.

Apart from the Department of Education’s unmanageable debt list, our government has done nothing to disincentivize colleges from raising prices. The only guardrail in place is this: If a university’s student-loan default rate breaches 25%, it can no longer access federally backed loans. In other words … 1 in 4 students must default before a college pays any penalty. One. In. Four. The bottom line is the culprit is universities — not taxpayers — and they should be on the hook for this, and any subsequent bailouts.

The missed opportunity here was a well-structured relief package paired with a plan to address the underlying problems. It’s easy to spend other people’s money and play Monday morning quarterback. However, we might actually be forced to step back to the plate, as Biden’s executive order is expected to be met with legal scrutiny and could be overturned. Then debt relief will require Congress to act, and that’s the opportunity to treat the cancer: cost, access, and format.

Beyond the existing treatment plan, here are three suggestions for creating systemic change:

- Offer expanded enrollment subsidies. This is the Grand Bargain. For public universities, which educate three quarters of our students, a carrot: extend federal/state funding to pay for the infrastructure (mostly technology) to expand enrollment through a mix of hybrid programs and year-round classes in exchange for tuition caps and reductions. If we have $600 billion to reduce the tumor we can find another $600 billion to cure the cancer. Private universities, on the other hand, get the stick: Increase freshman enrollment faster than population growth, or we dispense with the fiction that these are nonprofit institutions and start taxing endowments.

- Make colleges pay penalties for defaults. We need to implement harsher penalties on schools when former students default on their loan payments. So here’s an idea from former Education Secretary Bill Bennett: Make colleges pay a fee for every default. This would not only offload the debt relief from taxpayers onto our colleges, but incentivize colleges to bring education and cost in line with the economics of the Main Street economy. Another Bennett idea (similar but different) is to force colleges to take a 10%-20% equity stake in each loan that originates at their school. In other words, we engineer downsides into raising costs. (Specifically, downsides harsher than some bullshit naughty list.)

- Fund nontraditional one- and two-year vocational certificates. This would be especially powerful for the cohort that’s fallen the furthest fastest — young men. Vocational training in health tech, cybersecurity, specialty construction, and a plethora of other trades that don’t involve SaaS software are in demand. We need more mixing among young people who are going to Google and those doing apprenticeships to install energy-efficient HVAC. (BTW, great job — you can make almost $100,000 a year.)

Silver Lining

There are missed opportunities in the debt relief package. But there’s a lot to like. (See above: shades of gray.)

It’s also a positive sign for our government. Specifically, our government’s ability to get something done. The past four decades of policy have been characterized by gridlock and lethargy. Filibusters have become the norm; cloture motion filings have quintupled over 20 years. Our nation’s wealthiest call on government not to take action but to “get out of the way.” Eighty years ago, FDR was issuing more than 300 executive orders per year; these days, we get around 40.

A Higher … Higher Ed

A society built on rejectionism and frequent bailouts inspires moral hazard and class warfare. Many people approach me at conferences claiming their kid “doesn’t need college.” Yes, college isn’t for some people, but higher ed (affordable, different formats) could benefit most American youth. Jay-Z didn’t go to college and is a billionaire; assume your kid is not Jay-Z.

I was (seriously) an unremarkable kid, raised by a single mother who lived and died a secretary. The access and affordability offered by public higher ed not only gave me the opportunity to achieve things I wouldn’t have otherwise, but to be a better father, son, and citizen — more engaged in our society, more able to care for others. We need more, much more of this.

These are problems of our own making: a rejectionist culture, university presidents making $5 million a year, and an obsession with a four-year degree format. Where to start? Simple, where we came from: 76% admissions rates, Pell Grants that cover 70% of costs, different formats, and university accountability.

Universities are the tip of the spear for America. Our idolatry of innovators was fomented by a creeping, insidious gestalt on campuses that perverted our mission to identify the remarkable and make them billionaires. No, that’s not our purpose nor the soul of America. Our country is about giving as many people a shot as possible, as no institution or bloodline can predict greatness. Instead, we need to love the unremarkable … again … at scale.

Life is so rich,

P.S. One way to scale higher ed — do it online, with other people, at a much lower cost. This is exactly what we do at Section4. Check it out if you haven’t already.

Why has college become so expensive? It’s because of the huge increase of college administrators. The school I taught at went from a handful of administrators to a ponderous amount of unneeded administrators who began cutting faculty positions to save money. The cost has increased and the quality of education has suffered.

I think the growth of administrators/lazy rivers/clubs/other attractions is a result of the available funding and not the other way around. The government made money for degrees cheap, and much like every subsidy it wildly distorts the value.

It makes no sense to me to do this. People voluntarily entered into the debt. If the argument is that they didn’t understand the implications, then why is credit card debt not forgiven or why do we let people vote at 18?

I have seen some stats suggesting that ~60% of student debt is by graduates. So we aren’t talking about 18 year old students anymore.

My biggest issues is that having a college degree — for the vast majority of people — means they earn more than those who do not have a degree over their lifetime. So what do the people benefiting from higher lifetime incomes get those who don’t benefit to help pay for it?

As a Canadian, where higher education is still not a barrier to entry – an undergrad degree is affordable to all. As a result, upward mobility in Canada has not been hampered by the ridiculous cost of tuition. Even Graduate Degree tuition, while high, pales in comparison with the outrageous cost of American schools. How can American remain the driving force for innovation and growth in the world, if it disenfranchises its population of potential innovators through unaffordable higher education. I would be worried

For many of the undergraduates I teach, student loans go toward both tuition and toward room and board. The comments here mainly revolve around the pros and cons of forgiving loans that, in theory, provide for an educated commonwealth (and to paraphrase Scott’s favorite saying, “generate positive externalities”).

But is it fair to forgive loans that were freely taken out so that a young adult could enjoy dorm life instead of staying home and commuting? I see these loan forgiveness proposals as subsidizing “fun college living” just as much as “acquiring useful knowledge”.

Excellent storyline. The ‘cancer’ in this story is the result of too little accountability on colleges for 1) student learning gains, and 2) student earning gains. Where is the part in the implicit higher education contract that says in order to get any funding – whether through state legislative underwriting, student tuition, or federal borrowing aka the ability to receive Pell grant payments – the college must demonstrate some serious commitment to student outcomes? Nowhere to be found. To see what a real commitment to student success looks like check out the funding formula at Texas State Technical College. State funding here is not based on headcount or Carnegie units. The TSTC funding formula is 100% driven by student post-exit outcomes, including both completers and leavers. If the student does well, the college is rewarded. Does the college have a vested interest in making sure that they’re offering market-aligned programs and employment-relevant curricular content? Absolutely! Check out the basics of the TSTC funding formula in this podcast with TSTC Chanceller Mike Reeser and Vice-chancellor Michael Bettersworth with Joe Lonsdale of the American Optimist: https://americanoptimist.podbean.com/e/this-texas-college-offers-a-money-back-guarantee/

Not every college has to be as committed to being as market aligned as TSTC. Not all education is a direct financial investment. There’s plenty of room to engage in learning for consumption aka the joy and rapture of simply learning new things. But colleges are entrusted with the job of teaching – or at least facilitating learning. Until colleges have some accountability for student learning gains and post-exit successes there is no curing the ‘cancer’.

Why is the University Presidents job (almost exclusively) to raise money ? Why does a top 20 University need $billion over the next couple of years in new buildings to remain competitive? Is the goal to teach people or to do something else?

Exactly Don. That’s why it will never change. They are all building their own Taj Mahal’s. And it’s not just the elite schools, it’s all of them. The kids are attracted to the facilities. If the school wants to maintain or grow admissions they need to spend money.

Can someone tell Scott that “gestalt” doesn’t mean what he thinks it means? He’s been (mis-)using the word at every opportunity recently whenever he’s trying to sound smart.

Why would you not just include it in your comment and be helpful rather than be spiteful?

Tell me more about the middlemen.

You implied that half the price of college goes to them.

You have moved to london, where the cost of energy has tripled, good move scott, but I digress, Every american owes 242,000; the country is 21 T in debt and you are kicking out another 600 billion. That on top of the monies to the border crossers, the monies to fund a war in ukraine, the bill to stop bridges from collasping, only to find the pension funds of NEW YORK, ILLINOIS, AND CALIFORNIA getting the lions , You have uncle Festus making decisions and the third in line in session attempting to start wwIII, Check that comment about moving to London, as I live next to luke Air force base where the the F-35’s , use my house to practice bombing raids, I want the washington to sit on it’s hands, and let the American people decide what they want to do about student loans. In chicago Mayor Daley use to give out free Garbage cans for votes, the ante is now a Garbage truck for the dems.

Can you address the interest issue. I have read that the majority of the costs of student debt (as you cited $1.6B) is not the amount originally borrowed but accrued interest. Relatedly, the interest rates charged for student is usury-level- 5-8%. Recent PPP loans (since forgiven btw) charged 1% interest. So why the allowed abuse of students?

Also, can you discuss the role played by the implementation of a law that prohibited the dispensing of student loan debt in bankruptcy. All other debt is permitted to be forgiven but for student loan debt. This clearly has contributed to the marketing of free-wheeling issuance of loans and provided further incentive to colleges to raise tuition.

The kids are screwed, society pays the external costs, and taxpayers pick up the tab while neither the banks nor the schools profit hand over fist while having no skin in the game. Nice gig for them, and one that has to be called out and stopped.

I wish the communication and framing of this crisis more accurately demonized the profitting, powerful players and not the kids.

You need Kara to force you talk about the elephant in the room. Tenure – kill that to make sure professors have to compete with low cost labor like the rest of us. Then costs come down. Address the cost – colleges are fat with admin – non performing tenured faculty. I assume you are tenured.

Back to 76% admissions rates and grants that cover 70% of the costs means bad facilities and lower pay for professors and mixing with deplorables however one defines that. The elitist college administrations will never agree to this and surely won’t want to give up their luxurious faculty dining areas.

What caused the tumor? Did we go have fun in the sun and end up with skin cancer? Couldn’t we have used sunscreen?

Why have colleges increased tuition by 2.5 times the rate of inflation for over 30 years?

Prof Galloway, you should really dig into the changes in higher education circa 1970. Looking at the Land Grant colleges specifically. Between 1970 and current times the state support which was supposed to be built in has evaporated. The growing loan system changed what was a cost of goods into a an investment Ponzi scheme. Shrinking support for state schools was not a one for one dollar game either. Different dollars spend differently. Add in the closure of company training programs and they’ve outsourced the costs of doing business to the college student. The states further exacerbated that fact. Then industry infects career programs at colleges making demands on what colleges teach (politicians too) yet students bear the brunt of all costs.

It was not history of Duke Ellington it was Music 132b the development of jazz and you know it

No one is noticing how badly accreditation, set up in 1992, is working — as self-regulated gatekeepers, they should be closely monitoring and shutting down lousy schools. BUT accreditors are too busy representing the interests of their membership, which bankrolls the scheme with dues and fees — NO WONDER it’s not working! No independent watchdogs monitoring post-secondary quality! NONE!

Love the content as always Scott –

You make a lot of policy proposals – and I think it’s valuable to put a stake in the ground.

But! One perspective that might be missing is how incredibly hard it is to intervene in complex systems, and how often well-meaning system interventions (EG: Medicaid for single moms, government subsidies of dialysis, and government-subsidized loans) can have deeply perverse and negative consequences (EG: creating huge incentive against marriage, creating an incentive to get lots of the population on dialysis, and enabling extreme loan growth with no consequences).

I think we need to keep these famous backfires in our mind as we try to build a better future through “Big Government”.

Thanks Scott!

Right on. The anecdote about the $7000 per 300 students at NYU raising $2.1 million is truly outrageous. What about banning donor ego enhancing naming rights for buildings and auditoriums? Let’s get some big changes made!

Good post. It’s worth noting that the “exclusionary, rejectionist culture” that Prof G mentions is pervasive at only a subset of the American higher ed landscape. I’d love to see the “big dog” put his money where his mouth is and reach a community college course once in a while.

Long time fan first time commenter.

What about the All In Pod idea that not all degrees are of equal value? We shouldn’t loan art history degrees at the same rate as a computer engineering degree.

I have an English degree and it has taken me so far. Liberal arts degrees teach you how to think, consider other views, recognize beauty and harmony.

This crazy concept is known as a free market where lenders assess the creditworthiness of borrowers and adjust terms accordingly. Federally-backed student loans have removed this dynamic from the system.

One other issue not mentioned is the interest rate on the student loans. The govt. are using our to loan to the kids and charging anywhere from 5-7% . You tell me it costs that much to manage the loans. I think all taxpayers should get a dividend check each year for the student loan debt profits.

You got my vote

What about the institutions giving out these loans as if they were candy. When I was in college (72-76) I tried to get a college loan and luckily I was refused. Now they give out loans like they were a mortgage company from great housing bubble days. Make them pay. Like they made the defunct mortgage companies who gave out the NINJA loans. (Not)

I was initially opposed to student loan forgiveness, but it’s really nothing new. Consider bankruptcy laws which provide similar forgiveness on a recurring basis and the recent PPP loan forgiveness. The only difference here is it’s targeted to help the little guy.

Solution: Government should get out of the student loan business. Less money will eventually mean lower tuition rates.

Students should be able to declare bankruptcy and be discharged from these debts. Stupid loans won’t be made if the lenders lose.

Colleges should use their endowments to make loans in which they benefit from as they understand better both the quality of the student and the educational value of their programs.

In other words, allow the free market to sort this out.

Government policy no matter how well intentioned is detrimental if it creates unintended negative consequences.

What muppet thinks that 600 billion here and 600 billion later is not real money-universities are supposed to dispense know how- if that know how is defective or not enough to support a living, shouldn’t those sharlatans who dispense diplomas, be fully responsible- either via debt discharged via courts or suing schools for unreasonable and unrealistic expectations sold to the public!? If earning a degree from Juilliard that incurs 200k debt only few will make it in real life to support those debt loads, why it is the responsibility of the Johnny Public to pay for the debt while if they enjoy the music, ballet they can buy a ticket but not the whole boat of debt- some are taking full advantage and living a life with no responsibility and no inquiry of what they sign or do the due diligence of the entanglements they accept- crooked culture of borrowing from Peter to pay Paul, Paul will always be there to vote for the crooks who throw him a bone, from Pete’s money

No, the educational institutions shouldn’t be liable for over charging for their services. That is not illegal, nor should it be. Is it illegal to sell a handbag for thousands of dollars?

Government should get out of the student loan business. Less money will eventually mean lower tuition rates.

Students should be able to declare bankruptcy and be discharged from these debts. Stupid loans won’t be made if the lenders lose.

Colleges should use their endowments to make loans in which they benefit from as they understand better both the quality of the student and the educational value of their programs.

In other words, allow the free market to sort this out.

Government policy no matter how well intentioned is detrimental if it creates unintended negative consequences.

It’s not reasonable to compare non-profit institutions to luxury fashion brands.

Unless your point is that they’re really for-profit companies and should be treated as such.

Prof G is literally comparing non-profit institutions and their services to luxury brands in this article. Jeffrey is right. You didn’t make a point but I’m certain whatever it would have been is wrong.

As someone whose life was significantly improved by going to university, I dismay at the current costs of doing so. I am from the UK where the cancer now is very similar. Education is the key to both self improvement and improvement of our societies so it must be accessible at a reasonable cost. Love the posts – my Saturday morning wake up to the world!

Just a thought, but if these student borrowers went to purchase a car or any other asset with debt, they would be required to provide some proof that they would be able to repay the debt. Serious question: has anyone looked into the amount of debt acquired by students studying something that really can’t provide a decent living wage? And a correlated question, has anyone considered that maybe the professors of these degree programs should maybe be paid less than one teaching in a curriculum that does offer an opportunity for a great career after graduation? Final question and then I’ll get off my soap box, how many of the fees universities charge are really profit centers disguised as legitimate fees? My kids (really me) had to fund all kinds of things my kids never used or even would consider using. If you really do want to fix the ‘cancer’ – look into what we’re ‘funding’ and why. I wouldn’t pay a dime to reduce the student debt of someone who chose a ‘career path’ that had limited economic benefit – to them or society in general.

Great article. I would be interested to know the numbers on: these high college tuitions – where exactly is the money going? I’m not a college professor, but I could hear them being hesitant to criticize high cost of education when their own salaries are relatively low.

Government is always the problem that is what is wrong with Amerika today take it from people who have seen Socialism in Latin America ruin their countries but the good news is the Socialists in the USA are allowing us to come to the USA Scott is brillant marketer ( especially of himself) well written . Big Gov is the problem so dont look for band aids Bidens puppet masters took this decision to buy votes but as there is no free lunch ( yes Scott knows this) it was a drastic mistake Surprised Scott you did not do more bleeding heart comments about how it is regressive hurts the working poor slobs like most of us to help the elite but I guess 125k to the elite means they are slobs ( out of touch elite )

Thanks for the super work as always you were too gentle on the puppet masters leading the USA to ruin who are screwing up a more laissez faire system ( the same people who created the financial mess of allowing raising prices and easy loans. Surprised you get the puppet masters even a passing score. PS Scott we need more of your prognostications I have lost about 2 million dollars on your prognostications re Amazon etal sorry to be blunt but you have been quiet for a while on your stock market forecasts of the FAANGS

I agree that we are failing to address the root cause of the college debt malignancy, but it is not only the college system that is troubling. Our entire educational system is failing under the weight of higher expectations and outmoded methods. I won’t go into the textbook industry and constant churning of methods; that’s a tome of its own, but we need to look back to how the system promoted by Horace Mann has metastasized. For the sake of economy, I append the comment I made on a similar article elsewhere:

One reason a college education is needed is that the high school credential has become worthless. Around half of high school graduates do not exhibit grade level proficiency in either mathematics or language skills, nor do they have any other useful skill. The first years of college for these kids, if they attend, will be filled with remedial high school level courses. We need to stop social promotion, revise the way courses are taught, and ensure that every child who graduates from high school has the skills needed to support themselves. No enterprise or government organization which requires mission-critical competence would organize training in the way we do high school education. Proper K-12 education would render much of college unnecessary for many. Much of high school could be organized around a skills certification model, allowing the talented to proceed to further development and ensuring that no-one is out of their depth at any time. Add to this vocational training and apprenticeship programs, and tough-love counseling for those who wish a career in literary criticism but are not in possession of a trust fund, and maybe we can get America’s educational rip-off under control.

It seems that there is even more damage done to borrowers as Wall Street profits from these debts:

Clips From Jason Stanford’s “The Experiment” substack newsletter:

Sorry, risky Wall Street investments you say? You didn’t think banks were content to simply collect interest on the $1.73 trillion in outstanding student debt, did you? Remember what they did with all those home loans before the Great Recession? Yep, meet SLABs, or student loan asset-backed securities. They pay out like ordinary bonds but are just a bunch of student loans packaged together, which is where things cross over from risky into straight up evil:

The main purpose behind SLABS is to diversify the risk for lenders across many investors. By pooling and then packaging the loans into securities and selling them to investors, agencies can spread around the default risk, which allows them to give out more loans and larger loans. This way, more students have access to loans, investors have a diversifying investment instrument, and lenders can generate consistent cash flow from their securitization and debt collection services……

Wall Street needs people to take out loans to prop up SLABS and deliver higher and higher returns. Funny thing, people who don’t go to college don’t take out college loans. I am not arguing that popping the college debt bubble and causing a recession is a good thing. Every time an investment banker gets the sniffles, a renter gets the flu.

I am arguing that any industry that depends on putting all the risk on the customer who is forced into unsustainable financial commitments is a lousy way run a railroad.

Sometimes you hit it out of the park…today’s article is an example of such a home run.

The reason UCLA could provide such a high acceptance rate in 1982 was that the statewide California system was efficient. For a certain GPA, UCLA (or Cal, or Irvine, or San Diego). Next, the State University system, Cal State L.A., or Northridge, or Dominguez Hills, etc. Next, the excellent junior college system, LACC, or Valley College, or Pierce, or Santa Monica City College, or West L.A., etc. Of course, once the Jarvis tax cuts began to have a profound effect, state funding for education began to plummet, and the schools responded with tuition hikes, limited growth, and, ultimately, the situation we see today. It should be noted that UCLA is the top-ranked public university these days, above Cal Berkeley, Michigan, UVA, and the rest. Thus it gets more applications than any other university in the U.S., and there’s only so many students it can accommodate. And in-state tuition of $13,000 makes it the greatest bargain in higher education, as well.

Government is the problem Scott. BJ ‘a response is right on.

Government is the problem. BJ has it right on.

The cancer is government subsidizing the cost of higher ed. Full stop. When the government implicitly backs the majority of these outrageous loans it creates a system where higher ed is incentivized to see how far they can push out the cost curve and kids/parents feel like they can afford the loan because “why else would someone give it to them?”

For the record I’m not taking a side here, just calling it what it is. I believe there’s a strong case for government subsidies in higher ed but serving up risk-insensitive student loans to 18yo’s is probably not the answer

How about requiring colleges to reinvest a certain % of yearly endowment gains back into tuition abatement? If they don’t comply, they lose their tax-exempt status. Some colleges literally generate billions in gains from their endowments per annum. Is it so bad that they have to recycle some back into tuition abatement? I think the invisible hand would work well in this case.

Make schools pay for defaults? Make schools pay for drop outs too. Make parents co-sign ALL loans and hold them responsible. Make students work off their debts like potential doctors do by working in needed communities. Make 2 year community colleges the first choice for all HS grads to get the early mandatory classes done. Make ppl responsible for their actions.

I went to a 2-year school, transferred to a public 4-year college, had a Pell grant, and did all the things I was supposed to do, and still ended up in debt. So these things help but they aren’t the solution to everything. I’m tired of being made to feel like I wasn’t ‘responsible for my actions’ when all I was trying to do was be employable at a job that wasn’t waitressing

Well put. As much as I begrudge being absorbed into the cusp of boomer generation – the 1982 vs now stats don’t lie and we didn’t pay it forward. The three point plan listed plants accountability fairly and squarely where it belongs

You’ve touched on a subject that I’m very salty about. From 1985-89 I attended a well-regarded engineering school in Indiana that tied with Notre Dame for being the most expensive in the state. All in it was about $60k for the four years. Given my family’s blue-collar status we got lots of grant money so I could go, and I ended up with loans of about $12k. This has allowed me to achieve an upper-middle-class life, with means my parents have struggled to fathom.

Two years ago our youngest son was accepted to that same school. We make too much money for him to get grants and aid, but not enough to pay for remotely the whole quarter-mil-over-four-years ride. Yep, a fourfold increase since my 1989 graduation. He would have come out with six figures of debt. I told him that didn’t make any sense for his life whatsoever. He’d get nearly as good an engineering education at Purdue for a fraction of the cost, and be able to come out debt free.

I’d be curious to hear your thoughts Scott on a proposal to eliminate federal loans for any non-public college. Force private colleges to compete on price and tap into these endowments. Some would fail but that wouldn’t be a bad thing. This would also drive higher investment in public colleges. Many talented, smart kids would choose public colleges for affordability reasons potentially creating a virtuous cycle.

Agree. This. It’s baffling that so many smart people don’t see the correlation between the cost of higher ed and the availability of government-backed credit. Although it’s not surprising those benefiting from it would propose more subsidies versus less.

Just require these private colleges to provide their education to federal loan recipients priced at or below the national median price.

Bravo!! I am almost in tears. As a person in their 50s who still has student debt, you articulate the nuances of our dilemma beautifully. I, too, grew up with a single parent and working class, and I have been paying for it ever since. Even though from the outside I look successful (if you haven’t seen my apartment), I have a negative net worth. Thank you for all you do!

Great points! However I still fear that, yes, we will eliminate the tumor but the cancer will live on (and get worse).

item 1: Corporations are people. Not allowing students to declare bankruptcy seems contrary to all that is afforded to other entities.

item 2: all education should be free. Paid for by the taxpayers who will eventually reap the benefits of that educated society. An educated workforce is the engine of our future society. The better educated they are, the more productive they should become. Best outcome for our society in general. Who would be opposed to that?

Agree. This. It’s baffling that so many smart people don’t see the correlation between the cost of higher ed and the availability of government-backed credit. Although it’s not surprising those benefiting from it would propose more subsidies versus less.

Education debt is dischargeable in bankruptcy because the best path in the dischargeable case is for the student to declare bankruptcy right after graduation. The result is no private party would make a loan and the government would be creating a massive free college program.

All college should not be free. OK with the lowest state tier and community colleges. There should not be free NYU $75,000 a year paid by the government. And maybe, the loan value should be tied to the average earnings that the particular degree achieves in the real world.

Parents and students can do a great deal to make the cost of college more reasonable. The idea of moving across the country to go to a college that you can’t afford (i.e.: you have total out loans) makes no sense and it’s only done in America. Everyone else goes to a local college, often living at home. If students start out with a community college, the cost is readily covered by a summer job or a part-time job when classes are in session. NYU exists only because many students want to live in NYC, not because it offers much of anything else. And many students don’t understand that cost of renting an apartment in the very costly campus area. The cost of offering courses is actually quite small, but that is not what colleges are about. Almost all the money and attention goes to promoting academic scholarship. Professors spend almost all of their time engaged with their research, writing, and thinking about all matter of subjects. It’s mostly fascinating and mostly useless stuff, and it costs a fortune. Getting a 17-year-old to go to a local school or getting them to enroll in a program geared to their interests and abilities is hard, but bankrolling the excesses of the universities and the whims of young people is not the way to go.

Where is debt forgiveness for parents who took on debt so their children would not have student loans. We are not alone in doing that for our sons.

Don’t always agree with Scott, but he’s pretty much spot on in this piece. Having been an adjunct and someone who has both a bachelor’s and master’s degree, I see the crazy cost of higher ed as a huge problem. The one thing he missed is the compound interest that student loans are allowed to use and the higher than normal interest rates banks charge on those loans. If not for compound interest, my loans would have been paid off long ago.

Thanks for the plug for energy efficient HVAC! Seriously, the trades pay well and are literally starving for new talent. The Biden admin needs to spearhead a movement to make trade schools free. We can live without more SaaS engineers, we can’t live without plumbers and carpenters.

Amen, sister! Say it louder for the folks in the back!

Dear Professor Galloway;

You wouldn’t have to leave your NYU campus to take a short walk to the music department and poll the faculty there on Duke Ellington. You’d learn that most of them consider Ellington the greatest composer this country has ever produced. Or, instead you might hop in a cab and take a ride up to Lincoln Center and conduct the same poll among the music professors at Juilliard, from whom you would learn the same thing. So my question would be: why would you consider a course at UCLA with the title of “Ellingtonia: The Study of Duke Ellington” a joke?

The explosion of student debt truly began when Obama got the government to take it over. You may recall that he promised it would result in positive revenue to uncle sam. Guess that was off by a few Billion!

Average loan is $24,800.

Average payment is less than $300/month.

College grad average salary is $52,000 v high school grad $30,000.

Where is the crisis, burden? Total baloney and you got had.

Plus basic unfairness and lack of Constitutional authority and bastardization of faux pandemic authority.

When the Biden student loan forgiveness story broke I could not wait until Professor Galloway weighed in on this. Could not agree more with his conclusion we’re treating the symptom not the disease. The other factor is that 90% of students attend colleges at least 40 years old. The accreditation cartel is a high headwind for new degree granting colleges with lower cost structures and course delivery to disrupt the status quo. Competition is blocked. Higher Ed is an insidious beast.

What about the people who joined the military or went into the blue collar occupations because they could not afford college and otherwise lived within or slightly below their means? …………….

Pay for the college debt for everyone else.

I am curious what percentage and $ amount of student debt is in loans that are NOT federal loans. None of the articles I’ve read about this executive order mentions that. If anyone knows, please include it in a comment.

I believe it is about 10% or so

You say they are curing the tumor, but I say they’re just shuffling it from 1000s of individual corpses to the granddaddy of corpses (US deficit). How about we make normal bankruptcy laws apply to this debt, have interest rates reflect the default rates, and let universities then face the reality of the horrible value they deliver. Government funded education and true merit-based funding can continue without the madness.

Agreed. Having the system function outside of traditonal market dynamics is the real issue. BTW – that includes putting back an admissions system based on measurable merit, not on race, or gender, or income. It’s not elitist to see we have created too much demand for 4 year higher education and provided loans for same believing that was going to level the socioeconomic playing field, yet now we have millions of folks with lame degrees and 250K in loans when most of us can’t get someone to come and fix my refrigerator. Incentives (and capital) drive markets. Shift the loan programs to incentivize attendance at technical colleges and smaller state schools. This will better “love the unremarkable” and provide a more broad based, productive populace.

It’s insidious and wrong that student debt can not be included when filing for bankruptcy.

Good read as always but even for this Democrat, The Loan forgiveness is bad for almost everyone except the forgiven. Speaking of forgiveness, I can never forgive Biden for this. So how could an independent Weber vote for him now. I guess they could if the alternative sucks, and they usually suck

Brilliant ideas- now we just need to hold the legislature so we can make them real! I’m glad you came round to see that a bit of relief for those hardest hit by this boondoggle goes a LONG WAY- if only for the sense among voters that they are being heard and that government can as you say, get things done.

One other option to add, eliminate the legal barriers to discharging student loan debt in bankruptcy. It’s effectively the only debt that can’t be eliminated.