Labor Day

Audio Recording by George Hahn

I’ve been thinking about labor and the holiday meant to celebrate our nation’s workers. My observation: “Labor” Day is a ruse, just as “hero” is a moniker typically attached to someone we’ve decided to underpay — teachers, front-line workers, etc. A more honest name for a holiday describing who/what we value would be “Capital” Day.

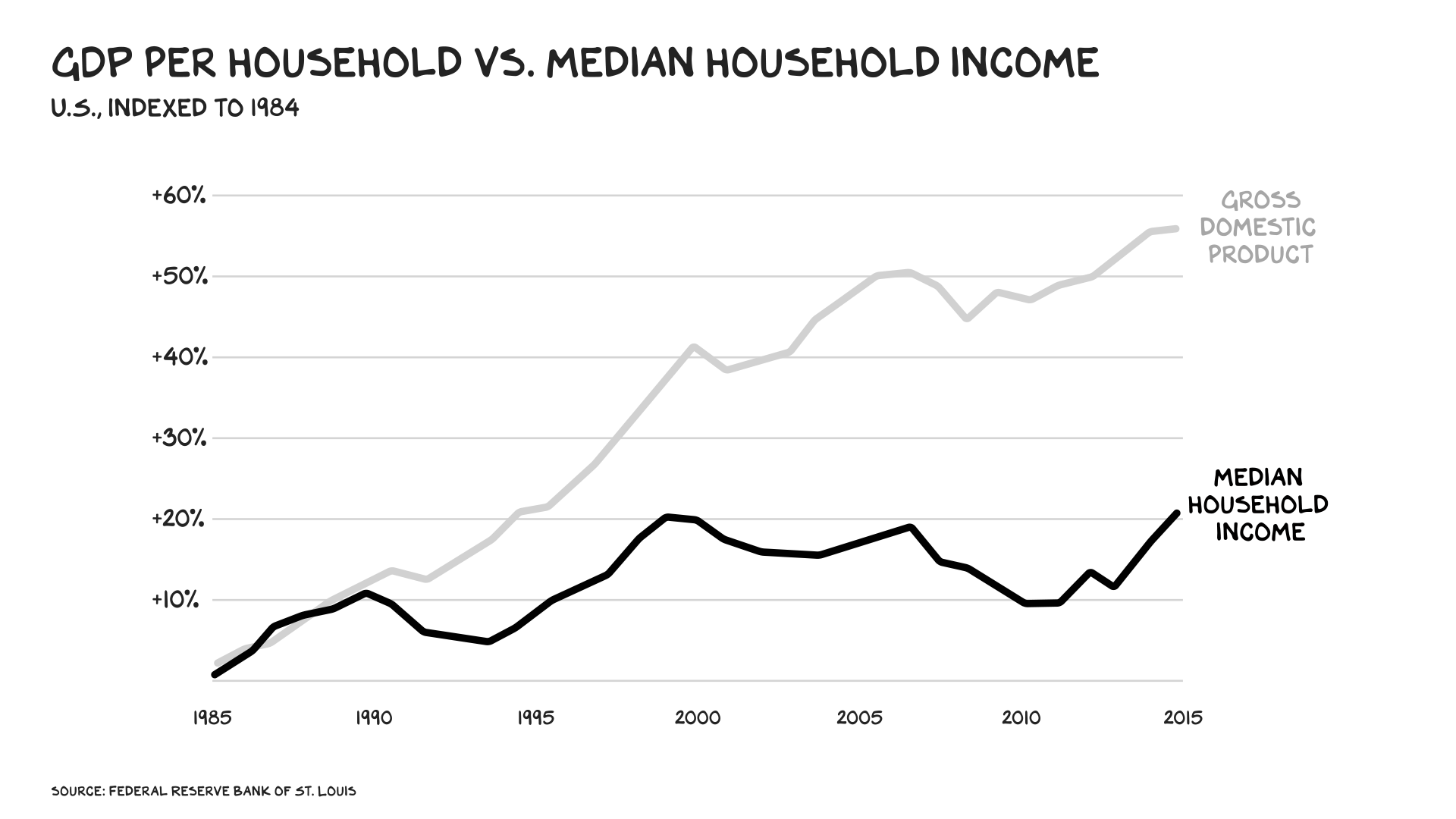

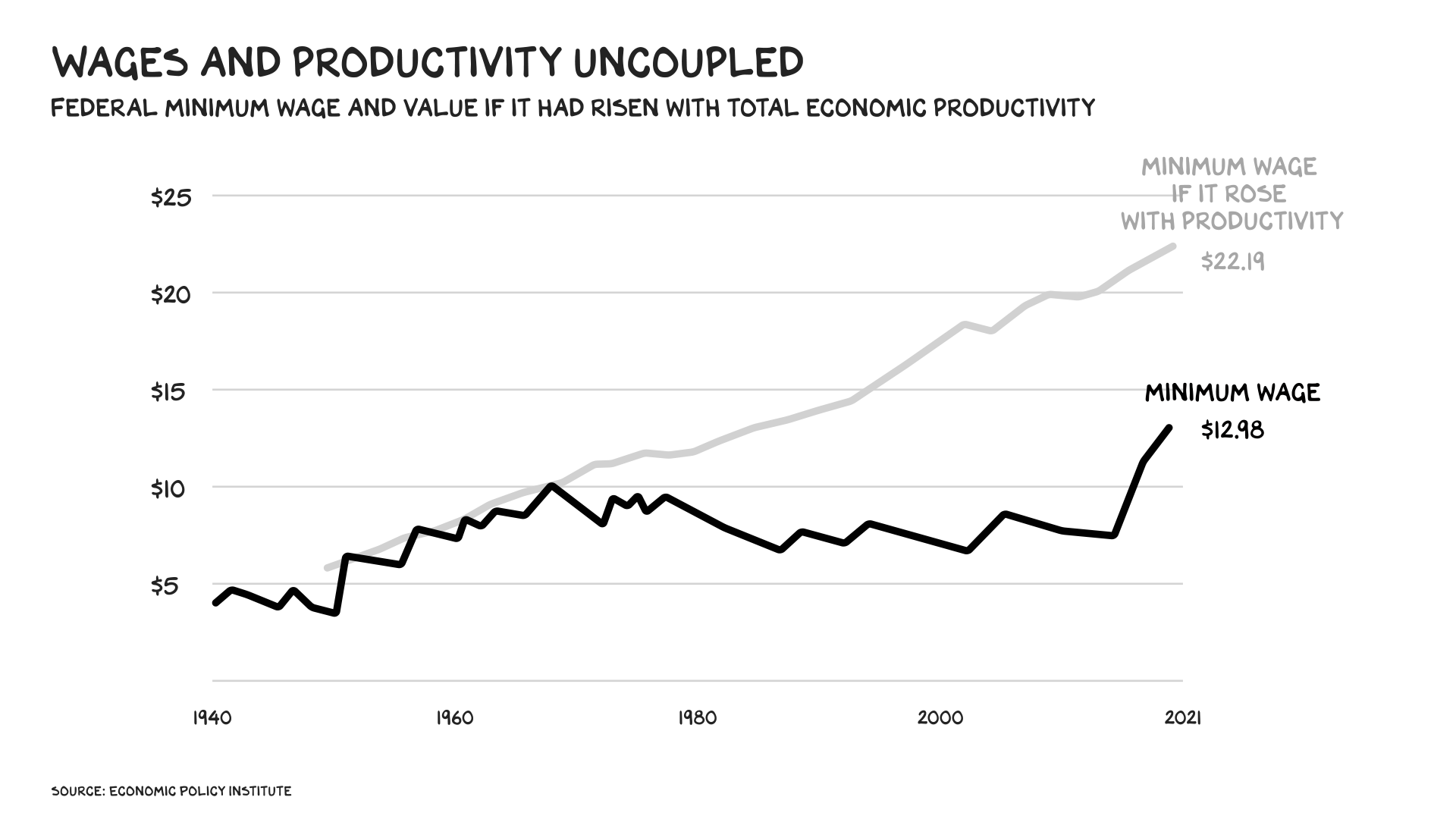

We don’t honor workers, we throw loaves of bread at them and give them circuses to distract them from their servitude to capital, which captures more of the spoils each year. Over the past five decades, U.S. GDP growth has outpaced wage growth by 63% — in years prior, GDP and wages expanded at the same rate. In 1970 the American middle class received 62% of the country’s aggregate income; today it’s 42%. The top 1% now owns 32% of our nation’s wealth, and the bottom 50% owns 3%. America has never been so disdainful of its workers.

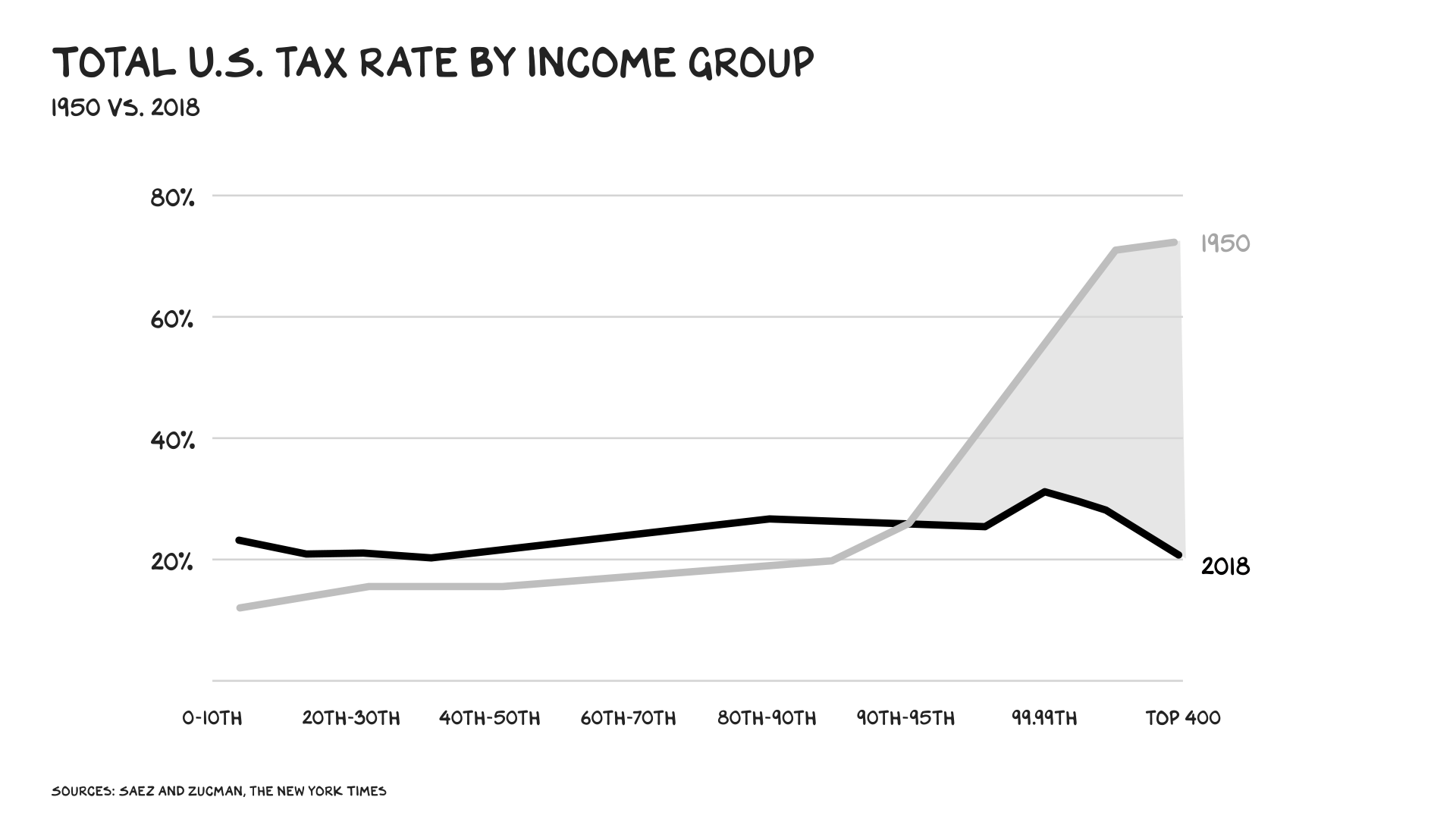

I discuss this in my forthcoming book, Adrift: America in 100 Charts. (You can pre-order it here.) It’s the story of our nation told through (wait for it) charts. It covers a lot of topics, but the common thread is that our middle class is dying — largely because of a purposeful, decades-long transfer of power from labor to capital. There was a time when 30 years of hard work got you the American Dream: homeownership, college-educated children, retirement, greater economic security than your parents. No longer. Today economic security is defined by the assets you already possess. We impose harsher taxes on income gains (i.e. the fruits of labor) than on capital gains, and reward high-net-worth individuals with tax loopholes and bailouts. America is no longer the best place to get rich, but to stay rich.

Anyway … this week I’ve been thinking about labor. What it means, who performs it, and how the holiday can register real meaning again.

Unions

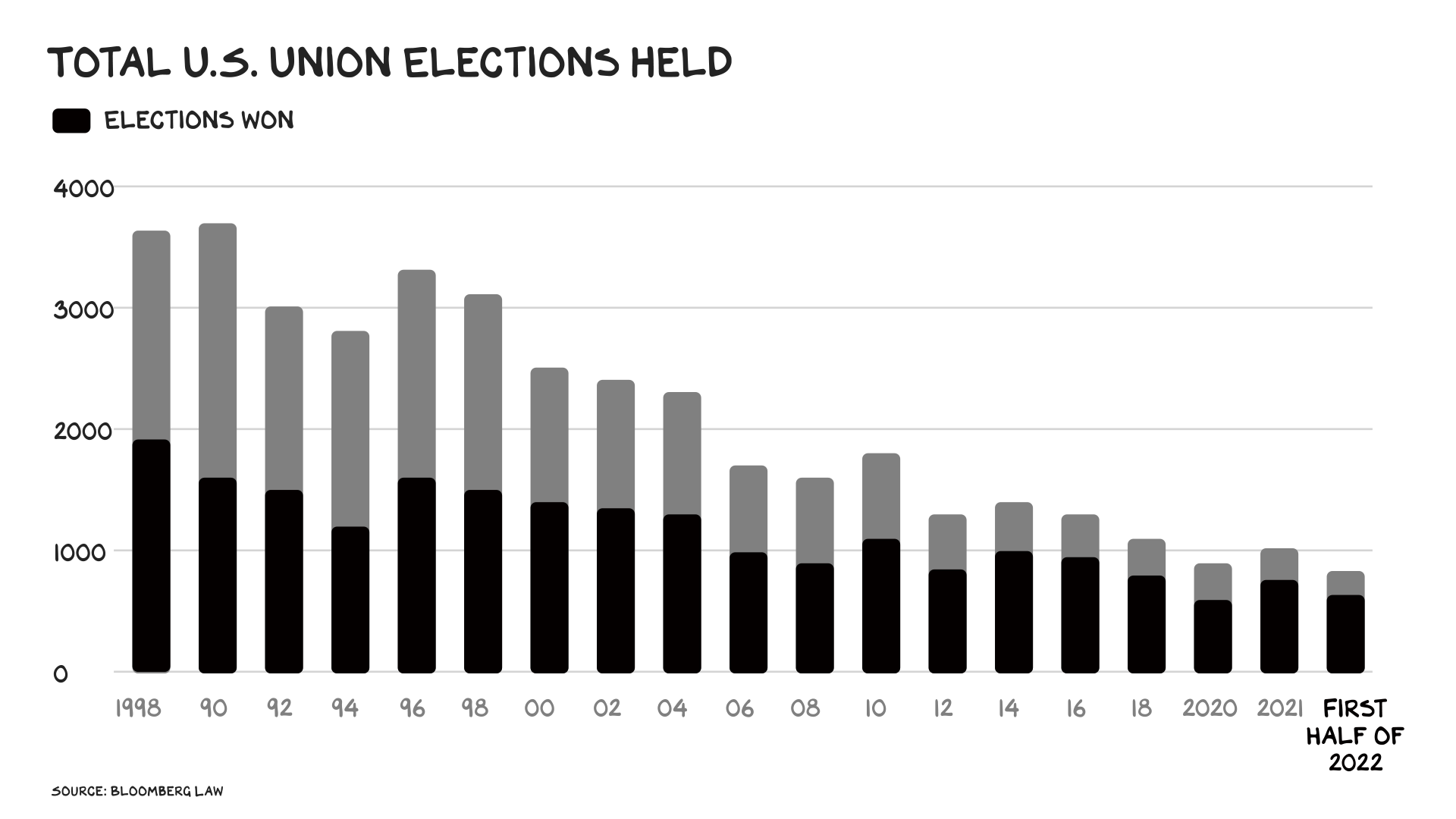

Unions are making positive headlines recently. Some Starbucks workers organized in December. Amazon workers followed in April. So far this year, unions have won 641 elections (the most in nearly two decades) with a 77% win-rate (the highest percentage on record). Almost 80,000 American workers have gone on strike in 2022 — three times as many as in the same period last year. Meanwhile, U.S. approval of labor unions is at its highest level since 1965. By the looks of it, unions are making a comeback.

People will say these wins for unions are wins for workers. Maybe. However, in my view, this is a dead cat bounce. Over the past several decades, unions have proven they don’t work.

As Rani Molla wrote, forming a union is the easy part. The hard part is negotiating a contract with the employer. Companies deploy various methods to ensure there is almost never an agreement with the union — usually just stalling. After Amazon’s Staten Island workers voted to organize, Amazon buried them in paperwork. Starbucks did the same. Almost a third of unions don’t reach an agreement within three years. Proving to the National Labor Relations Board (the agency that enforces labor law) that a company is unnecessarily stalling is difficult. And even if you do, per Rani … “there’s not much it can do.” So the union gets tired and discouraged, the employees inevitably turn over, the effort bleeds out, and the company marches on sans union.

In many ways, the union is the corporation’s perfect enemy: disorganized, inexperienced, underfunded, and understaffed. “I want to work for the United Auto Workers union,” said no ambitious college graduate ever. It’s not a coincidence that, despite the recent uptick in union formation, union membership is in freefall.

One Union, for All Workers

The need for labor representation remains, however. The balance of power between capital structurally favors capital. Capital has, well, the capital — to hire lobbyists and public relations teams, lawyers and strikebreakers, to outwait workers who need their paychecks to put food on the table. You don’t need to be a labor economist to see this, just review the past 50 years in America. And it’s likely to get worse: automation is projected to put nearly 40% of American jobs at “high risk” by the early 2030s. We already let offshoring decimate a generation of American labor, we have a moral and economic obligation to better manage this greater transition. But if not labor unions as we know them, who?

There should be one union: the federal government. Unlike small, fragmented groups of workers, this is a force to be reckoned with — and companies must comply with its demands. It should demand more. Dignity in work, for starters. The right to not be sexually harassed or discriminated against is a good thing, but it’s a floor. In America, the wealthiest nation in the world whose corporations are registering the greatest profits in history, you can still work full time and fall below the poverty line. We must raise the minimum wage, dramatically. If the federal minimum wage had risen at only the same pace as U.S. productivity since 1960, it would be three times what it is today. A $20-plus federally mandated minimum wage would send some consumer stocks down, and make many small businesses unviable. It would also be worth it.

Workhorse

We often talk about income inequality, the top 1% vs. the 99%, and we should. But there’s another cohort that’s rarely discussed, whose workers on an effort-adjusted basis may be the biggest losers re changes to the tax code: the 90th-99th percent.

Lawyers, doctors, accountants. Smart, ambitious, hard-working, college-educated people who’ve played by the rules and done everything right. While the media often buckets them in with the top 1%, many are actually struggling — but they’re too embarrassed to complain about it.

A lawyer living in San Francisco making $350,000 a year likely pays 49% of their income in federal and state taxes. Most “workhorses” need to live in a high-cost urban area (the average home in San Francisco costs $1.5 million), and things are likely tight. This is not a sob story — many Americans would kill for these problems. However, we’re being heavy-handed with the wrong people, as many could build real wealth and make the jump to lightspeed if we returned to a progressive tax system that charged the same rates on the top 1%. Asymmetric upside is reserved for the ultra-wealthy — accounting for capital gains tax, they pay lower tax rates than the 90th-99th percent. We have opted for a regressive tax system.

Care Work

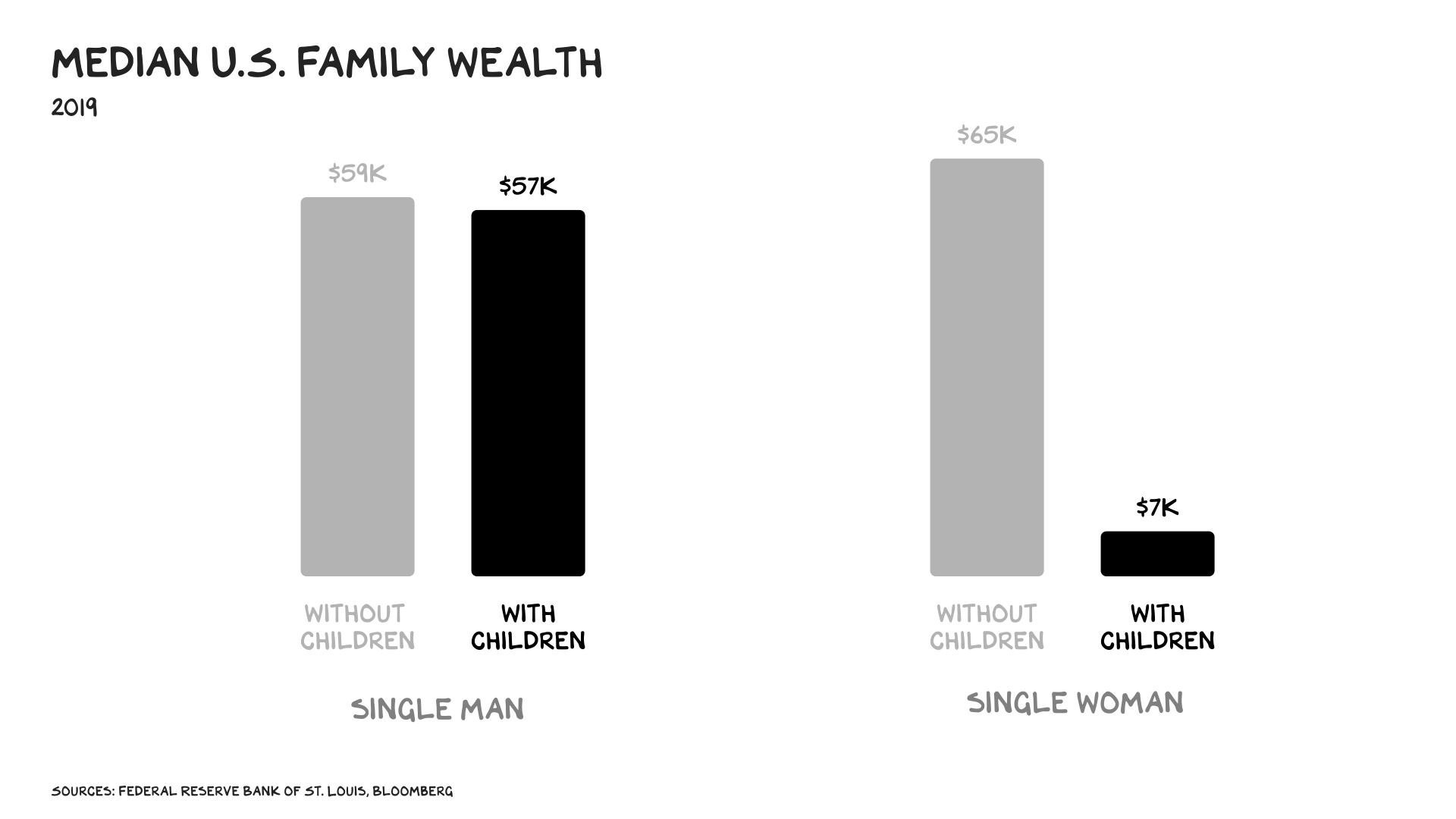

When we discuss labor, we almost exclusively talk about paid labor, the work we do for money. But there is an enormous, critical swath of labor this view overlooks, and it’s important work: caring for one another. Raising our kids, administering to the sick, and caring for the aging.

A good measure of a society is how well it provides for its weakest members. It’s also a good predictor of a society’s future. A poor system for raising children is a recipe for future failure. What’s our system? We turn to women. Among solo-parent households, 82% are headed by single mothers. When it comes to the elderly, 61% of caregivers are women, and they are much more likely to be the primary caregiver.

Besides the inequity, our assumption that mom will take care of things is brittle. Covid illuminated how brittle. Students fell four months behind in school, and reading and math scores sank by the sharpest margin in three decades. The gender gap in employment and labor participation increased, and a quarter of mothers said they had to either stop working or work less.

In some distant past, when people lived in extended family units, with three or four generations under one roof and a dense network of siblings and cousins ready to pitch in, an “informal” system of caregiving — i.e. no system at all — might have been viable (though it was rarely fair between genders). But that’s not how our society works today, and more important, that’s not how we want it to work. Mobility and migration are the unlocks that have powered a century of innovation, but they mean we need to support people as they care for those who need support.

This is the role of government. It is neither feasible nor fair to expect employers (the paying kind) to abandon their competitive advantage and unilaterally support a societal good. Yet our existing protections for caregivers are deficient. The U.S. is one of only six countries that doesn’t offer paid family leave. The others? Marshall Islands, Micronesia, Nauru, Palau, Papua New Guinea, and Tonga. This is bad company. Every other developed nation provides substantial paid family leave, with the average OECD country offering more than 17 weeks.

The Biden administration tried to advance another much-needed policy to support family care work, the child tax credit. This is something I’ve long advocated for, inspired by Senator Michael Bennet. When we instituted this program on a temporary basis during the pandemic, we kept 3.7 million kids out of poverty and cut hunger by 25%. This was a massive win: child poverty is a scourge, and its costs on society compound over a lifetime. But the Democrats were forced to strip a provision extending the credit from the Inflation Reduction Act, after Joe Manchin (and, to be fair, the entire GOP caucus) refused to go along. Maybe next year.

The rise of remote work and new flexibilities in employment will allow us to do more. I believe we need to explore an additional employment protection that gives people who care for others rights in flexible work arrangements. If working from home enables a single parent to stay in the workforce, that’s a win for society. Temporary part-time status and flexible schedules can match our needs to our resources. We should incentivize companies to make this happen and level the playing field so they’re not at a competitive disadvantage when they do so.

As always, the criticism of taxpayer support for care work is the cost. However, we spent $800 billion bailing out corporations with PPP loans while offering $1 trillion in tax breaks per year in the form of loopholes. No government agency can provide a good level of care, more efficiently, than a loved one. We need to arm citizens with the resources to care for loved ones.

A substantial increase in the minimum wage, restoration of a progressive tax system, and greater flexibility for caregivers starting with paid family leave. There’s nothing wrong with America that can’t be fixed with what’s right with America. And Americans like to work. All of these efforts would come at a cost, and it’s likely the stock market would go down. But putting more money in the hands of middle-class Americans has one key advantage: They spend it.

Loneliness, stressed young families, a lack of connection, class warfare, the draining of meaning. All of these things plague America. There is no silver bullet. But there is something we can do to help address all of them. We can work.

Life is so rich,

P.S. Our next workshop is an essential one if you want to grow your career: Building a Business Case, taught by Meta’s Nicole Alexander. Sign up now.

P.P.S. Tonight (9/9) at 10 pm I’ll be on Real Time with Bill Maher, streaming on HBO Max.

44 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

Great article! Lots to think about. Reminder: reality is hard – Inflation Reduction Act (The carried interest loophole, which allows hedge fund managers to pay a lower tax rate than their cleaning ladies, is an issue that Democrats love to campaign on. And they were going to finally eliminate it with this big bill! Until, quietly, that got scrapped. The ones who have actually achieved carried interest reform recently are, oddly enough, Republicans. Here from the WSJ Editorial Board this week: “When out of power, they rail against Republicans for not closing what they call the carried interest ‘loophole.’ But when in power they never get around to changing it. This time they couldn’t even extend the date to qualify for the capital-gains rate to five years from three. Republicans in their 2017 tax bill extended the carrying period to three years from one.”)

Great work, Scott.

The 2020 election cycle, conducted during a pandemic so crushing that it “necessitated” massive corporate loans (later forgiven, so can we call them gifts?), cost a record $14 billion. Why is it that no one ever bats an eye about this kind of spending, but even people who would benefit from social spending lose their minds about funding anything that would help caregivers and get us out of the company of those five countries?

That “gift” was contingent on keeping people employed when business collapsed. And- many businesses still folded. Why ignore all the additional individual benefits that ultimately encouraged workers to stay at home instead of going back to work?

To: Scott Galloway: On the Bill Mahrer show on Friday night Sept. 9th,

you advised young people to “work their asses off”. How does this square with this article?

I think caregivers and teachers work their asses off just as much as young scientists, engineers, and lawyers do. And for a lot less money. Who will take care of you when you are so old and weak you cannot even wipe your butt, David?

The Paycheck Protection Program was far from a corporate bailout. It was fully based on saving jobs – tied to, and making it directly into the hands of the employee via the employer. I would argue it was the most successful government program in a generation – saving countless businesses from firing employees and going under.

It would be nice if Scott would keep these partisan talking points to a minimum, as it greatly diminishes his thoughtful analysis. It always seems to be on throwaway lines too. So good on the substance, so why be a parrot?

Bravo!

Best set of charts on this is wtfhappenedin1971. I agree with a lot of what Scott is saying but the main one he is leaving out is inflation. Since 1971 the dollar has become a fiat currency without a real tether to gold to stop further debasement. Inflation helps the rich and hurts the poor. Asset prices automatically and immediately go up. Workers need to negotiate a higher wage which takes time and often may not be successful. Another few things that have caused the broad middle class to struggle are women entering the workforce essentially doubled the labour supply which has pushed down wages. Now both parents work for the same real salary that one family member used to earn and no one is home to raise the kids, so childcare needs to be paid for so the wealth effect goes backwards. The other big issue is Antitrust at a regional level having two competitor firms gave skilled employees bargaining power- now US is mostly regional oligopolies as the only negative impact courts will consider is whether consumers are paying higher prices. But if there is only one employer for your skills in the region then the lack of antitrust action has hurt employees negotiating power- megacorp decides your salary.

I do love reading your posts as they give me some perspective about the world. The US that you write about is somewhat different (more extreme?) from the UK that I came from. But this post resonated because you wrote about extended families and how care is a natural way of living. Here, in Thailand, where I have chosen to end up, it is the natural way of life. Everywhere around me a I write, there are families caring for each other. Much to be applauded with a much more caring society. One reason why I do not wish to return to the West.

How in the world does raising taxes on the 1% help the 90-99% in any way whatsoever?

I’m a liberal, thoroughly believe in a progressive tax system. But what’s the logical argument and mechanism by which higher tax rates at the top help the next level down? This article takes it as an article of faith

Scott, your antiunion stance sounds to me a lot like victim blaming. I wear the short skirt because I feel sexy in the short skirt. Doesn’t mean I want or deserve to be raped. Workers unionize to feel powerful and in control. It doesn’t mean that they can’t be; it doesn’t mean that corporations won’t rape them. But it sounds to me like you’re saying “why are you wearing that short skirt?” Unions are only going to get violated? The problem isn’t unions, but that capital has too much power, which I think the rest of your post addresses. Anyway, my $0.02. Keep working

Captivating post and well placed arguments. In my experience, industrial jobs pay far more than minimum wage. There is a serious supply and demand dynamic if you want to keep producing product. I’d actually like to see a chart of the % of workers that get paid minimum wage.

Regardless, the reality remains that robots and automation are coming, in fact to a large degree they are already here. Physical labor off-shoring will shrink as automation onshore increases. We are simply in a transitionary period. Where real bang for tax payers money could be found is education and training. And for this, Unions are good. So are vocational schools. Low-wage jobs should be seen as a stepping stone in a multi-career path with multiple instances of upskilling. If the cost of education is reduced, chances are livelihoods will increase. A certain level of free market gyrations are healthy and perhaps even preferable.

Too much government intervention with regards to wages will create the situation where it is difficult to scale it back when necessary, ie. recession, off-shore competition, etc. What could stand some analysis is barriers to entry of cheap goods, including digital services that can be delivered on foreign territories yet delivered with a click of mouse. The remainder of Scott’s post makes sense.

While labor unions may no longer contribute to higher incomes, they still have the potential to play an important role as a middle group in society. Looking at this population from the perspective of someone like Anthony Giddens, it could be used to simplify procedures, collect data, and ultimately compress administrative costs and improve the quality of administrative services. Middle groups are also necessary to reduce the number of individuals who are exposed and isolated from society. The freedom to choose isolationism should be given, but the administrative and social implications of isolating those who do not wish to be isolated should be considered.

I stopped reading at “There should be one union: the federal government”. That’s the definition of communism isn’t it?

I think you mean socialism. And no, it’s not that either. There are dictionaries available online at your disposal.

Socialism is when the government controls the means of production. With communism there is no government, just communes.

Interesting Scott. Given your charts, worth a look at “Superabundance” if you haven’t yet jumped in. Page 142.

Nicely said. Important reminders to see the situation as it is. Thanks kindly.

Thank you for the thoughtful piece and all the great comments. There a couple of things you should consider:

Changing a the tax code, which is driven by powerful lobbies and government workers who want job security, would be a “fool’s errand”. Instead we should consider changing the way employees are paid. If employees get mandatory company stock with voting rights it fixes a few things. They would pay a lower tax rate on capital gains, they would get a voice in the direction of the company that unions could never provide, and it would allow them to own something that grows exponentially (like Tesla stock) instead of wages that barely keep up with inflation. Workers would “own” their own productivity.

Huge raises in minimum wage would not readily be realized. The cost would pass through to more expensive goods and services and the poor would only realized a small portion of the raise.

People glorify the 50’s and 60’s saying that’s when the middle class was strongest but lest we forget there was an “underclass” of women, minorities, and migrants that did much of the work for less wages which artificially kept the price of goods very low.

As an alternative to higher wages lets figure out how to take the real burdens: healthcare, dependent care, and basic education under the government umbrella. That way people keep more of what they earn and everyone is guaranteed basic dignity of health, safety, and education.

Lastly, the rise of automation is here. There are robots that can do most of what humans can do for about the cost of 1-2 years salary. Increasing wages increases IRR and will result in faster adoption of robotics and automation. This will drop the demand for low skill workers, eliminating up to 75% of those jobs by some studies. The only bright side is demand and pay will increase for skilled workers with trade school or apprentice degrees.

To report as a problem that “automation is projected to put nearly 40% of American jobs at “high risk” by the early 2030s” and then go on to say that a fix for what ails us is that we “must raise the minimum wage, dramatically” is economic malpractice. The machines are coming, quite directly in response to the misguided policy of forcing businesses to pay people more that a job is worth.

Common sense. Bravo!

Are businesses paying people what the jobs are worth? I doubt it. The balance of negotiation power is so out of balance that most employees are underpaid.

And here I thought all along you were a capitalist! But indeed, you’re a Socialist! And being from Saskatchewan, the birthplace of Canadian Socialism, I know one when I read one!!! Unfortunately, Americans conflate Socialism and Communism and that’s truly unfortunate! I wish Americans would expend as much energy “coming out” of this of this delusion as they do other issues. Helping your neighbours isn’t an the evil concept the GOP make it out to be. The delusions that “ROI is most important goal of society” and “trickledown economics is the way”, are two Friedman “THEORIES” that must be disposed of. Good on you for your comments…but let’s stick a fork in this Friedman Turkey…it’s done!😎

Thanks for the s/o to accountants. You nailed it, too. Workhorses do have these good problems, and it feels ridiculous to complain because of other, real problems…real suffering. Looking forward to seeing you on Real Time, that’s awesome

An excellent piece on what is wrong with the economic system of our country. One thing I would have said something about is that in general Republican politicians are owned by the plutocracy. And Republican politicians vote against many bills that would take money away from the greedy plutocracy: Including not voting to give food to starving children.

Developing a national child care system would serve our most blatant need. A system that would certify childcare professionals is the only answer to the stunted growth of infants and the young who languish while their minds yearn for information. Just one less B-1 Bomber could initiate the effort.

I would keep the B 1 bomber and tax the uberwealthy for the system you propose.

My experience follows your thesis… many of my university and professional class peers are seeing the loss in earning power and feel uncomfortable talking about it… yet they live so much better than their parents. Many of us who invested in real estate prospered from inflation and living in growth cities. Two thoughts come to me (1) we are all subsidized … follow that like you should always “follow the money to understand change” and (2) each pol is purchased to protect the power that bankrolls policies to favor one group over another. Your charts and effort to expose the privileged info you have gives me hope about exposing power and helping educate the masses. Thank you.

I deeply appreciate your in-depth, educated and well-reasoned perspective. I don’t agree with everything you say, but I learn so much from your missives (might be the professor in you). Thank you.

I’m all for unions if they empower the middle class to catch up with GDP growth. But what about that aspect of unions that tend to squelch upward mobility? And considering how the US government manages things like the VA, would you really want them organizing a huge and precious resource like labor?

Fixed pie fallacy:

What is the relationship between income inequality and poverty?

If we were to double everyone’s income tomorrow, millions of Americans would be lifted out of poverty, but inequality would actually increase.

“Poverty can decline even as inequality rises, as long as the total amount of wealth in the world is growing. To ignore this is to fall prey to the “fixed pie fallacy.” Throughout most of human history, global wealth hardly changed. But thanks to trade and industrialization, wealth has skyrocketed since the 1900s and continues to climb. At the same time, technological advances have also increased human wellbeing in ways not captured by looking at GDP alone.

Because the pie is growing, focusing solely on inequality makes little sense.

Most of us would rather have a relatively small slice of a gigantic pie than the biggest slice of a microscopic pie. In other words, most of us would rather be wealthier in absolute terms, regardless of our relative position. This is why many of us, if given the choice, would choose to be an ordinary person today instead of a member of the upper crust a century ago or a 17th century king.”

IMPT NOTE: “Real” median incomes have been steadily increasing for over 50 years: Per the US Census.

(bigger pie + equality) > (bigger pie + inequality)

You can subtract “bigger pie” from both sides of the equation:

equality > inequality. Thus it makes perfect sense to focus on fixing inequality.

Scott

It is misleading to state that the middle class’s percentage of income has shrunk as a percentage of GDP.

Why?

Because almost all of the shrinkage is a result of the middle class’s migration to the upper class.

Interesting facts from PEW Research about the decline of the middle class over the last 50 years. On the positive the upper class has gotten larger shrinking the middle class, and incomes of all classes have increased.

Most importantly, the middle class has shrunk 21% since 1971 in part because the upper class has increased 20% over the same time frame. In other words, more people have escaped the middle class. For those with an education, times are better today than when our middle class was larger.

Where are your proofs? What you are saying is nonsense. Times are better for the Koch’s of the world….no one else.

I would post links- they don’t get posted- tied up in censor heaven/ hell. It is a fact per Pew Research, not an opinion.

Public policy should work to maximize equality of opportunity not equality of outcome.

Wealth is created by those that add value to society. There is no “right” allocation. Finally, and much to the chagrin of those that buy into this class warfare, high income inequality in a free society is a sign of health as it indicative of a high degree of opportunity.

Our federal income tax is already too progressive…

Source: CBO: Congressional Budget Office

Share of individual federal income tax 2018:

The top 20% of earners pay about 90.9% of all personal income taxes.

The bottom 60% pay no personal income taxes (in aggregate).

When are the bottom 60% going to pay there fair share?

Every hear of gas taxes, sales taxes, SSI payments … you’re just a one trick pony.

Those are consumption taxes. They are paid equally. Wealthy people consume more than poor people and therefore pay more. For example- expensive cars, homes etc. They taxes are equitable. You don’t want fair. You want punitive. Robinhood is another way to justify theft.

Scott: I agree with most of your analysis of US inequality of income/wealth and your proposed solutions. However, isn’t the incredibly bloated $1 trillion defense/national security budget a major source of funds for the programs you propose? Must we continue to indulge the whims of our national security elite to be the world’s policeman?

The poor pay taxes, the middle class pay lawyers and accountants, the rich pay politicians. I forget who coined this phrase but it does ring true. It guarantees income inequality inexorably increases until society says enough.

Scott,

Sounding like Tredeau – “ There is a level of admiration I actually have for China because their basic dictatorship is allowing them to actually turn their economy around on a dime and say we need to go green, we need to start, you know, investing in solar,” Justin Trudeau. Yours is a profession and job which feeds off the system. I love you. You’re thought provoking… but we all end up in the same place. Let’s really do something different.

Thanks for your thorough exploratory efforts to show, again, realities of an issue. ssc

No matter what level the federal minimum wage is set to, the actual minimum wage is always $0. This is especially true in light of the other trends you correctly mention, Scott (automation and offshoring) – employers don’t have to create jobs, and they don’t have to create them here, and they don’t have to give them to a human. Without jobs, workers are even worse off. I’m surprised you don’t mention the role of inflation in eroding the purchasing power of the worker.

From PEW:

“Long term trends. From 1970 through 2007, median annual household income increased by a total of 41%, after adjusting both for inflation and for the decline in household size. Most economists agree that trends in inflation-adjusted median household income are the best single indicator of a population’s changing standard of living. But they are not the only measure. Our report also examined changes over time in household wealth and household expenditures. All three indicators tell essentially the same story: over the past several decades, there has been measurable progress in America’s standard of living.”

http://www.pewresearch.org/wp-content/uploads/sites/3/2010/10/MC-Middle-class-report1.pdf

“Long term trends. From 1970 through 2007, median annual household income increased by a total of 41%, after adjusting both for inflation and for the decline in household size. Most economists agree that trends in inflation-adjusted median household income are the best single indicator of a population’s changing standard of living. But they are not the only measure. Our report also examined changes over time in household wealth and household expenditures. All three indicators tell essentially the same story: over the past several decades, there has been measurable progress in America’s standard of living.” PEW RESEARCH