Venture Catastrophists

Audio Recording by George Hahn

In 1907, amidst rising interest rates and a declining stock market, two New York bankers attempted to corner the stock of a copper company. Their scheme collapsed, and depositors at the banks that backed them pulled their money. One bank, Knickerbocker Trust, lacked the capital to withstand the bank run and, four days later, shut down. The rout was on.

J.P. Morgan, the nation’s preeminent banker and business leader, saw obligation and opportunity. He gathered the heads of New York’s banks at his Madison Avenue mansion and, the story goes, locked the doors and pocketed the key. “This is the place,” Morgan proclaimed, “to stop the trouble.” First he addressed his obligation: to save the system in which he’d built his wealth. He pledged an $8 million loan ($255 million in today’s dollars) to the next domino after Knickerbocker, the Trust Company of America. Then he convinced a dozen other banks and the U.S. Treasury to deposit $70 million into other vulnerable banks. The “Panic of 1907” subsided. Morgan saved the financial system. Fourteen years earlier, he’d done the same thing.

Trust

What J.P. Morgan understood was that banking, and by extension the economy, is not built on gold, labor, machinery, or spreadsheets, but on trust. Trust that deposits will be there when needed. That trust ruptured when the Knickerbocker Trust Company said, “We can’t.” Trust was restored when J.P. Morgan said, “We’ll ensure they can.” Once people trusted the banks again, the monetary crisis was solved. Fast forward to today: Can you imagine any part-time libertarian billionaire in the Valley pledging 5%, much less 50%, of their wealth to cauterize an emerging banking crisis?

Banks need your trust because they don’t actually have your money. When you deposit cash at the bank, it loans it to someone else. In fact, banks loan out more than they take in. It is a miracle and the cornerstone of our economy — turning short-term deposits into long-term loans. This is a good thing: Money sitting dormant does not fund startups, expand existing companies, or encourage consumers to … consume. It’s not useful.

Every bank is vulnerable to a run if enough people ask for their money on the same day. If Bank of America’s 67 million customers simultaneously withdrew their funds, in the same day/week/month, it would fail.

Together

But Bank of America doesn’t stand alone. It’s backed by a safety net of federal agencies — the Treasury, the Fed, the FDIC. Regulators, risk managers, and bank management are supposed to calibrate a sufficient level of liquidity to prevent insolvency — to “stress test” the bank. The Fed serves as a lender of last resort to troubled banks. Regulation moderates risk but can’t eliminate it.

This federal backstop exists, in substantial part, because J.P. Morgan didn’t see just obligation back in 1907. He saw opportunity. In the aftermath of the panic, Morgan called in the loans he’d made and went shopping for distressed assets: He acquired six banks, including the Trust Company of America, a steamship line, and the second-largest steel company in America (he already owned the largest). By 1913 officers of J.P. Morgan & Co. sat on the board of 112 public companies, representing 80% of the public market capitalization in the country.

We learned two lessons from 1907. The first was that the banking system needs a backstop. The second was that we shouldn’t rely on billionaires to be that backstop. In 1913, Congress passed the Federal Reserve Act, which created the central bank as we know it today. (The FDIC came along in 1933.) It’s no coincidence that the generations that followed 1907 made historic investments in the collective strength of America, from Social Security to the G.I. Bill to the Interstate Highway System. They understood their obligation to be part of a broader solution and rest it on the shoulders of democracy.

However, prosperity has a poor memory. By the 1980s, Morgan’s obligation was forgotten, and his opportunism became our model. Reagan and Thatcher branded the new (old) era: “There is no such thing as society,” said the Iron Lady. “There are individual men and women, and there are families.” Reagan added: “Government is not the solution to our problem; government is the problem.” Libertarianism, the political philosophy of a 19-year-old who’s just discovered Ayn Rand, became the governing ethos. Regulators were no longer backstops but impediments to be defunded or ignored.

By the 2010s, trust itself was seen as an inefficiency. Crypto rose to prominence with the core promise of “trustless transactions.” There’s no such thing.

SVB

Last week, Santa Clara had its own Knickerbocker moment. As the name suggests, Silicon Valley Bank was the bank of choice for venture capitalists and their portfolio companies, holding funds for nearly half of U.S. venture-backed companies. On Wednesday, March 8, SVB announced it had sold securities at a loss and was trying to raise more cash. A small number of VCs panicked and encouraged their portfolio companies to pull their funds, and on Thursday they withdrew $42 billion — breaching SVB’s liquidity cushion. On Friday the FDIC seized the bank.

Any complex event has multiple causes. The direct cause here is obvious: Too many of the banks’ customers tried to withdraw too much cash at once. The proximate causes were numerous:

- SVB committed the same sins that bring down most financial firms: mismatched durations and poor risk management. It invested long in mortgage loans and Treasury bonds, and borrowed short from startups that needed cash to fund operations.

- SVB lobbied the Trump administration (successfully) to raise the asset limit for tighter regulation.

- Interest rates rose, at a historic rate, decreasing the value of its long-term investments.

- SVB bungled its communications and strategy of trying to plug the hole in its balance sheet by selling equity, triggering the run it was trying to prevent.

- SVB’s customer base of startups is uniquely twitchy: They have cash balances well over the FDIC insurance limit of $250,000, and they’re interconnected through a handful of VC firms, which increases the risk of a bank stampede.

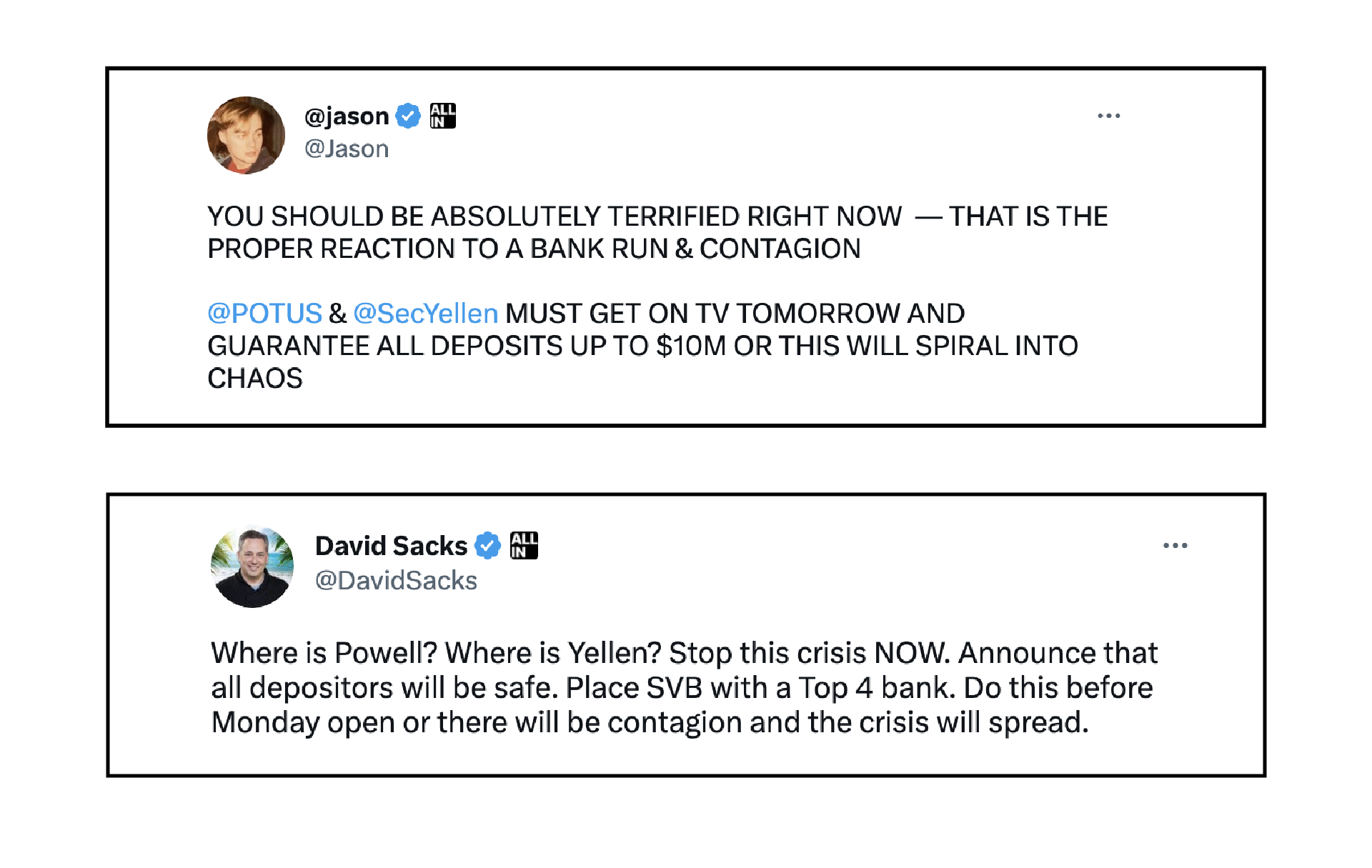

By Friday morning it was over, and the feds had arrived to turn on the lights and close the bar. While they were working over the weekend to ring-fence the contagion and make SVB’s depositors whole, a new species of venture capitalist was born on Twitter: the Venture Catastrophist. The fear mongering’s stated intention was to drum up support for a federal bailout of SVB depositors — many of whom were the Catastrophists themselves.

There are no libertarians in foxholes.

After SVB

In the immediate aftermath, observers are doing what they do after a complex catastrophe — cherry-picking the proximate cause that suits their politics and priors. It wasn’t rising interest rates, poor risk management, the concentration of the depositor base, or Venture Catastrophists on social media. It was all of it.

A more interesting question: What could have prevented the collapse? What is obvious is there does not appear to be a J.P. Morgan figure in the Valley with the leadership, citizenship, and sense of sacrifice to cauterize a contagion. There was, however, a group of venture capitalists working behind the scenes, quietly with our leaders, to figure out a solution. No all caps, no posing for the algorithms — just responsible people working around the clock because they saw themselves as part of the solution. Several hundred VC firms signed a letter committing to keeping their business with SVB, intended to make the asset more attractive to an acquirer.

More interesting than who signed the letter was who didn’t. In sum, venture capital firms that have a vested interest in destabilizing the banking system and the dollar, via crypto investments, have morphed from Americans to agents of chaos. I believe Marc Andreessen or Peter Thiel could have stopped the run with one tweet. They chose not to. This week, on the other side of the country, big banks, including the one J.P. founded, are following in his footsteps, depositing $30 billion in First Republic, after close coordination with Treasury Secretary Yellen.

I am a founder, director, or investor at four firms that have approximately $20 million in deposits at SVB. We did not pull out a dollar. (Note: One of the companies tried on Friday and was unsuccessful.) We didn’t keep our deposits at SVB because we’re moral or felt an obligation to save the bank, but because I went to the FDIC site and found that 73 banks have failed in the last 10 years, and all had their deposits backstopped. I didn’t lose a minute of sleep. Why?

- My backers, and the backers of the firms I’m an investor in, assured us they’d do whatever was required to make payroll, etc.; and

- Nothing is ever as good or as bad as it seems.

“This Is the Place”

It’s no surprise a community of increasingly atomized individuals chose survivalism over citizenship. Now, many Americans are disgusted with the backstopping, despite it being standard operating procedure, as they are wary of bailouts. More specifically, they are exhausted by a tech community that captures the upsides of risk but expects other Americans to bear the inevitable downsides.

Thanks to its ubiquitous apps — which create billions for management and investors but addict and depress our teens and make our discourse more coarse — the brand “Silicon Valley” has fallen farther faster than any brand other than “Musk.” If the failed bank had been “First Bank of Iowa Agriculture,” there would have been no reticence by the feds or public to backstop its depositors. Fortunately, the wisdom of prior generations to establish the FDIC and the steady hand of the U.S. Government has endured.

It comes down to this. What type of leader, business person, and (quite frankly) man do you want to be? When shit gets real, do you want to be the steady hand who stays calm and works with others, with purpose and skill, to figure out a solution? Or are you in the foxhole screaming, only giving your position away and making things worse? The real man here, the real American, is in Washington, and his name is Janet Yellen. The Venture Catastrophists are the other guys.

Life is so rich,

P.S. We did a special episode on Silicon Valley Bank for the Prof G Markets podcast this week. We’ll be discussing it more on Monday — tune in.

P.P.S. Speaking of investors … our newest sprint, Investor Mindset, is enrolling now. Learn to make smarter decisions with your time and money. Sign up here.

83 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

“In the immediate aftermath, observers are doing what they do after a complex catastrophe — cherry-picking the proximate cause that suits their politics and priors.”

Like blaming Trump for raising asset limits. Not a compliant Congress, right? While I’m no Trumper, blaming a past administration for something that could have easily been remedied by the current one is one of those “cherry-picking” things to which you allude. Very democratic of you.

Agreed with this statement: deposits were never really at risk based on history, we have forgotten how to be community minded – and it has a real impact and Janet Yellen is extraordinary.

Prof. Galloway: Appreciate this explanation, and agree with your thesis. I would suggest an edit. “SVB lobbied the Trump administration” doesn’t speak to the reality that this bank and others saturation lobbied Congress for this change, also. They had many Democrats side with them to promote the release from regulation installed by Dodd-Frank, and the group of lobbyists even benefited from some of their former regulators and legislators serving on their boards and as consultants for this removal of regulation. I don’t like much about the former President, but the one line in your piece caught my eye because it may help hide just how challenging it is to get real governance in banking due to the immense amount of money spent to influence legislators and the attraction personal wealth offered by the revolving door. Yes, Trump might have vetoed the legislation, but he had so much paid-for, bi-partisan covering fire that he was free of any splash back. The people are not represented in these matters, but the financial players certainly are.

Withdrawing your money when the bank appeared in trouble is 100% the correct thing to do. VCs were correct in advising their clients to do so.

The simple truth is once the market lost trust in SVB, the outcome was always going to be this.

Did the “market” lose trust or did Peter Thiel and Mac Andreessen see an opportunity they could capitalize on. Given their track record and their Libertarian positions I would guess it was the latter. There are no ethics in economics and VC’s in general prove that point. It is to about a system that will help the most people, it is about how much can I get from the unwashed masses. Peter Thiel is a major backer of the absolutely useless J.D. Vance.

Silicon Valley has always been, and always will be a haven for sociopaths. Marc Andreessen and Peter Thiel are perfect examples.

Andreessen is possibly the dumbest smart person in the valley. He complains about a housing shortage in the Bay Area and then tries to NIMBY-block housing development in his own community. He claims the price inflation of US healthcare is due to excessive government regulation, despite the fact that America has one of the most privatized and proft-driven healthcare systems of any nation in the OECD. He was one of the most ardent crypto investors alive and followed the bitcoin economy all the way down into the dumpster. People like him are supposedly future-oriented visionaries — seriously?

Thank you! Listening to this newsletter was definitely better than just reading it (fantastic voice overs!) As a real estate professional, and over the past few years (7 or so) I have been whole heartedly recommending considering a “certain” loan product to customers purchasing in LMI zones. In the past 10 months or so the loan officers have been very upfront about the fact that their bank use this program to avoid “oversight” and even though it is a great product for certain clients, something about it had started to feel really **icky** Fast forward to today, now those same clients are customers of a bank whose shares fell by 33% and Im sure those customers are feeling vulnerable. They were just looking for a great mortgage rate, not looking to participate in a scheme to help venture capitalists game the system.

I am not sure if you read the comment section here (Im hoping you do) but as a conscientious real estate professional (and human being) I would be grateful if you (or anyone reading) could point me in a direction of how to guide my concerned clients. I want them to know that I care.

Also, it would be very interesting to hear your take on LMI zones over lapping with those “Economic Opportunity Zones” if you have one.

Janet Yellen …bank investments investments in the woke agenda… climate change and social justice are to blame for the bank failures…No I don’t expect you to post this …this is for the censors only:)

What?

…I think he’s said enough, don’t you? 🙂

Scott, you conveniently left out the fact that:

1. On the board of directors only one member had a career in the banking industry

2. The bank didn’t have a risk management officer for most of last year.( What kind of financial institution leaves such an office vacant, and for such a length of time?)

3. SVB focused on implementing ESG, Woke, DEI policies, donating more than $73 million to Black Lives Matter, to the detriment of sound corporate governance

In the light of all this do you still think it was right for the government to step in to save the bank?

America likes to pride itself as a free market economy, yet time and again it has gone against that ideal when the government intervenes to save an industry or sector.

Please — explain to us how a bank whose board was comprised almost entirely of white men was too “woke”, and then, explain how DEI caused the bank run. Do it with facts and not FOCX News memes. Best of luck.

1. JPMC and BofA are much bigger and both only have 2 or 3 on their board, excluding their own employees, and one of those ran wealth management at Deutsche, which is experience I hope is used only as counter-examples.

2. This is a management failure, of course, and should have been a regulatory red flag. The answer to your question is a poorly run financial institution.

3. Define “focused?” Most companies have ESG and DEI goals: there’s ample research indicating better overall performance for those that excel on those measures. Nearly every failed corporation in US history was run by white men (by definition, since they ran most everything for most of that history), including during the Great Depression and Great Recession. Did they focus on white supremacy “to the detriment of sound corporate governance?” (Which btw is the “G” in “ESG” so which is it? Too little or too much?)

The government didn’t “save the bank.” It’s bankrupt, the shareholders are wiped out, the bondholders will get some but not full recovery, and the banks pay for it, since the stability benefits them. The depositors got saved, as is necessary to maintain a stable, trusted financial system. Depositors should not have to be experts in banking and spend effort doing due diligence— that would be grossly inefficient, and also reinforce “too big to fail” banks at the expense of the rest.

I was a financial planner back in the Michael Milken days…I thought interest rates were too low in 1999…it was befuddling to me that Yellen didn’t slowly raise rates back in 2014…Good to see you this morning!

The whole piece was very good until you mentioned Janet, I was like huh? really? I am gonna link something which will help to know the real her.

https://twitter.com/theemikehobart/status/1636494845144432643?s=20

That’s for the authorities to figure out

Great analysis, I’m enjoying these deep dives where you get a chance to riff on what you believe are the main problems our modern American society is facing.

There’s a big difference between market participants like J.P. Morgan that have profited from the market they’re in putting their own money on the table to act as backstoppers (the way it should be), or if it’s taxpayers money that supposed to do the backstopping (immoral in my view).

As a follow up to my earlier post: the timely release of The Age of Easy Money on PBS provides the real answers to why we are in a banking crisis.

And unfortunately, Janet Yellen, who you revere here, is part of the problem.

Scott:

Thanks for the clarity in this fog of information. Government works!

Scott, for certain we exist in a me first culture and to call out the people who have benefited the most from ground zero of tech entrepreneurialism makes sense, yet I’m surprised you haven’t referenced the main issue here: our government and central bank. There rests the greatest culpability as over the last few decades, they created and then through irresponsible, excessive policies and guarantees, backstopped and encouraged irresponsible risk taking behavior.

From the Fed put, ZIRP, a near decade of QE, and direct to consumer fiscal handouts, our institutions cultivated a free call option mentality based on free money and minimal downside.

SVB, SPACS, crypto, housing, NFTs, VCs and soon to be PEs have all been exposed from the end of free money.

We should not penalise depositors and we should hold corporate decision makers accountable, but make no mistake, they have operated in a construct created and emboldened by the government.

And I also ask you, where is the San Francisco Federal Reserve been? Asleep?

Scott,

The ‘nail’ was struck in the ‘head’ so perfectly….it is flush to the surface.(In one blow, yet!)

Do keep up this excellent work.

The past is prologue…

Warm Regards,

PJ Olsen

This is a must read for anyone who wants to go beyond the headlines. VC (I have my own fund and we have portfolio companies at SVB) it’s perplexing to see the VC community, who by definition should be conducting the deep and nuanced understanding of complex situations, we’re unable en mass to articulate what you have so clearly stated here.

Great article. Spot on.

As the SVB story unfolded last week, I too was shocked by the run accelerated by Theil and Andreesen. Yes, the bank’s risk management was poor . . . having no Chief Risk Officer in place for most of 2022 as interest rates rose to assure proper bond/mortgage duration had been hedged. SVB was the tech community’s trusted friend, until it suddenly wasn’t. Echoing others, I’m not a fan of Yellen . . . I’m sure the banking system backstop wasn’t her sole call.

Praised the Federal Reserve? really. I wonder if your reader know that it is a private entity?

Banks get richer … people get screwed.

Thanks for all you do. Running joke aside, I find you very sufferable indeed.

Your piece reminded me of Hong Kong in 1989, right after the Tiananmen crackdown. There were rumors of hit squads being dispatched from Beijing, and one morning I came to work to see hundreds of people lined up outside the Citibank across the street from my office. The run was on.

It last for about 90 minutes. Then Li Kai Shing announced he was depositing a not massive but still significant sum in the bank ($25MM?), and within 15 minutes the line had disappeared. Crisis averted.

Just another reminder of the power the powerful can have when they stand up for the common good.

People aren’t just exhausted by the tech community. They’re sick of the entire corrupt system of global enterprise. (N.B., I’m not using “global” as a dog whistle here.) Despite all the mass- and social-media misdirection, every American with half a brain knows that plutocrats and their politicians have been busily stripping the place for spare parts since the 1970s.

You’re a fantastic podcaster, with an agile mind and a strong moral compass. You’d be even more impressive if you left the NetJets / HBR / Soho House bullshit bubble with greater frequency. I understand, it’s nice and warm in there. But don’t let yourself get too comfortable. That way lies irrelevance.

Thank God I have your podcast and emails in my life. You are the lighthouse in the storm on so many issues. Thank you.

lol re: Janet Yellen and regulation. The corruption in the system is so smooth, so well organised that it’s just part of the fabric.

A snippet below:

“The incoming US Treasury secretary, Janet Yellen, has been paid at least $7m (£5.1m) for speaking engagements at government-regulated banks, consultancies and hedge funds over the past two years, according to newly disclosed documents.”

ps it’s even worse when it comes to regulation of the pharmaceutical industry.

Kind Regards,

Conspiracy Theorist (someone making fairly obvious observations that the government and its cronies don’t like)

So impressed with your analysis. I believe much of the problem today is due to a lack of integrity; of investors not taking responsibility for their decisions.

I loved this piece until you ended with props for Janet Yellen who deserves none. Regulators have failed to regulate the banks because the regs themselves are not enforced. Why would bank’s permit deposits in excess of statutory insurance limits? Depositors ( like you Scott) know full well the regulations mean nothing. How can a system like that expect to survive? How can a society function if people choose to ignore guardrails put there to protect everyone? I’m glad SVB didn’t fail. I’m not happy it was allowed to endanger itself and the banking system as a whole

Calicanis, Sacks and those other guys are disingenuous, bleating baby goats at this point. Meanwhile, the little guy continues to effed by a different set of rules.

Janet Yellen has experience, courage, calm, and has been a leader in Monetary Economics since she was Jim Tobin’s star graduate student at Yale.

And yes, she’s a mom, which is helpful in dealing with chaos.

Loved the podcast explaining the SVB rescue. However you referenced catching the last helicopter “out of Hanoi” when you clearly meant “Saigon”. Fortunately neither of us fought in that war.

My very first time getting your newsletters. What a great analysis and of course good read. I’m definitely here to stay. Thank you so much Scott.

This is one of the best and most straightforward assessments of the debacle that I have yet seen. Kudos to Scott (yes, we are one of the VCs who *did* sign the SVB support letters, and yes, I fully agree with Scott about the Venture Catastrophists, both generally and specifically. I do not understand how they can look themselves in the mirror.)

Excellent piece Scott. You never disappoint when taking something complex and deconstructing it. My question is: why are we continually surprised by stuff like this? You teach risk/reward, cost/benefit, and SWOT analyses in your classes. And our reptilian brain constantly performs threat assessments to plan flight or fight responses. But we are terrible at looking out for the adverse outcomes of things like this; we disregard downside risk. We don’t gameplay for the worst-case scenarios; the people who do that are purged from the room every time a pitch deck or quarterly report is produced. SVB isn’t a one-off. We know there are inherent risks in every bank and investment house, yet we’re always surprised when they betray us. And banking isn’t the only industry with its head in the sand when it comes to self-assessment. As we continue to develop the previously unimaginable – crypto, AI, and nuclear fusion, to name just a few – we should spend as much (or more) time assessing the potential for calamity as we do promoting the promise of prosperity. Let’s get the Catastrophists involved at the beginning, in the planning, before something goes sideways – which it always does.

Excellent analysis, professor Galloway. Thanks from Brazil.

All what’s been said makes good sense but i don’t see how is Trump one of the reasons! That i totally disagree with you on , take a look at what’s happening around you today

Excellent analysis. Another issue about those decrying a “bailout” with “taxpayer money” is that no one (and by that I mean talking head media pundits) is mentioning that in the 2008-2009 crisis the TARP funds from the fed were repaid in full, with interest. Every dollar invested in saving the banking system was returned to the nation’s coffers.

The govt get a subset of people (banks) loans at rates not available to the average person. Can I get billions at those terms from the government? nope. TARP was just another helping hand to the rich elite bankers, nothing for main street. Just wall street.

Dear Scott, great analysis and reflections.

Only one more observation, more important from a structural point of view.

Mostly of CEO’s and CFO’s, Boards, etc, of the Banks in problems, in this case the svb>, also behave as venture catastrophists.

Trying to make huge amount of money as faster as they can, only looking the health of their wealth and not that of the system. A big pity and a heavy stone in the backpack of each system to construct trusty and healthy systems.

It happens every Friday like clockwork. Prof G publishes his piece and I fall in love.

Great post – great context. Not sure Janet had a good day today with Senator Lankford…that was extremely Not reassuring. Most corporate finance people are bred to ‘shoot first, ask questions later’ and in terms of where they place their deposits – well, you get the picture.

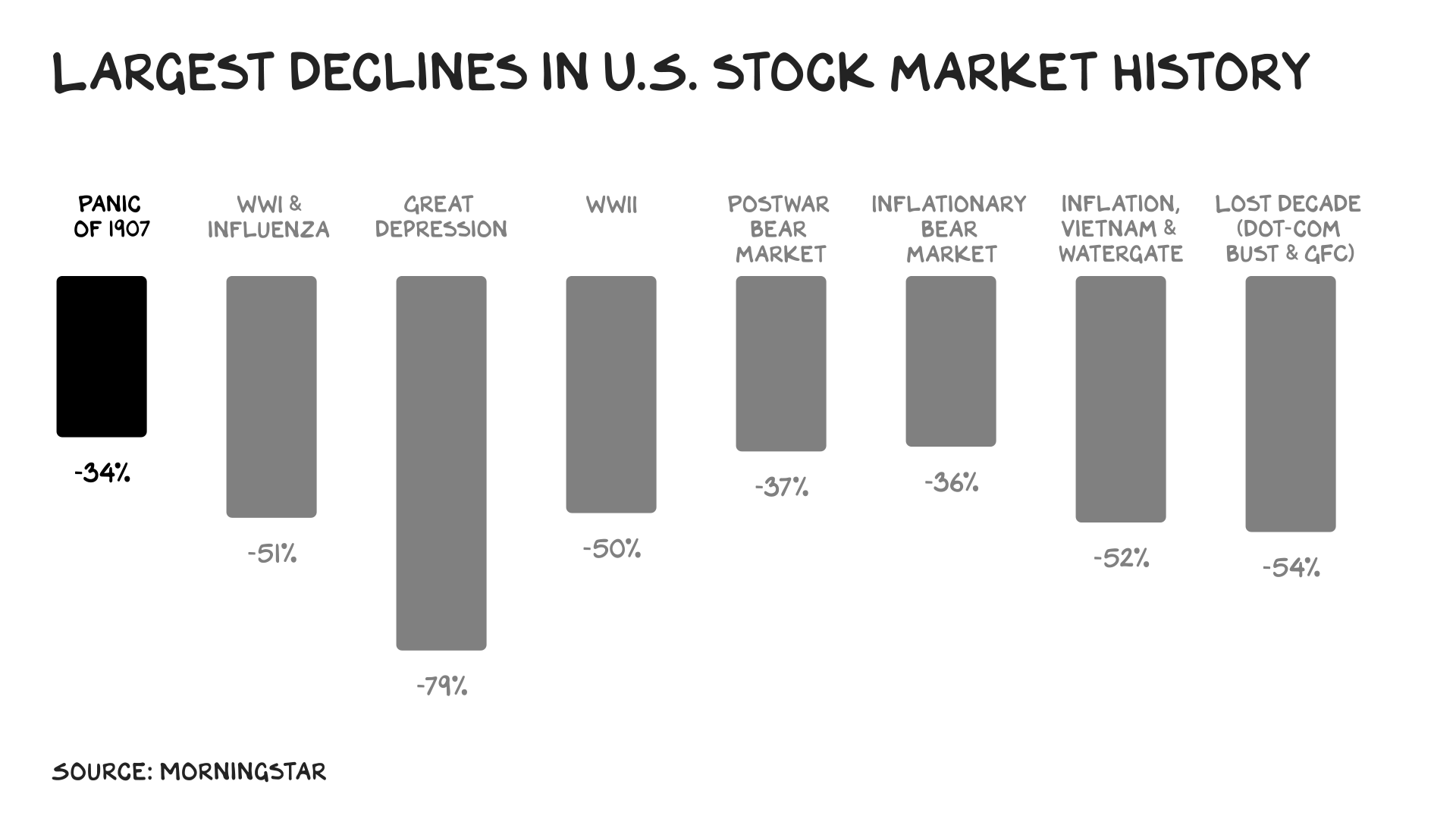

Scott, well done. Whether the economic downturn ahead will look more like dot.com, the GFC or garden recessions of the past has yet to be written, but I think lots of volatility and change is inbound. As they say, no two recessions are alike, but they often rhythm. We have a fairly ugly time ahead, let’s hope work like yours gets even wider play and serves as a basis for thoughtful and respectful discourse as we see in both in your presentation and in the comments below. The rate of change has sped up dramatically over the last few years and I think it will only increase. The most valuable asset moving forward will be the ability to examine and challenge old methodologies and then selectively synthesize the lessons of the past. Mapping these new understandings onto the evolving social and technological fabric will be essential.

No surprises here. This is the way neoliberalism functions in 2023. Banks again get bailed out as the People get sold out. The question is, how long can this form of capitalism system stay intact–as climate chaos worsens and the educated underclass grows? How many more bailouts will the People allow?

Even if this did not happen – SVB lobbied the Trump administration (successfully) to raise the asset limit for tighter regulation – they still would have failed for the other reasons outlined.

Scott, I 💯 agree. I LOVE that you called out Theil and Andreesen for the screaming little shrews they are. I’m proud of Yellen and the bankers that truly understand their role in the American economy. Thanks for another great article and kudo’s to you for having balls the size of church bells when it’s time to get real and tell it like it is.

Everything ok until the cringe line at the end calling Janet a man.

What has gender to do here with being courageous! Smh!grow up

Um no offense but “man?” You had me until Janet Yellin is a man.

You lost many in your female audience with “the real man is Janet Yellen”

Well said. And I’m going to be “borrowing” that “there are no libertarians in foxholes” line.

Prof G for Prez – time to let the adults in the room- with all of your shortcomings you are still my top pick- leaders don’t chose they are chosen I nominate you. Shortcomings? yeah get over it.

Love that you presented the invisibly ubiquitous equation between economics and leadership. Seems like leadership is a currency in high demand and low supply. Leadership is long term investment, but with potential exponential returns, or at least significant risk aversion.

Nice bit of copy writing flex on the “what type of man do you want to be?” I was about to fire up and write “PERSON!” you ding-ding, and then got to the end of the paragraph and “his name is Janet Yellen.” Nice!

Another great editorial. I love Fridays for getting a clear, well reasoned new insight

All on point, Prof G. Though — Yellen, yes, but Biden too.

Dear Scott, great analysis and reflections.

Only one more observation, more important from a structural point of view.

Mostly of CEO’s and CFO’s, Boards, etc, of the Banks in problems, in this case the svb>, also behave as venture catastrophists.

Trying to make huge amount of money as faster as they can, only looking the health of their wealth and not that of the system. A big pity and a heavy stone in the backpack of each system to construct trust and healthy systems.

“…the real American, is in Washington, and [his] HER name is Janet Yellen. The Venture Catastrophists are the other guys.”

The future is female… x

You’re a GOD

You left off one of the causes. 6 trillion pumped into the economy the past 2 years which made banks all flush with deposits and allowed SVB to more than double in size in less than a year and go on hunt for yield which killed them. A failure all around – management primarily but also regulators, fiscal policy , monetary policy and good old fashioned greed.

Scott

So good to hear you, and not because it shadows what I’ve been saying all week about this panic, drama and lack of leadership. I’ve been harping on TRUST for 17 years in my classes and I get a “that’s nice soft stuff” – Get a grip – it’s leadership.

When I was a banker, your word was your bond and it meant something. Crypto is not building an economy that will save the planet. Time to reclaim our values and salute the real leaders who still believe their word is their bond.

S

The backstop was the right thing to do, but taxpayers should have received compensation for doing it. Why didn’t the Treasury receive warrants in all the companies that exceeded the $250,000.00 insurance limit.

Quick one. It’s possible the value of J.P. Morgan’s loan is understated here. $8M inflates (CPI) to +/- $250M today as the post says, but given how large that number is, it might be more appropriate to compare it to the size of the economy, rather than the price of a loaf of bread or equivalent? The site Measuring Worth does an excellent job of this, and suggests that as a share of GDP this $8M is closer to being the equivalent of $5B (five billion) today.

You mentioned ‘Trump’ as a cause of this, but forgot that legislative changes were bipartisan. No mention of the fact that the likely DNC Presidential nominee for next year had a large percentage of his, his family’s, and his winery business cash in accounts way above the $250K FDIC Insurance.

Oh, you FORGOT that Signature Bank, the OTHER bank that cratered. Conveniently. Seems the man who likely sparked the 2008 financial crisis was a Director of Signature Bank. The Democrat Barney Frank. And was actively lobbying Congress to further change banking regulations to the benefit of Signature.

Scott, I use to respect your opinions. Now, all we get is MSM, without the screaming obese women.

less than half of the Senate Democrats voted for the changes, so how is that bipartisan? You can find some members of each party in favor of most things (including, for example, impeaching Trump). Wasn’t it a GoP bill passed in GoP controlled legislative chambers, signed into law by Trump?

I like Prof G. He’s a decent and intelligent person. It’s absolutely mind blowing to observe his (leftist? democrat? too many chocolate mushrooms?) blind spots, it’s just strange. We now have Janet Yellen warning of the risks that climate change poses to the financial system. You’ve got to be kidding me Scott. Bizarre

Scott

So good to hear you, and not because it shadows what I’ve been saying all week about this panic, drama and lack of leadership. I’ve been harping on TRUST for 17 years in my classes and I get a “that’s nice soft stuff” – Get a grip – it’s leadership.

When I was a banker, your word was your bond and it meant something. Crypto is not building an economy that will save the planet. Time to reclaim our values and salute the real leaders who still believe their word is their bond.

S

Excellent piece. I think most moderately minded people are getting sick and tired of the arrogant tech bros in our midst – including many VC partners. The clowns who caused the panic around SVB lat week should be ashamed of themselves.

Thanks for an excellent analysis!

Brilliance as usual Scott. The Country needs more “thinkers” like you.

Peter (Thiel) needs to be a pal and pay the piper (for once). Great post!

Brilliant as usual. I never thought of the banking system as a ponzi scheme but you describe it accurately as such. “There is little to fear beyond fear itself”. I live next door to Larry Ellison on Lanai. It is an interesting question to ponder what to do with 100 Billion. What does he do with it? What could he do with it? What would I do with it? “It’s no surprise a community of increasingly atomized individuals chose survivalism over citizenship.” I believe this is a function of the erosion of character in the last 50 years. Character does not matter much anymore. It is Trumped by Convenience and of course Capitalism

Richard—Thinking of the banking system as a ponzi scheme really misses the point of Galloway’s essay. Certainly ponzi schemes depend on trust, as the banking system does. But Galloway underscores the difference between a collective system based on mutual trust, and a con game that exploits that trust. It’s an important distinction that’s lost in your framing. I suggest you read Matt Levine’s “Money Stuff” column, “3,3” (Big Banks Trust First Republic With Their Money) for a plain language analysis of what happened with SVB and First Republic.

In the history of the world, no one has ever washed a rented economist.

Superb article. Good lesson in accountability & naming names!

Thank you for this recent writing from you. Very insightful observations.

I am a portfolio Manager and professional investor for 40 years, I find your writings are very perceptive and informative. Plus I like the humour in your writing. Always happy to hear/read what you have to say.

“There are no libertarians in foxholes.” <3

The ability to remove deposits instantly from one’s phone is a significant change. Customers didn’t have to walk in, wire or fill out a withdrawal form at their local bank. Like electricity, technology can be a blessing or a curse.