Think Slow

-

Audio Recording by George Hahn

Daniel Kahneman, who died last month, leaves an extraordinary intellectual legacy. Few people have unpacked our behaviors with greater insight than Kahneman and his longtime collaborator, Amos Tversky. In the wake of his passing, we’ve been reflecting on the many ways his work has shaped our thinking. Something I wish I’d figured out when I was younger is that greatness is in the agency of others. I have often tried to identify a guide or sherpa for different aspects of my life. Jesus and Muhammed Ali are my Yodas around social issues (love the poor, be fearless and poetic) and Peter Drucker informs my views on the economy (the purpose of an economy is to create a middle class), etc. Professor Kahneman helps me navigate the strait between instinct and decision. Some thoughts:

Homo Irrational

Kahneman studied how humans make decisions, and the shortcuts our minds take, unbeknownst to us. These shortcuts are efficient; they foster a key skill for survival, the ability to make rapid decisions with incomplete information. We have to make thousands of decisions every day, and we couldn’t leave the house if we had to objectively analyze every choice: breakfast, outfit, route, music, etc.

Our efficiency comes at the cost of accuracy: Many instinctual decisions will be poorly calibrated (i.e., wrong). To facilitate the requisite speed, our brain buttresses our decisions with artificial confidence. Kahneman’s body of work demonstrates that we are often wrong but frequently confident. These shortcuts and mistakes are present in the structure of our brains, and impossible to avoid, but recognizing them helps us discern between trivial and important decisions and invest the appropriate intellectual capital. Put another way, take a beat and you increase the likelihood of making a better decision.

Though he was a psychologist by training, Kahneman got his Nobel Prize for economics. Before him, economists “relied on the assumption of a ‘homo œconomicus,’” as the prize committee wrote, a self-interested being capable of rational decision-making. But Kahneman “demonstrated how human decisions may systematically depart from those predicted by standard economic theory.” That dry language obscures an intellectual nuclear detonation. Expectations about human decisions — whether to work at a certain job, how much to pay for a specific good — are the foundation of economic theory. Kahneman showed those expectations were incorrect.

Loss Aversion

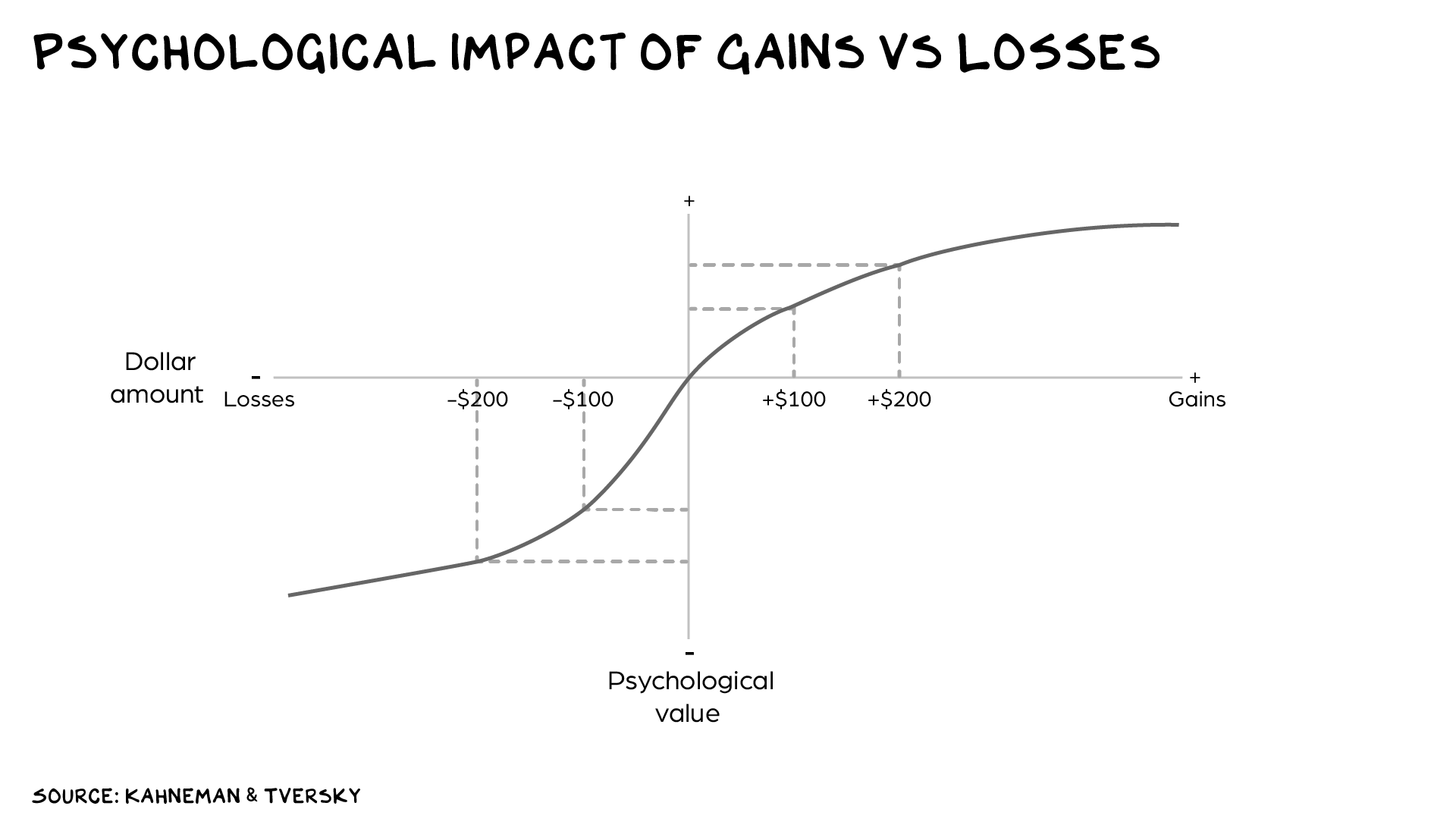

One of Kahneman and Tversky’s earliest insights was the simple observation that we feel the pain of loss more intensely than the pleasure of profit. It’s irrational to an economist, but we put more value on not losing $100 than we do on gaining $100.

We also have a skewed perception of probable gains and losses: We overestimate the likelihood of unlikely things. Insurance is a profitable business because people would rather suffer a series of guaranteed small losses (premiums) to avoid the risk of a single but unlikely catastrophic loss. The healthy profit margins of insurance companies reflect our tendency to overestimate the likelihood of calamities. Overestimating an unlikely outcome is also the secret behind the lotto, which offers terrible odds. Some examples of how this has influenced my actions. (Note: I am not claiming these are the right way to put Kahneman’s insights to use, just my way.) What I’ve done:

I actively limit the number of decisions I have to make to preserve neuron power for the key ones. I have other people order for me at restaurants; I have a uniform for work/working out, wearing the same thing every day, and someone else buys my clothes. I delegate the majority of decisions at Prof G Media — I participate in a one-hour weekly editorial meeting and check in with my executive producer 2x per month on business issues. I have not planned a vacation in 20 years or put anything on my calendar in 10. Despite having made more than 30 investments in private firms over the past decade, I review few documents, and rarely even sign them. (That’s all handled by counsel.) I try to reserve the largest possible cache of gray matter for research, thinking, storytelling (writing, presentations, etc.), and investment decisions. Over the next five years, I plan to outsource all investment decisions so I can focus on storytelling.

Seven years ago, I canceled all my insurance coverage — health, life, property, flood, etc. I don’t own a car, but when I did, we purchased the minimum amount required by law. This is a position of privilege (don’t cancel your health insurance), as there is no disease or property loss that would cause me financial strain. Since adopting this strategy, I’ve saved $1.4 million in premiums.

My belief in the market’s collective loss aversion has reshaped my investment portfolio over the past decade. The majority (90+%) of my investments used to be in publicly traded stocks. That share is now less than 20%. Instead, I lean into my access to private companies, as I can absorb big losses and withstand illiquidity. Per Kahneman, there have been periods of real pain. In the last 12 months I’ve registered four wipeouts — four investments that dropped to zero. However, two other investments registered a 4x and 25x return. My net return has beaten the market, but it’s been more taxing (emotionally) than just investing in SPY, as I have trouble shaking the big losses — again, making Kahneman’s point.

Take a Beat

Prospect theory won Kahneman his Nobel, but he’s best known for his seminal book, Thinking, Fast and Slow. The titular concept — that we have two thinking systems, a fast one for intuitive, emotional insights, and a slow one for logical, calculated decisions — is something that has saved me from … me, dozens of times.

Our fast thinking system is an incredible tool. It allows us to drive cars, compare prices, recognize friends at a distance, and play sports. But its availability makes us lazy. Why do the hard work of thinking through a problem when we can just “go with our gut”? In any decision of consequence, it’s good policy to slow down, get out of the stimulus-response cycle, and let your slow thinking catch up. That’s not to say we should disregard our gut — just don’t let it take the wheel.

Specifically, I try to be vigilant about not letting my fast system make decisions that merit the attention of my slow system. Often these are reactions to things that upset me. Last week, a journalist who’s active on social media posted on Threads that Jonathan Haidt and I were “grifters,” and that I did not care about young people. This pissed me off.

Feeling threatened, my lizard brain took over, and I saw the situation as a conflict, a threat to my standing in the community. That framing, courtesy of my instinctive, fast thinking system, dominated my consciousness for the next four hours, distracting me from my kids and vacation. I drafted an angry response to counter the threat.

Then I shared the situation with several members of my team. Able to evaluate the situation dispassionately, they were universal in their response. “Let it go.” I was just playing into an attempt to draw attention with ad hominem attacks the algorithms love. (e.g. Trump or Musk.) The learning, other than social media is a cancer? Speaking to others, before acting, is a great way to slow your thinking.

Happiness, Diminishing Returns, and Taxes

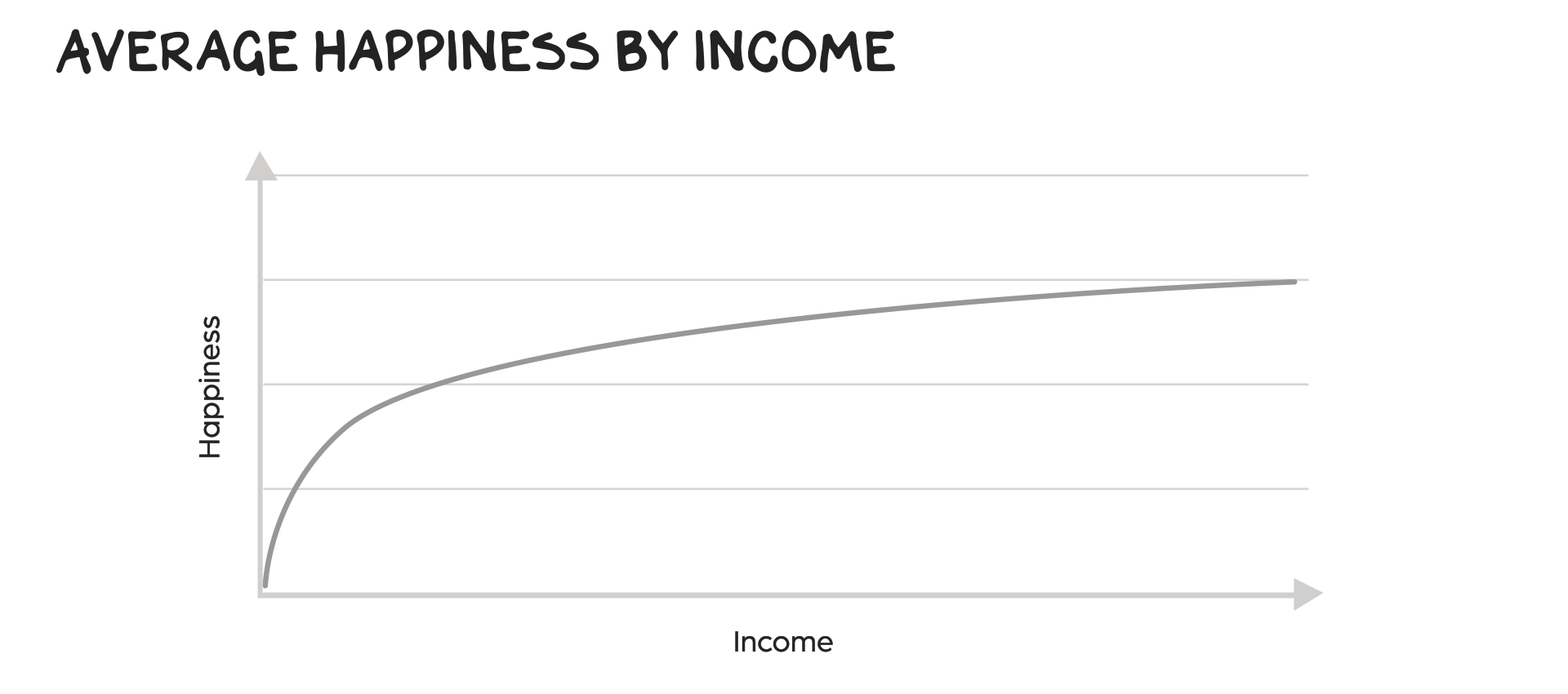

In 2010, Kahneman and another Nobel winner, Angus Deaton, published a study which appeared to show conclusively that income was strongly correlated with happiness at low income levels, but that income above $75,000 had no impact on happiness. The study was widely celebrated, but in 2021 a much less famous academic, Matthew Killingsworth at Wharton, published a paper reaching a contrary conclusion, based on a sophisticated smartphone-based happiness tracking system.

Rather than ignore the unknown academic challenging him, or using his global fame to undermine the upstart, as is the norm in Congress or pretty much anywhere else, Kahneman teamed up with Killingsworth. They engaged in a collaboration alongside a third academic neutral to the dispute — a process Kahneman pioneered. Working together, they found that Kahneman’s original study had measured the decrease in unhappiness but hadn’t captured the upside high-income people enjoyed. When more carefully measured, happiness did continue rising with income. However, there were dramatic diminishing returns. There were real gains to happiness in moving from $100,000 income to $200,000, but to see that same gain again required another doubling of income to $400,000. Extend the curve, and it flattens further.

I believe this should influence tax policy. A substantial increase in the progressivity of income tax would offer a net positive in overall well-being. According to the IRS, 26,576 U.S. households reported income of over $10 million in 2020, totalling $824 billion in income. We collected $210 billion income tax from these filers, or 25% of their income. If we collected an additional 25% of just the income over $10 million, there would be little impact on the lifestyle or happiness of these taxpayers.

But the additional $140 billion in revenue could cut child poverty in half ($100 billion) and end homelessness ($20 billion). These investments would generate a massive increase in the well-being of our commonwealth and a huge economic boon. (These societal ills cost us trillions in lost productivity.) Plus, we’d have enough left over to pay for most of NASA ($25 billion). And rich people love space.

Disassociate

Ideas are yours to play with, disassemble, shape, and apply where needed. I’ve taken the idea of “slowing down” and mixed it with atheism and stoicism to enhance my personal relationships. When my kids are disagreeable (i.e., awful), or my partner is upset/angry, I often respond as if it’s a threat to my authority or value. I reflexively escalate and get back in their face(s). I now try to disassociate. What I mean by that: I take myself out of my “self” and see someone I care about upset. Being an observer, vs. being in the line of fire, inspires different emotions.

When my kid is agitated, I recognize it’s more about what they are experiencing elsewhere, and they know that — no matter how unreasonable they are — I will still love them unconditionally. When my partner is upset, my role is to notice it, to give witness to their life. Their emotions matter, regardless of my ego or the perceived criticism. I can take arrows, get shot in the face, and never lose sight of my role as their protector. I am the man of the house. If that sounds like we digress to traditional gender roles, trust your instincts. I’ve slowed down, thought about it, and determined it works for us.

Life is so rich,

P.S. Join Section’s free event, How Will AI Change Education?, to learn how AI will upend education from high school classrooms to board rooms.

While I’m also a fan of Kahneman’s work, my biggest take away is the sentence “the purpose of an economy is to create a middle class.” A paradigm shattering statement. I’m currently obsessed with looking at the world through this lens. Many thanks.

C’mon. The $20 billion to end child poverty would be skimming the foam off of the DoD budget, making some simple safeguards against fraud in Medicaid and Medicare, or imposing a measley 0.1% high frequency trading tax.

It’s a rounding error.

Solving poverty is more complicated than just redistribution, or we would have figured it out decades ago.

Tax policy should be focused on collecting the most revenue in the long run, not happiness or fairness. Happiness is a backward looking measure. Tax planning is a forward looking analysis, i.e., rich people think they will be happier if they make and control more wealth. We want to encourage not discourage long term capital and rich people to come and stay in the US not try to leave or avoid. High marginal tax rates, high corporate tax rates, and wealth taxes 1) never get paid due to clever loopholes and 2) incentivize the rich to avoid. California and New York are two test cases that prove the point – for all their positive lifestyle attributes, rich people are leaving. Its ironic that within two minutes in the same episode you argue for high marginal tax rates and then make a comment on how Argentina became a mess through similar policies – high taxes, high social spending. If you really want to collect more cheese, you should advocate for a consumption tax combined with a negative income tax to eliminate the regressive impacts.

I’m all for more fair a sustainable distribution and reasonably high taxation.

But the only real game changer for out fiscal woes and the stark inequality and dissipating middle class is to tax the wealth, not just the income.

Rich families/ trust fund kids with dozens millions/ billions in assets, may choose not to work a day in their life and not pay any tax whatsoever, while we want to heavily tax the middle / upper middle class. The solution to world’s problems lies with Gates/ Bezos and Waltons’ assets not kids busting their assets off to get their dream $250k jobs just to pay 50 or 60% tax

Great newsletter. I too am working on changing my thoughts in the face of a perceived threat. I love that you are leaning into your role as protector. Doesn’t mean that your wife can’t also lean into whatever role works for her and you all. If she so desires, she can also identify as a protector. Partnership is fun like that! Bravo.

2 things inevitably came to mind while reading this: moving away from micromanagement and taking a step outside.

Not long ago, I came across methods for overcoming procrastination and I devised my own approach based on this insight. Step 1: Acknowledge the situation. Once I have this information, Step 2: Decide what to do with it. Step 3: Utilize the information gathered and either act on it or disregard it.

By actively choosing to engage with or dismiss the information, we take control of our productivity and mental clarity.

The fact that there isn’t a “View in Browser” button atop the emails, and that clicking the header (even where the title of the newsletter is) brings you to the Amazon page for the book and not to this site is quite irritating; poor design.

That was beautiful. Thinking Fast & Slow was incredible work and that was a great tribute to Daniel Kahneman. Thanks for sharing how you personally navigate. While we are in radically different life situations I think the principles are the same. Can I be slow and thoughtfully and open to another perspective than that of my lizard brain? Can I re-think some of my assumptions about how I allocate decisions, time, and money. This was good.

I am thinking about your partner who I gather is making all those domestic decisions – lucky you that you can just switch that off – how do they feel about it?

“But the additional $140 billion in revenue could cut child poverty in half ($100 billion) and end homelessness.”

It sounds “nice,” but it’s far from true. America’s problem is not a lack of money but a lack of focus on the right things.

An extra 140B is most likely to be spent on more arms to Ukraine or welfare for illegal immigrants.

The “solution” is not more taxing but the proper use of the existing resources.

Your comment is a great place for me to practice letting it go.

“But the additional $140 billion in revenue could cut child poverty in half ($100 billion) and end homelessness.”

It sounds “nice,” but it’s far from true. America’s problem is not a lack of money but a lack of focus on the right things.

An extra 140B is most likely to be spent on more arms to Ukraine or welfare for illegal immigrants.

The “solution” is not more taxing but the proper use of the existing resources.

You do need to write- all non-fiction, I suppose. It would be delightful to read your take on world-buildung fiction- where are you meaning? Out of genuine concern- how’s the drinking going?

Thanks for sharing-

Kathy

Giving more money to politicians does not solve the problem, it does encourage them to pass more legislation to fix the world however.

As California has proven, no amount of money (and we have spent billions already) will solve the homelessness issue as long as we have our current political leadership in place.

If you don’t plan vacations, how do you take them?

The Tversky intelligent test. The sooner you realize that Tversky is more intelligent than you, the smarter you are. We also use this to describe my son. He is PHD neuroscientist for the NIH in Bethesda. Keep up the good work Scott. I love these emails.

What you share with Kahneman is respect for intellectual integrity. Being right lasts a moment; integrity, a lifetime. I’m a fan.

Love your emails and I really look forward to reading them. They give me a lot of joy. Today though you really got me thinking!

Please can you expand or explain what you mean by the below statement ?

“investment decisions. Over the next five years, I plan to outsource all investment decisions “

Why would you outscource them? I thought investment was not a science but an art. What would you gain by outscourcing, surely the responsibility of the decision has to be with you? More importantly how would you implement such a process (asking for shellfish reason so I can understand if this is something I can copy! Hope you don’t mind)

Thanks for the wonderful post as always, Professor G.

I would LOVE to attend the Section on how will AI change the education. But I am a teacher and the timing of the lecture falls within the school day. Any chance this could be offered as a recording/podcast? I am a true foot soldier and this topic affects my students and me…and yet, in is inaccessible to the actual “real-life” educators 🙁

The ball costs 10 cents.

Hi Scott!

After reading your blogs forwarded by my wife, I’v finally subscribed. Good work!

Perhaps you will recall my admonition from class about RE developers “Not always right, but never in doubt.”

Hey Prof G,

I’ve long admired your work and was thrilled you discussed a book that significantly influenced my thinking.

I appreciate your candor in sharing your lifestyle, especially your approach to decision-making to preserve mental energy for crucial tasks. However, your method might slightly miss the mark in terms of maintaining your relatability and humility. You mention relying on others for daily decisions, from dining to dressing and even significant business operations. While delegating is an important and powerful skill, particularly in your position, some practices, like having others choose your meals or buy your clothes, might detach you from essential, grounding daily activities.

These choices might seem minor, but they illustrate a broader theme of disconnect that could be alienating. Surely you could have a standard restaurant order or two in mind, and set up a recurring and consistent online clothing purchase that aligns with your minimal decision ethos but keeps you connected to everyday activities.

Your focus on storytelling and investment is valuable to me and others, and your strategy frees up mental space for these pursuits. Yet, maintaining some of these small personal decisions might enhance both your grounding and the relatable aspect of your public persona.

That said, I’m in favor of you spending more time on storytelling. You’re good at it, and I value it.

Thoughtful comment!

Years ago I heard Peter Drucker at Claremont Graduate School say that the job of management was to magnify the talents of their subordinates and minimize their weaknesses. In addition, it was management’ s task to ensure that their charges had all the resources and training necessary to do their best work.

I heard that before my very first job interview. Got the job.

Thank you Scott for your thoughtful message. Instead of doubling the tax rate for high incomers (a loss, and thus unhappiness no matter their high income), I would try to promote philantropy (the impact in + happiness of voluntarily giving vs. having no option but to pay the compulsory incremental tax). Win-Win. Abrazo y gracias

Hi Jose, I’m not against philanthropy—indeed, everyone, especially the wealthy, should contribute positively to society. It benefits us individually, as you note, and collectively.

Yet, philanthropy alone cannot replace structured, strategic decision-making for our common future. When we over-rely on philanthropy, we entrust critical choices to the unaccountable. As frustrating and slow as democratic processes like legislatures can be, they’re essential for protecting individual rights and preserving democratic values.

I’m currently on a business trip in China, embarrassed by the US’s inability to build an efficient high speed train system. An amazingly smooth 250km/h ride is enviable, but I would never trade our democratic ideals for smoother transportation. Similarly, why should we trade marginal dollars—which diminish in personal value—for our democratic principles? Relying on philanthropy, like expecting the Gates Foundation to fix education, skirts these ideals.

Tax policy is a complex beast, and we may never perfect it. However, Kahneman’s insights on wealth and happiness suggest that a progressive tax could tackle our biggest issues with minimal happiness impact. It might sound harsh to those making $10 million a year, but this trade-off—fair taxation over unpredictable and unaccountable billionaire generosity—is one I’d endorse every time for the sake of broader societal progress.

This is a beautifully written and meaningful eulogy to another great thinker. Thank you for sharing.

Wonder how many other liberal elites self-insure.

I bet the professor pays a proportionately low tax rate as well.

I have a friend, lefty with strong views on tax policy, worth $2MM. His wife makes $70k. Yet they pay no taxes. They look poor on paper and as such benefit from many welfare programs because of clever manipulation of the tax code. Not food stamps but many other programs. Because assets aren’t considered. Free tickets to all the fine arts, subsidized health insurance, etc.

So in both cases a tax rate increase isn’t such a big deal.

I don’t hate the player. I do hate the game. But in this case, I caution the player levering much of an opinion.

“I bet the professor pays a proportionately low tax rate as well.” Yes, he does and he has stated multiple times the whole game and tax code is now rigged in his favor. That’s why he donates as much as he does. He’s humble-ish, but still enjoys the game. You called him a liberal elite, you do hate the player. It’s ok.

Well 2 points

1.

“”we are often wrong but frequently confident””

The GOP candidate for the presidency is mostly wrong (lying) but always confident.

2.

The faster your slow thinking system is, the less it matters which one you are using E.g. in a mall choosing which product is best price can be done by the slow system if it is fast enough (making head based calculations) instead of the fast system which is being misled very knowingly by the “sellers” be it the mall itself or the big and small names on the products.

KR

Scott I would agree with the increase taxing, unfortunately it won’t work.

If our government would agree to to invest the money toward those issues that would be amazing but we know it would never happen they would just waste it on some nonsense or it would get lost in the system

Quality morning read 👌

Thank you for this. Your consistently Kahneman-esque insights never fail to make my life more deliberate and rational.

People ask me why I’m a vegetarian? I tell them Herbert Simon. Dramatically reduces the number of decisions I have to make.

Quality article.

Danny Kahneman was a real pioneer and made important contributions to economics and psychology. I also agree with the previous commenter who mentioned the “Hidden Brain” episodes – well worth a listen. Fascinating stories and real insight, and so much fun to listen to Danny. He will be missed.

EVERY alleged justification for increasing the theft of income taxes and handing it to government to be squandered is stupid, but using a happiness quotient is egregiously stupid.

Spot-on! With age has come wisdom and the ability to slow my frenetic/kinetic ass down and pause for a beat (I’m a musician after all) before snapping something off. Oh how I wish I knew half of what I know now when I was younger, alas. Great post. Cheers!

Sage rhymes with age. Coincidence?

My thoughts exactly. Exactly!

Last weekend, the NPR program “Hidden Brain” re-broadcast an interview with Kahneman and it was just brilliant. Especially insightful was his comments about how global warming/climate change presents huge obstacles for humans to address (uncertainty, future impacts, etc). What struck me was simply the elegance and humility of Kahneman’s thinking.

This is a great reminder for me to not act so quickly based on emotion, but rather be more conscious/mindful so I can act more rationally. This should be a monthly reading for me. Thanks for this post.

On this bit of text: “my role as their protector. I am the man of the house. If that sounds like we digress to traditional gender roles” – I think it’s entirely feminist for being the “man of the house” to include being everyone’s protector, as long as it’s a role that is also, simultaneously, available to the “woman of the house.” Everyone, no matter their age or gender, deserves someone to protect them in some way. Feminism is about expanding roles and opportunities, far more than about taking them away.

Thoughtful comment!

Nicely said, Rochelle!