Stream On ’22

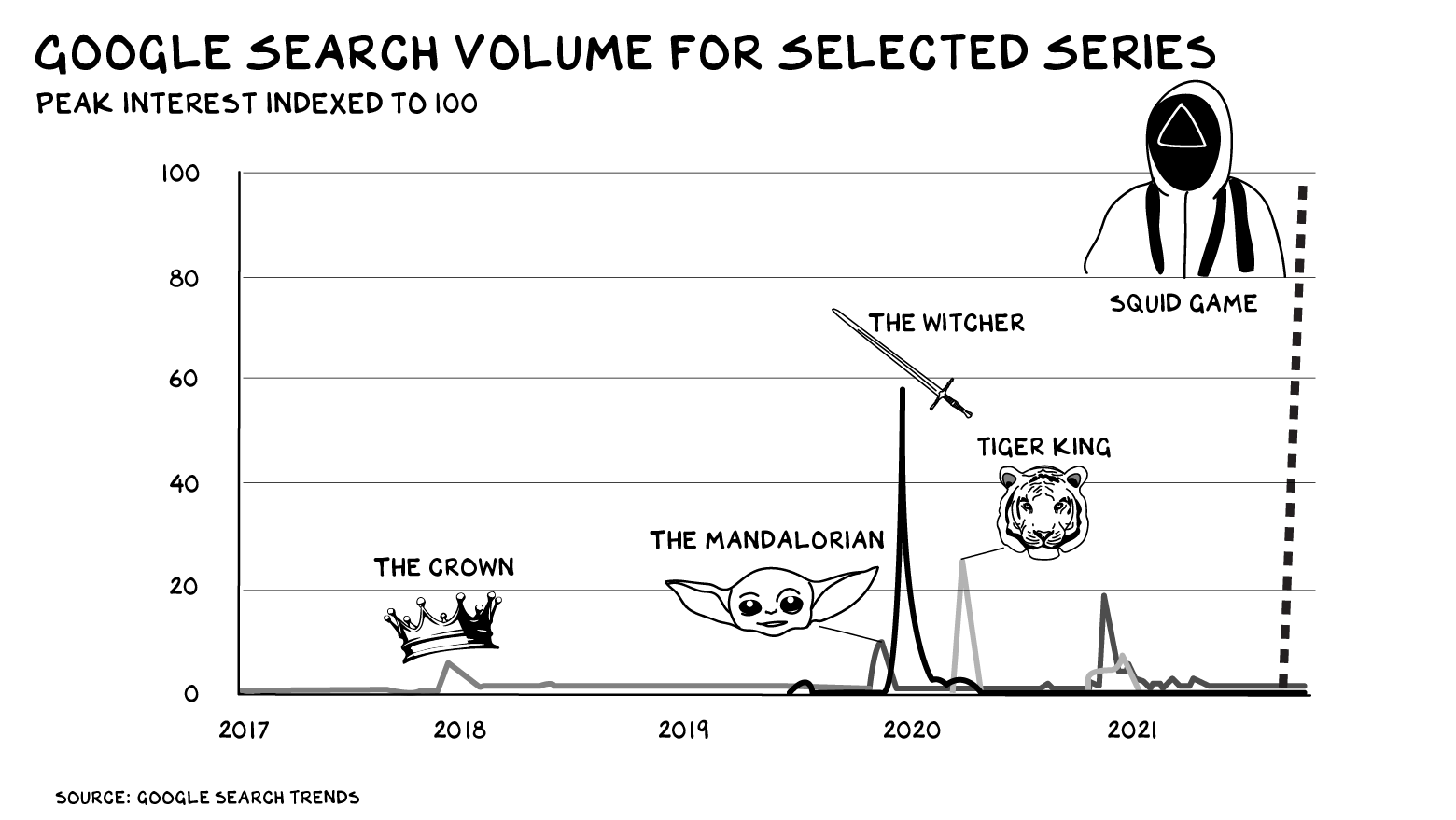

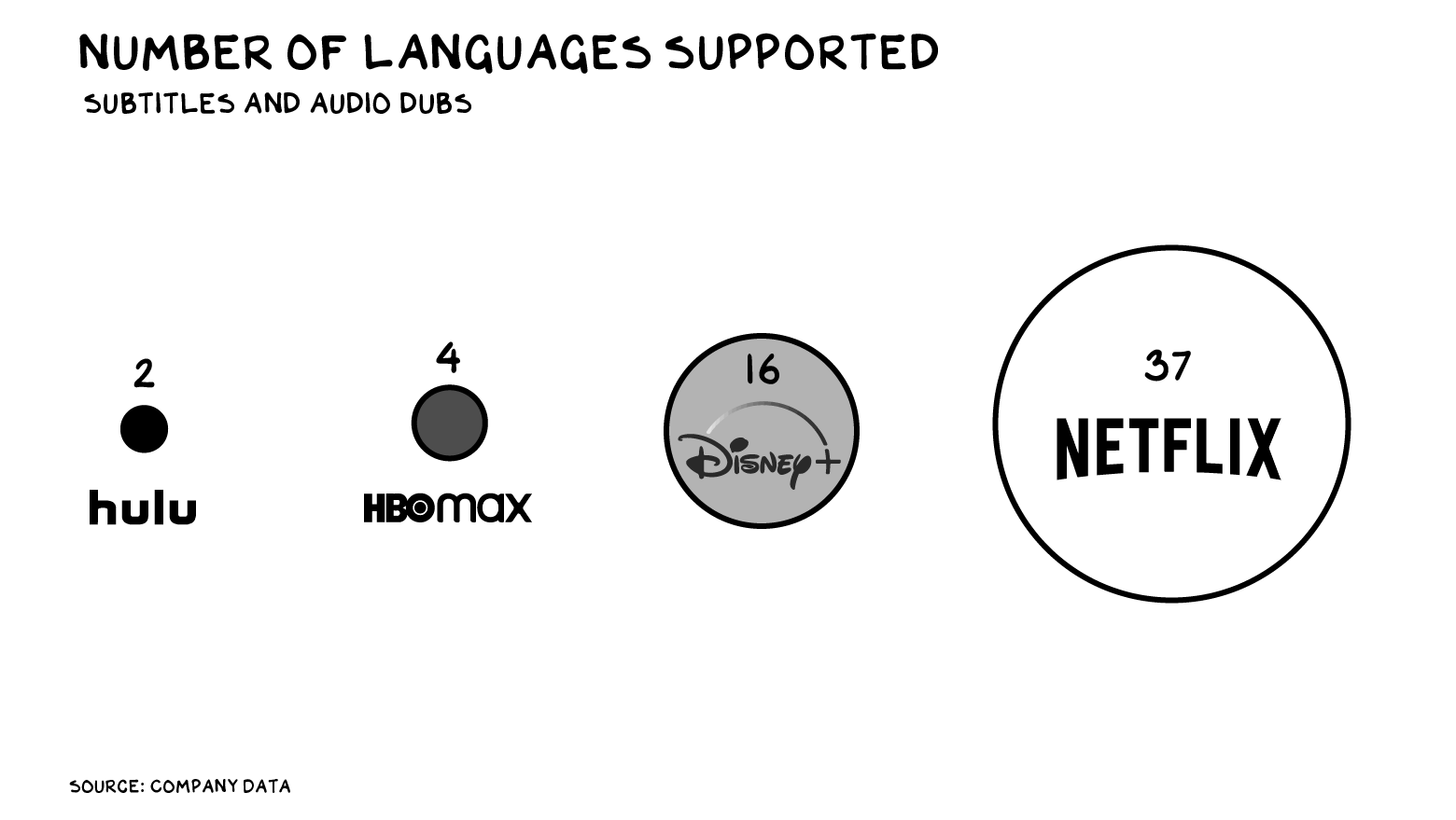

Two weeks ago, at the Code Conference, Endeavor CEO Ari Emanuel claimed “the total addressable market of content is infinite.” Netflix is spending $17 billion a year to validate his thesis. So far, they’re both right. Since last Friday, Netflix raised subscription prices in 11 countries by as much as 40%. A company’s ability to raise prices is a function of the delta between the price and the perceived value. Nothing better illuminates this delta than the below chart:

Glocal

Squid Game was sourced, written, and produced in South Korea. Within 10 days of its release, the show was No. 1 on Netflix in 90 countries. The Tarantino-meets-Terry-Gilliam take on children’s games has the fastest-growing audience of any Netflix original ever, registering a 981% engagement increase in its first week. On TikTok, #SquidGame has been viewed more than 22.8 billion times. The jump in South Korean internet traffic was so great that internet service provider SK Broadband is suing Netflix to pay for the costs it’s incurred to deliver the megahit.

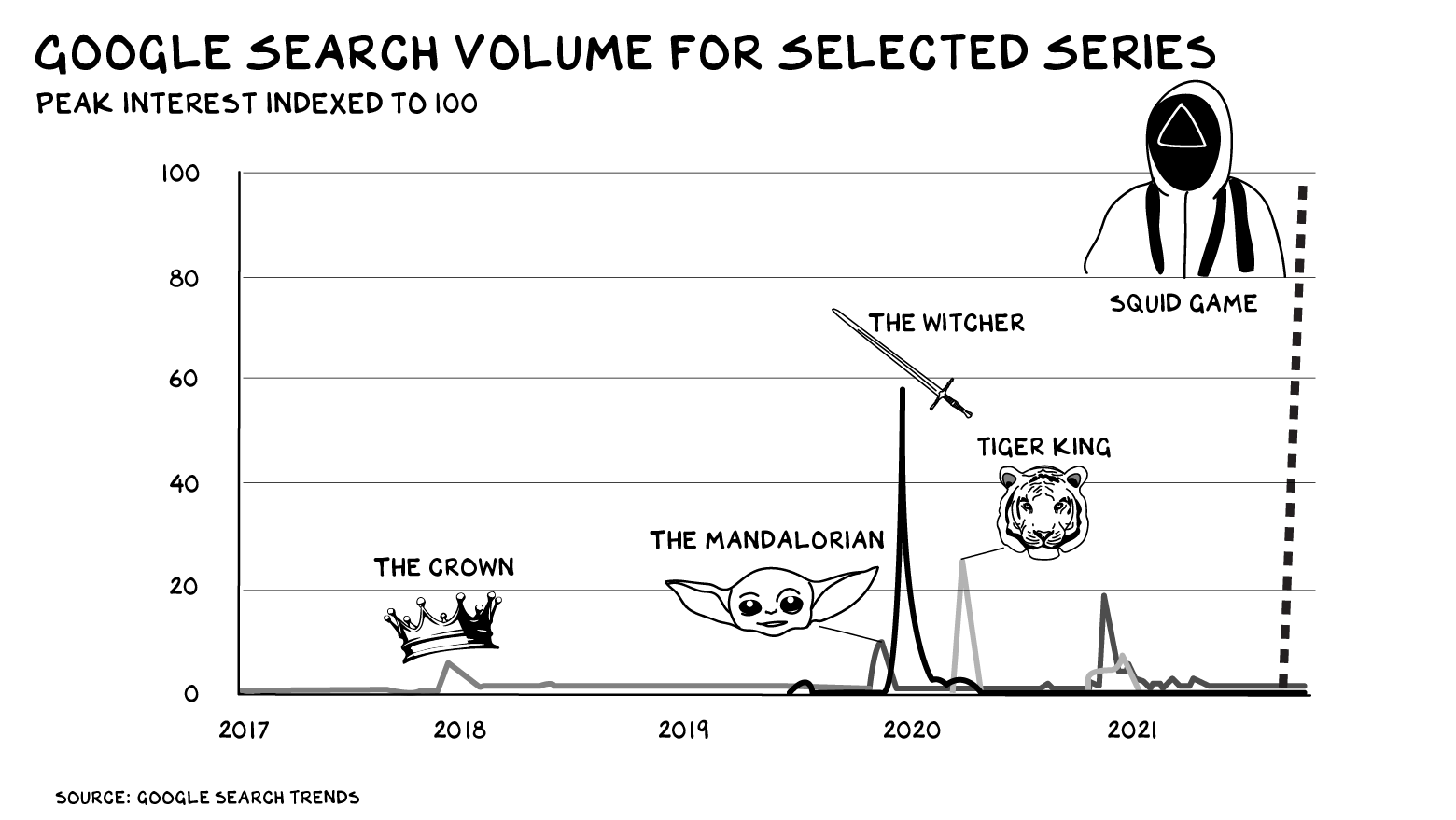

Q: How did this happen? A: Intentionally. Netflix landed on foreign shores in 2011, when it launched its service in 43 Latin American and Caribbean countries. Now it’s available in every country except for China, North Korea, Syria, and the disputed region of Crimea. Four years ago, Co-CEO Reed Hastings estimated Netflix could achieve a 75% to 80% international user base. Currently its non-U.S. streamers make up 65% of its users and generate 56% of total revenue. Netflix is far and away the world leader in distribution.

But expanding distribution globally is nothing new. That’s been Hollywood’s strategy for generations. Think big production budgets, special effects, and guys in capes. Netflix’s innovation was committing to “glocal” content — content sourced and distributed locally with global scale and Nasdaq capital to build an army that’s registered historic success. The company is now investing in original programming in 40 countries and has produced original scripted shows in 20 foreign languages. It’s spent more than $1 billion on Korean content alone. This year the company has either built or announced plans to build two production facilities in South Korea, offices in Canada, Italy, Colombia, and Turkey, a production hub in Sweden, and a full-service post-production facility in India. In each country, Netflix hires content executives to commission work from the local creative community.

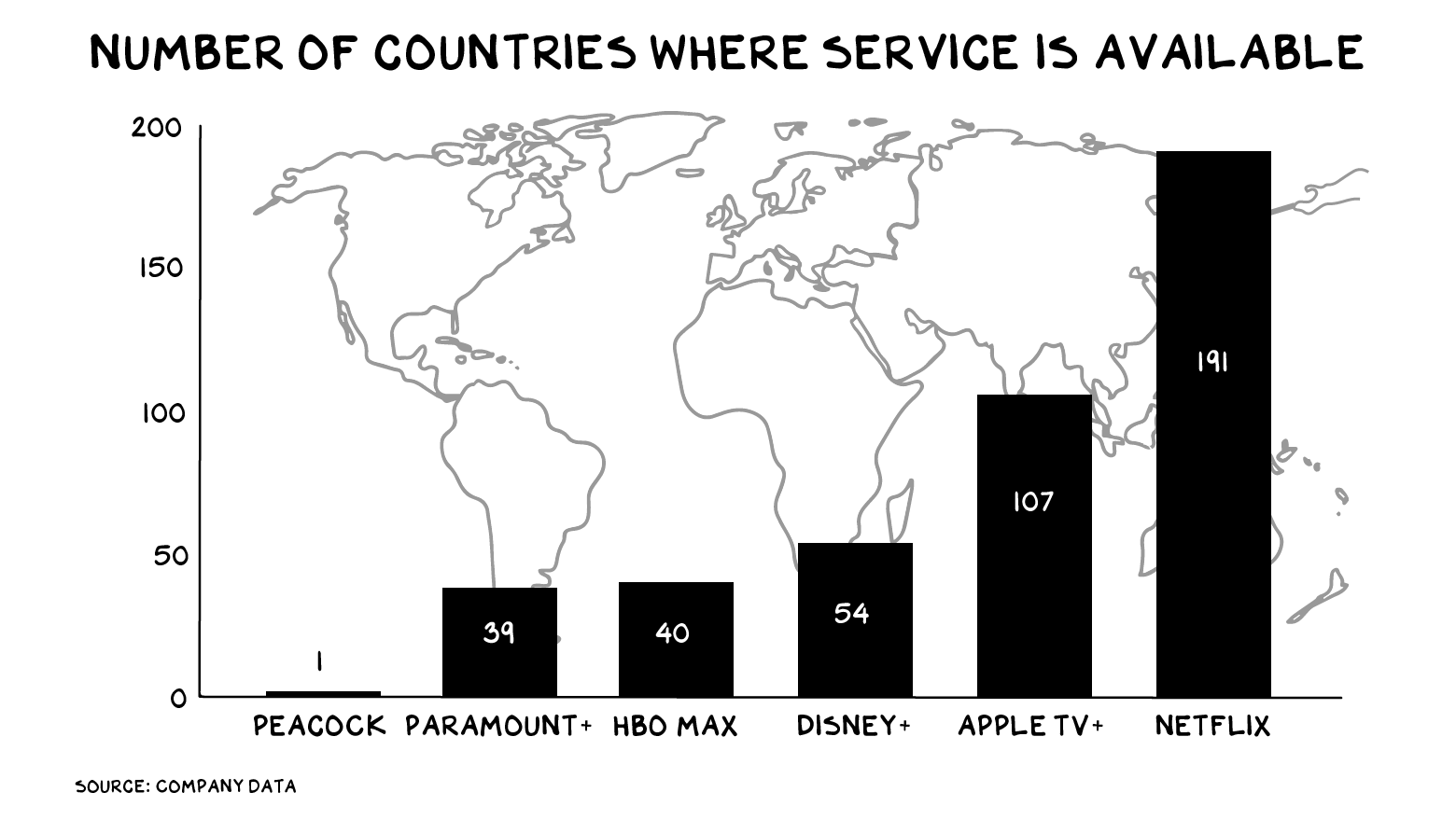

The obvious benefit is more local content. South Koreans like Spider-Man and Star Wars, but they have their own cultural traditions and preferences, too, as do the other 189 non-U.S. countries in Netflix’s empire. This is true in other industries. Only 10% of Nestlé brands are in more than one country, and fewer than 1% are in more than 10, as it recognizes people want global scale but local products. Consumers in other nations face a choice: the production values of U.S. content or the relevance and connection of local content. Netflix offers both, and it can now provide more home cooking than any other firm. Take HBO Max. Its user interface cannot be changed from English, and it’s produced original scripted programming in just two languages other than English. Peacock, Paramount+, and Apple TV+ have all produced none.

The secret weapon here is boring and obvious — brute strength. Netflix will spend as much on content this year as Apple, Facebook, or Samsung spend on R&D. Disney and Warner/Discovery can claim they spend more, but their munitions are spent across multiple offerings/brands with different business models. Netflix’s investment in glocal content is now paying off at home as well as abroad: U.S. consumption of its non-English-language programming has grown 71% since 2019, and 97% of American Netflix subscribers have watched at least one non-English title in the past year. Read that last sentence again. This is a radical change to the American media landscape. Meanwhile, the number of Americans studying Korean on Duolingo has spiked this month. Should we really have a best “foreign” film award?

Per Ted Sarandos (the other CEO), Squid Game is likely to be Netflix’s most successful series ever. That means two of its top three series will be internationally produced: Squid Game Season 1 (South Korea), Bridgerton Season 1 (U.S.), and Money Heist Season 4 (Spain). Expect to see more subtitles moving forward.

Prey

While Netflix ascends, the previous prestige television king has lost its crown in a corporate swamp. HBO has demonstrated remarkable resilience, and the case study that still needs to be written is how its culture continues to do more with less. The firm’s in late-stage puberty — it’s now in its forties — and converting to a streaming platform was as awkward as it sounds.

AT&T should never have owned it and, to its credit, recognized this and spun it to Discovery. But Discovery will probably inherit AT&T’s legacy shareholder base, which likes dividends and may not have the stomach for the kinds of investments required to muscle up and glocalize. Discovery Inc.’s first-half revenue is up 12% from last year, to $3 billion. That sounds nice until you realize it’s a fifth of Netflix’s H1 revenue and is still dependent on advertising through linear channels. Put another way, AT&T shareholders may still be in a consensual hallucination that you can have ATT profits with NFLX growth. You can’t, and the transition period will likely produce neither. The wild card may be CNN+ — rumor is they’ve signed up some remarkable talent. Yep, we’re talking dragons, bounty hunters, scorching-hot dukes, and sublime chess protégés, all wrapped into one person. So excited for them. But I digress.

A scenario: Discovery misses a quarter, as companies do, and the shareholder base realizes this is not the guy they thought they were marrying and bail. Stock takes a hit and invites a new, older suitor, as it’s the only media firm with iconic assets that can be acquired — others are too big or have dual-class shareholder structures. The inamorato is from Philadelphia, rough around the edges … and rich. Comcast has the capital and the backbone (see above: Philadelphia) and likely already realizes its homegrown effort (Peacock) is fighting Panzers on horseback.

Unleash the Mouse

Disney had the most impressive launch in OTT history, but its staggering potential is still unrecognized. The company should double down on the rundle (recurring revenue bundle) model and tie all its assets into a tiered subscription offering. Disney² members would get exclusive access to Disney parks, experiences, and merchandise, which today account for 34% of the company’s total revenue. Disney is Lebron James in junior high school: It’s got unmatched assets but is short on coordination.

Our D² rundle vision included a new content feature: edutainment. We suggested the company launch an education product for kids in grades K-12, advice the company seemed to take halfheartedly onboard. In July, Disney licensed its characters to an Indian education company, Byju’s, to launch a learning app in the U.S. — a start, but I still think Disney should take matters into its own hands. The synergy of education with parks, merchandise, streaming, and singular IP is a subscription-based motherload the company hasn’t tapped.

Lieutenant Acquirer

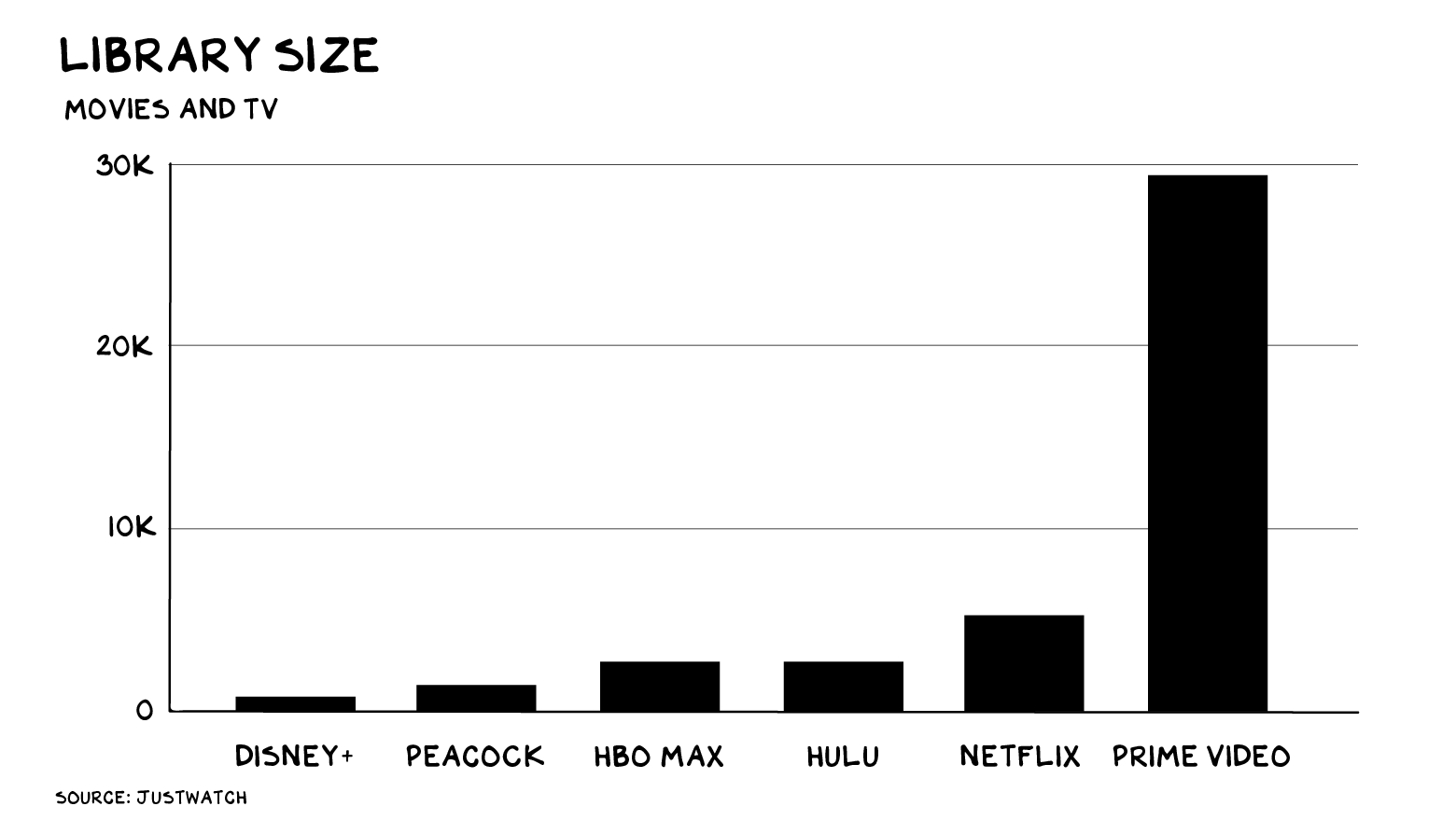

I correctly predicted Amazon would add health care to its ever-accelerating flywheel. I could not have predicted it would pick up James Bond along the way. Amazon announced the acquisition of MGM Studios in May for $8.5 billion (subject to antitrust review), more than double what Disney paid for Marvel or Lucasfilm. Bob Iger’s balance sheet used to be his superpower. But $386 billion in annual revenue and a $1.7 trillion market cap make Amazon a formidable force in M&A. It now leads all streamers as measured by number of titles. There are seven times as many movies on Prime Video than on Netflix.

Dark Horse

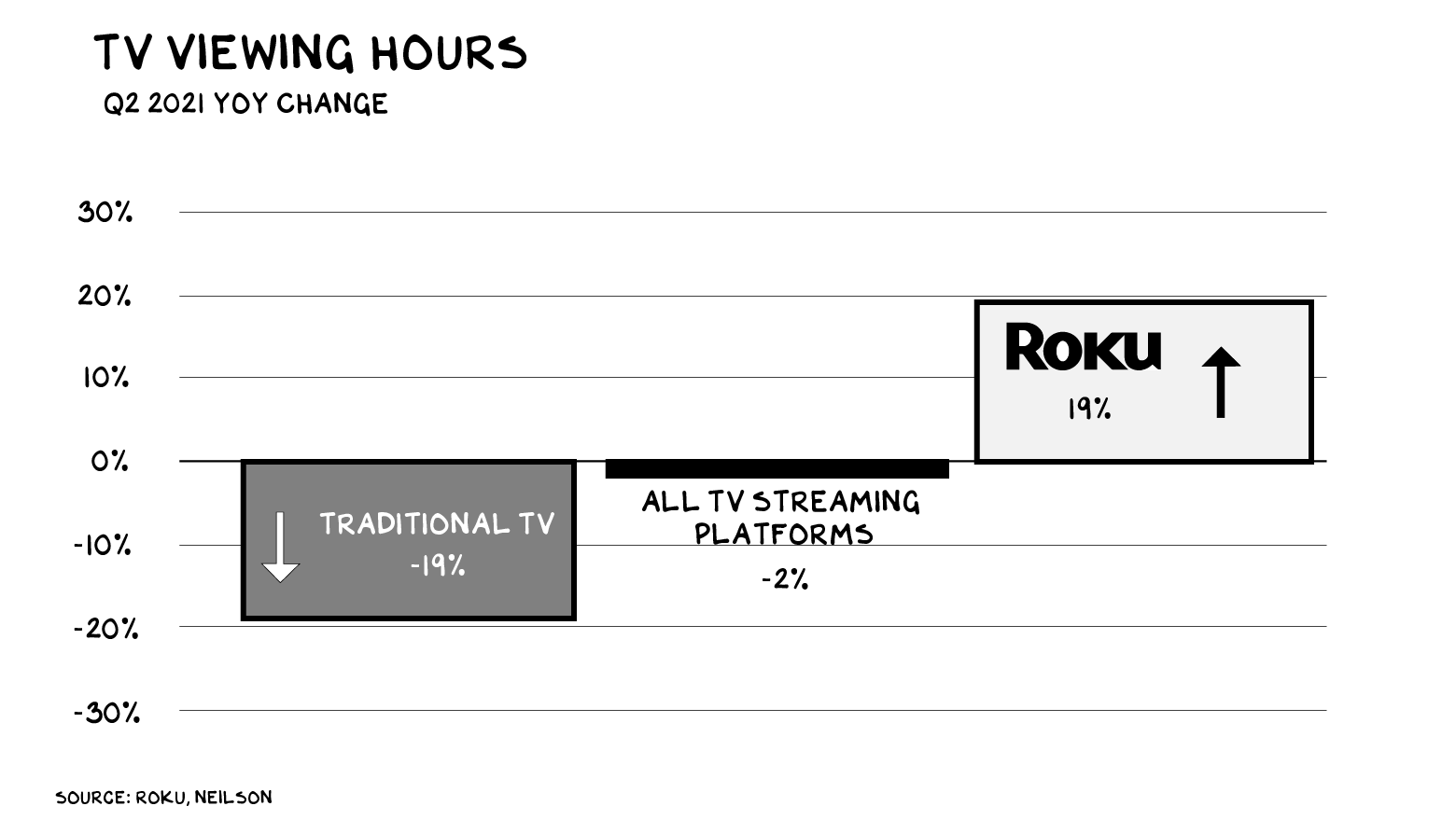

Roku has quietly gone door to door through the streaming neighborhood, picking up partnership deals with major distributors. It’s now a key operating system for content. In the second quarter, the company registered an almost 20% increase in TV viewing hours year over year, compared to the slight hit other streaming platforms took when we began our slow return to a less-indoor life.

The market has provided Roku with the capital to go hunting, even if its first kill is a newborn wildebeest that never learned to walk. Roku acquired Quibi’s assets this year for a seventeenth of the funding raised to create its content. It still may have overpaid.

The Silent General

Apple doesn’t release any financial data for its streaming product, nor does it report its subscriber numbers. I don’t see this as cause for concern. Apple TV+ is Roman Roy — it doesn’t matter how badly it fucks up … it’s going to be successful, because Dad owns the railroad. Ted Lasso is a good, if not great show. If it was on Hulu, it would be a cult hit getting a fraction of the views and buzz. BTW, if someone showed you Ted Lasso a decade ago and told you either Apple or Nike had produced it, you’d have guessed Nike. Nike should and will get into the content game. But that’s another post.

In sum: Netflix goes global, Disney grows into its content body, HBO ends up with a third owner in as many years, Roku takes off its glasses and becomes the hot girl, the swoosh shows up with sports content, and Amazon and Apple continue to underwhelm but eventually land on their feet, as they were born into privilege.

What’s the key takeaway, the only thing I’m sure of? I can’t wait for Season 3 of Succession.

Life is so rich,

P.S. Going with your gut is fine, going with data is better. Learn to make data-backed business decisions at every level of your organization in Tom Davenport’s The Principles of Data & Analytics Sprint featuring special guest lecturer, Jonathan Francis, Chief Analytics Officer at Starbucks. Sign up now. Opportunities like this don’t come along too often.

34 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

Just one correction: You didn’t account for HBO’s channel business and streaming platform in other countries – HBO GO, soon to be converted into HBO Max and sharing the platform with its US cousin.

Also, HBO “invented” content localisation and local production. Netflix has just been pouring in a lot more money recently and will probably surpass HBO in this respect (would be interesting to see the graph).

My guess is HBO gets some success out of HBO Max global launch, but starts to struggle with building up subscriber base due to content which is premium but also “heavy to understand while not really thinking about it while lying on the couch”.

Lovely as always. Noticeably absent: YouTube on TV screens…

Great post, back to your brilliant best!

“In sum: Netflix goes global, Disney grows into its content body, HBO ends up with a third owner in as many years, Roku takes off its glasses and becomes the hot girl, the swoosh shows up with sports content, and Amazon and Apple continue to underwhelm but eventually land on their feet, as they were born into privilege.”

That summary is just pure gold. Maybe your best recap yet.

Yet HBO still makes the best content @ quality batting average.

By far.

Once th Warner people iron out the global expansion of the OTT platform, they will be fine.

Netflix does have a first mover advantage in developing content in many markets tho.

Your analysis demonstrates a scope and depth that casts a beacon in the darkness, in short a lighthouse on the shore of media. You are a joy to read – I hope you run for office some day !

Agreed!

Scott. Your a god damn genius. You managed to net out a complex market and subject in a very concise and understandable manner. Your one two page articles are worth more than reading a hundred other pundits as they drone through the financials. Keep up the good work! You are a breath of fresh air.

Excellant article – thank you !

There will be multiple winners here. The ability to directly reach virtually everyone around the globe dramatically increases the value of all content. Therefore, virtually all of the players outside of Netflix and Disney are dramatically undervalued. Eventually prices will adjust accordingly. In other words, the real opportunity is outside of the leaders as their content is valued at 20- 30c on the dollars. The new entity of the combined Warner/ Discovery may be the best long term play.

“AT&T should never have owned it and, to its credit, recognized this and spun it to Discovery”

is Stankey a friend or client?

I think you’re missing the trend towards paid ad-supported skus(a la HBOMAX), and that being the future of this industry. The service that can build a successful business out of ads and be able to lower the subscription price as a result to gain scale will have a competitive advantage.

Also, where is Google/YouTube in your analysis?

Great article! Just like your older work before you decided to blame the Republicans for everything.

I think VIAC;s strategy is being overlooked. Through CBS they have an international presence. They have a budding sports empire with international soccer, NFL, NCAA basketball, golf etc. They have the ability to distribute product (shows, movies and sports) across linear, streaming, and the dark horse Pluto TV. Pluto is an ad supported service which is free to users and a cable like interface. We have an American centric view of the world. Pluto is a great alternative in poorer nations and VIAC can also distribute their news, entertainment and sports world wide. VIAC has deep knowledge of how to lock in advertisers. You may want to look more broadly at the nature of this worldwide competition. I also think predictions of cable/linear are premature and overlook the synergies between and among the various VIAC platforms

What about Utube? Doesn’t Alphabet have a seat at table? Maybe they acquire paramount or discovery? At one point is the content too much? Not enough hours in the day to absorb

The Google Search trends graph is a bit misleading. If you switch “the Mandalorian” to “Mandalorian”, the search index is much higher than Squid Games at multiple points in the time series (last 5 years). Also, there are other examples of Netflix shows that have reached similar search volume (ex: Money Heist) so correlating the price increases directly to Squid Game’s Google Search volume is a bit misleading.

https://trends.google.com/trends/explore?date=today%205-y&geo=US&q=squid%20games,money%20heist,mandalorian,the%20mandalorian

Yes, Amazon Prime has way more content than the other but they will pretty much let anyone put content on their service. Meaning there are lots of poor quality, ultra low budget independent films that they get at ultra low cost paying the content creators a fraction of a cent per view. Sadly, there is way more chaff than wheat in all that Amazon Prime content to consider it a real asset at this point. With that being said, the acquisition of MGM and its library will provide the some of the quality content that they really need, regardless of the price that they paid.

What, you are too good for Velocipastor 3: Triassic Trinity?

Can anyone name a better example of a white guy failing upward than John Stankey of AT&T? That guy was made to lose billions of dollars. At least he’s a modest guy though.

“Apple TV+ is Roman Roy” may be your best line ever.

In terms of library size, are you considering free versus paid? Of the 183 items currently on my “My Stuff” list at Prime, 105 require a purchase.

I want to comment on your last thought PS….about the need to understand data or your career growth will be stunted. I agree. But there is another side to the data equation…that if you don’t understand your career and life in general will also be stunted. Data captures information. It is dispassionate. Data does not capture the soul, the intuition, the emotion, the human factor. While there is a focus on empathy and soft skills…it is usually a discussion, while data is a tower of classes, instructions, information, technology and analysis. (Very often I find that professionals don’t even know how to actually apply the data. And in smaller organizations, they can collect it, but they can’t really afford the analytical staff or the disruption to to make the changes in operations that the data is revealing.) The human anecdote is often dismissed as invalid in comparison to the mound of data. But the anecdote and the stories they tell, must be integrated with the data in order to get an accurate picture. A few examples. Years ago I was in discussion with the philanthropic arm of Google when they told me they would no longer be funding any organization unless they can prove a wide swath of system change through the data they collect about their work, as opposed to anecdotal change in a single person’s life. As I explained, the nonprofit sector is about both—the system and the individual. The individual stories are what move donors. It does get back to the importance of powerful human stories…which is one of the reasons why Squid Games succeeded. I have also found that data is sometimes killing innovation. When presenting a new idea to an investor, some will say, “Show me the data to prove it.” But it’s a new idea….there is no data. Ideas are a risk. So how many great ideas does the request for data kill in their inception? So many people are waving the flag of data because that’s what they are supposed to believe and say to sound relevant. But there are two sides to this data coin. If a new generation is only believing data, while also only socializing on social media, without human interaction, humanity is up a creek.

Good point very well stated.

Discovery started as high brow, high minded edutainment and devolved into a cringe fest of dumb-downed reality shows. “Give the people what they want.”

Where are national broadcasters in the mix? Wouldn’t it make sense for Disney to link up with BBC World, ZDF, a TF1/Canal+ to bridge the gap and cash injections into the old world TV.

The chart under Lieutenant Acquirer is likely not a correct comparison as the Amazon Prime number would list a large number of films that are only available through subscribing to an Amazon Prime Channel (Starz / IFC / BET+/ etc) vs. an apples to apples comparison with Netflix or HBOMax. You need the Amazon Prime Video film number that counts what is available for free to Prime Video subscribers.

I noted that as well. I also assume the Prime number also represents or includes movies available to rent and steam for additional fees (not necessarily included with Prime). By that measure,the options through the iTunes Store combined with Apple TV+ would be make Apple comparable or even larger.

Had to look it up because you mentioned it, but didn’t put it on the graphs. Amazon Prime Video is available in “more than 200 countries” slightly more countries than Netflix. Kinda doesn’t follow the narrative you’re building up. However, I could only find support for 7 languages, and a given show isn’t guaranteed to have them all. That does.

Language is one barrier for global growth. Another is device compatibility. Disney+ doesn’t work on older smart TV’s, limiting its potential in places where folks don’t buy new sets every year. Not a trivial matter when the objective is raw distribution volume for a quasi-zero variable cost industry.

You’re great, Scott. Love listening to and reading you. BTW, it’s motherlode (not motherload).

You nailed it with the AppleTV+ being Roman Roy quote

I hope the new ‘talent’ over at CNN+ doesn’t make Don Lemon so jealous that he asks his boi Chris Cuomo to convince the talent to STFU because he’s out of his league.

Coming from a non-english speaking country (Chile) It’s been clear to me that that’s the main advantage of Netflix right now. It’s only a matter of time that the others start doing the same thing with local content. HBO has had great show coming out from Brazil, Argentina, Chile and some amazing shows from nordic countries as well.

If you recommend “Succeesion” I’ll watch it. Thank you for putting some streamimg in order