Bottom’s Up?

Audio Recording by George Hahn

“Sock!” wails my oldest son. We spring into action. Finding the door to my youngest son’s room open, we proceed inside to validate our fears. Our Great Dane, Leia, lies still on her dog bed, bigger than most queen mattresses, looking guilty. “Where is the other one, why did you leave your door open?” our oldest, holding up a singular Bombas sock, queries his younger brother. It’s painfully clear what’s happened. Leia has, again, eaten a sock. This revelation inspires a crisp trip to the vet.

The vet injects Leia with a small dose of apomorphine, which stimulates dopamine receptors located in the area of the brain reserved for vomiting. She’s uncomfortable for a few minutes, heaves, and we get the sock back. Bombas claims they give a pair to someone in need every time they sell a pair. I wonder if that person feels nauseated when this happens, similar to a rabbit’s blood pressure rising after a sibling rabbit dies. The previous sentence is ghoulish even for me.

But this isn’t a dog post.

Debbie Downers

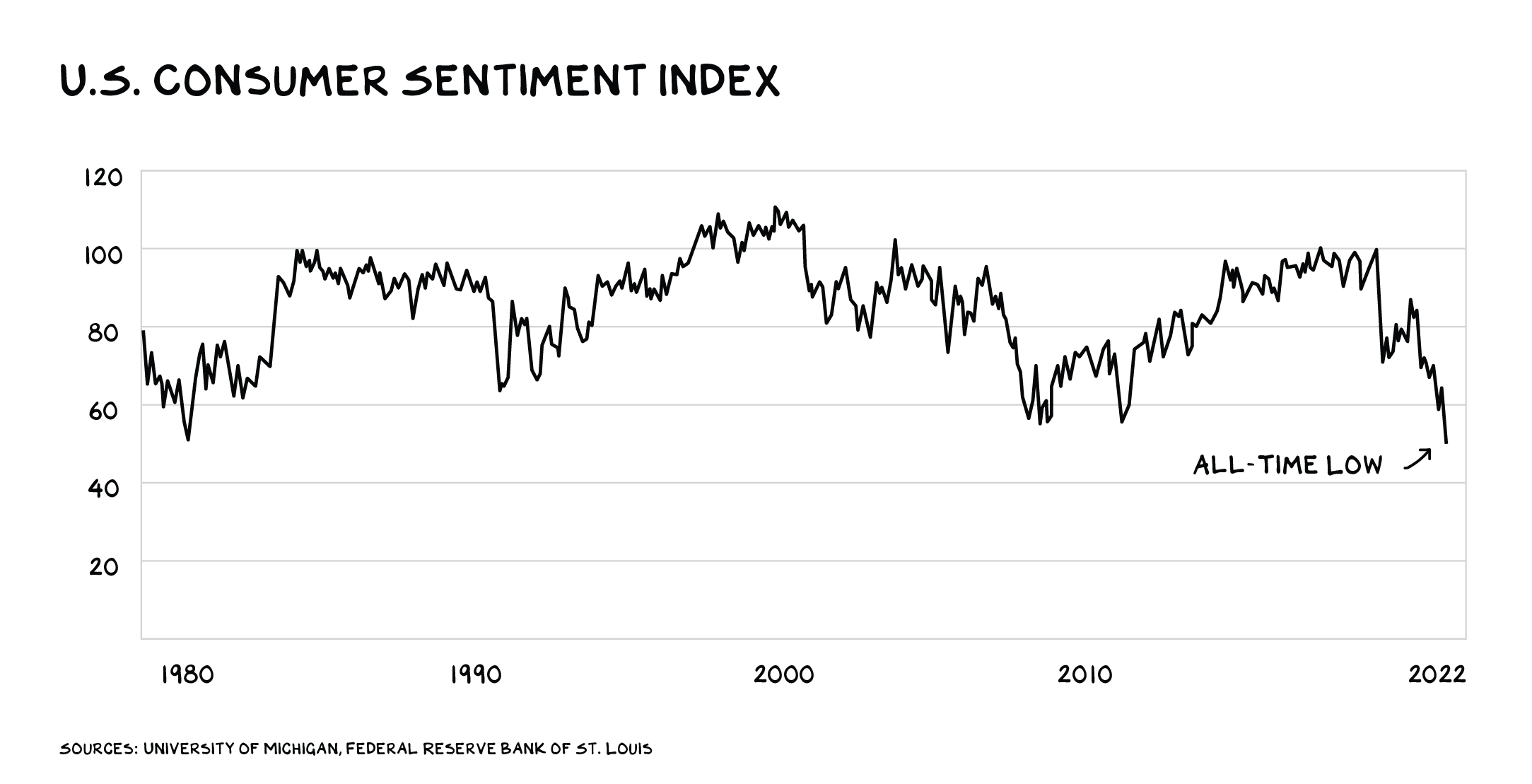

Only 10% of the nation feels positive about the economy, and last month consumer sentiment hit a record low. Americans are more anxious than they were even in 2008. Inflation is raising our collective blood pressure, and the media’s love of bad news is tipping us into hypertension. Anyone with a phone and a New York Times subscription has seen, over the past six months, 20 headlines regarding rising gas prices vs. 1 on their equally precipitous fall.

We’re witnessing similar pessimism among investors. Six in 10 fund managers say they’re taking less risk, the largest share … ever. Cash vs. stock allocation has surged to its greatest level since 2001, and more than half of managers say recession is likely.

We’re witnessing similar pessimism among investors. Six in 10 fund managers say they’re taking less risk, the largest share … ever. Cash vs. stock allocation has surged to its greatest level since 2001, and more than half of managers say recession is likely.

Both And

A difficult concept to grasp is that contradictory things can exist concurrently. This is partly what makes markets so challenging: A company reports significant revenue growth but the stock declines, as price is a function of millions of signals creating a set of expectations that are reflected in the stock leading up to earnings. It’s impossible for the human brain to process all of them. So we cling to binaries — up/down, good/bad — wherever possible. But binaries are black and white, and markets are in color.

U.S. GDP just contracted for the second quarter in a row — and for some people, that means a recession has already arrived. But … it hasn’t. I know this, because I just paid $140 for one adult and two kids tickets to “The Color Factory.” After waiting an hour, we were exposed to a “one-of-a-kind experience that immerses you in joy and color.” Not sure much joy was registered, but I did find out my “spirit color” is Majestic Gazpacho. Point is, there were several hour-plus lines in SoHo this past weekend so you could jump in ball pits, sample beauty products, or try on running shoes. Other anecdotal evidence: It’s become a foregone conclusion we were going into recession, which often means … we’re not.

A more robust determination will eventually be rendered by the National Bureau of Economic Research, and according to its chairman, the whole negative-GDP-in-two-consecutive-quarters thing “doesn’t make any sense.” Per the NBER, a recession is “a significant decline in economic activity that is spread across the economy and lasts more than a few months.” And even that’s just a rough guide. Case in point: The group identified the early days of the pandemic as a recession, though the contraction lasted only two months.

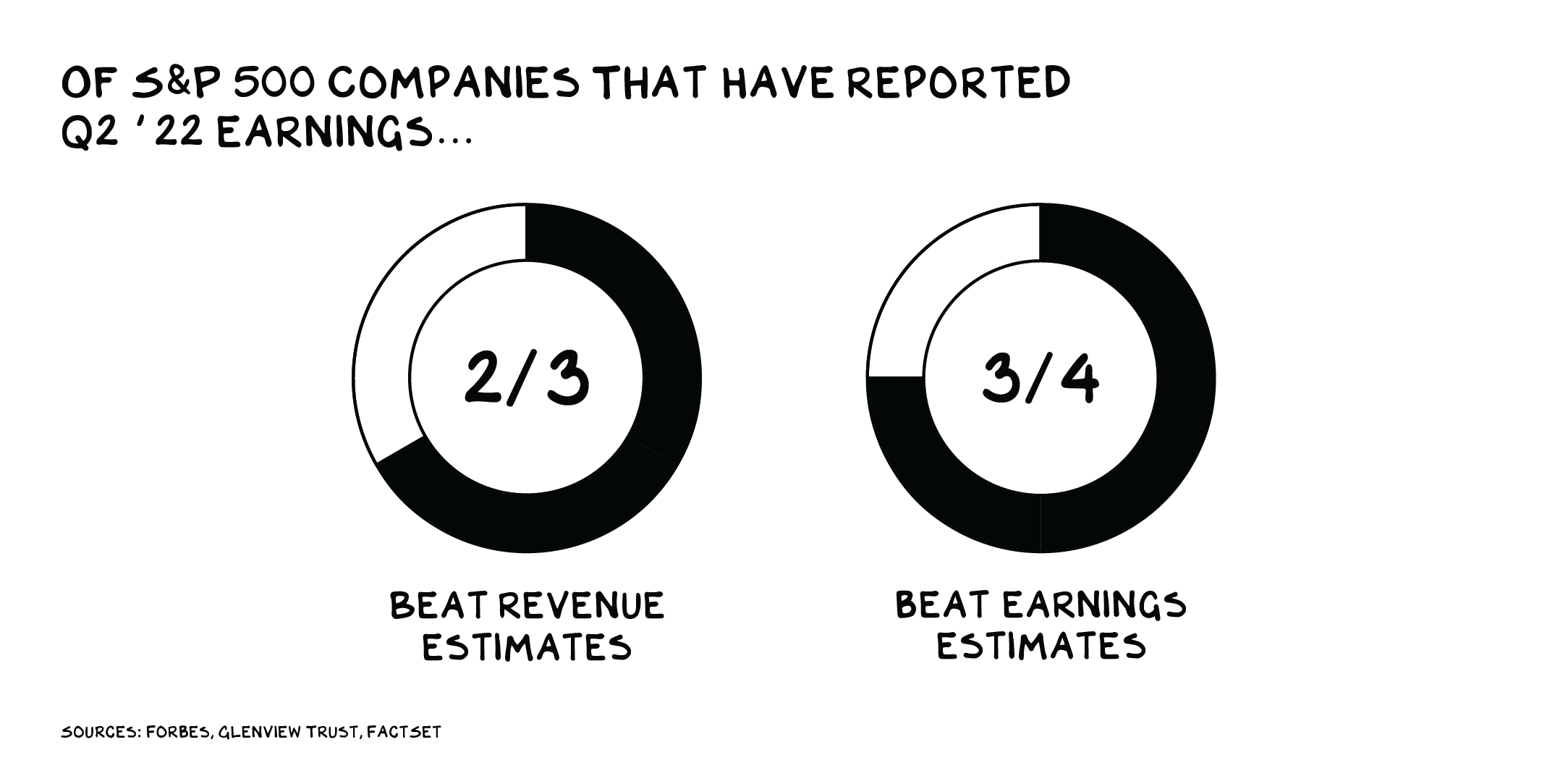

Employment has risen every month this year. We added more than 500,000 jobs in July, and the unemployment rate is near a 50-year low. Personal consumption (70% of the economy), adjusted for inflation, has been up in five of the last six months. (See above: “The Color Factory.”) Over half the S&P 500 has now reported second-quarter earnings — two in three companies have beaten Wall Street’s revenue estimates, and three in four have beaten earnings estimates. Our fears, one economist says, are “completely at odds with the reality. I’ve never seen a disjunction between the data and the general vibe quite as large as I saw.”

The red lights on the dashboard: Inflation is still high, household debt levels are rising (because of inflation), we need the GDP growth number to turn positive, and the war in Europe presents real risk to everyone everywhere. That consumers and investors are so anxious is itself cause for concern. Mass feelings of pessimism (warranted or not) can become self-fulfilling prophecies.

Oh, and there’s this:

Gag Reflex

Gag Reflex

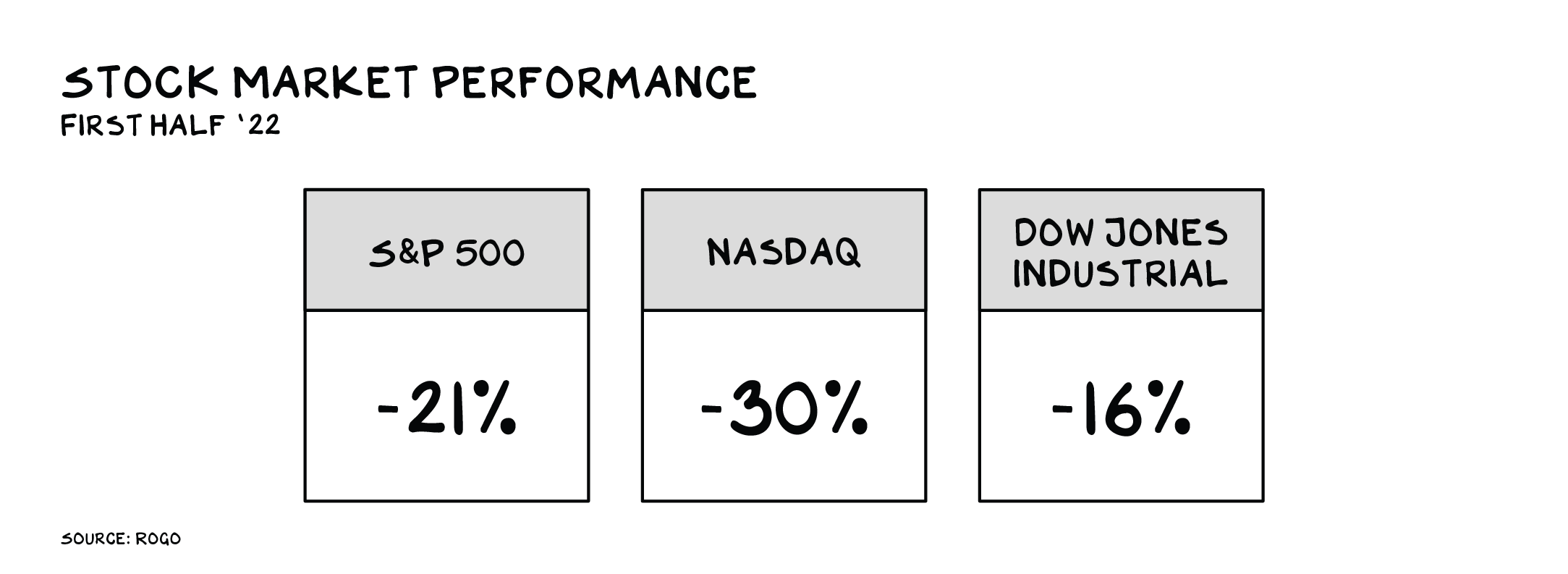

Just as we all became virologists when the pandemic hit, many of us now fancy ourselves economists. Every third tweet is a hot take on supply chains, and interest rates are cocktail party conversation. With the exception of a brief pandemic lapse, the market has been on a more than decade-long bull run. We saw “up and to the right” as the natural backdrop for stocks. Now that we’re seeing red, we’ve convinced ourselves that the market is suffering some sort of severe illness. Recession? Depression? Global collapse? Maybe. But more likely: The market is vomiting up stocks that should never have been ingested.

If we look at the stock market by sector, things aren’t that bad. Energy (albeit a Russia-Ukraine anomaly) rose 65% over the last 12 months. Utilities climbed 14%. Most other sectors, including real estate, industrials, and tech, are down, but not by much — and no more than 10%. There is, however, a vast force pulling the market down: unprofitable tech companies. Think Snap (down 86% in the last 12 months), Peloton (down 90%), and Roku (down 80%).

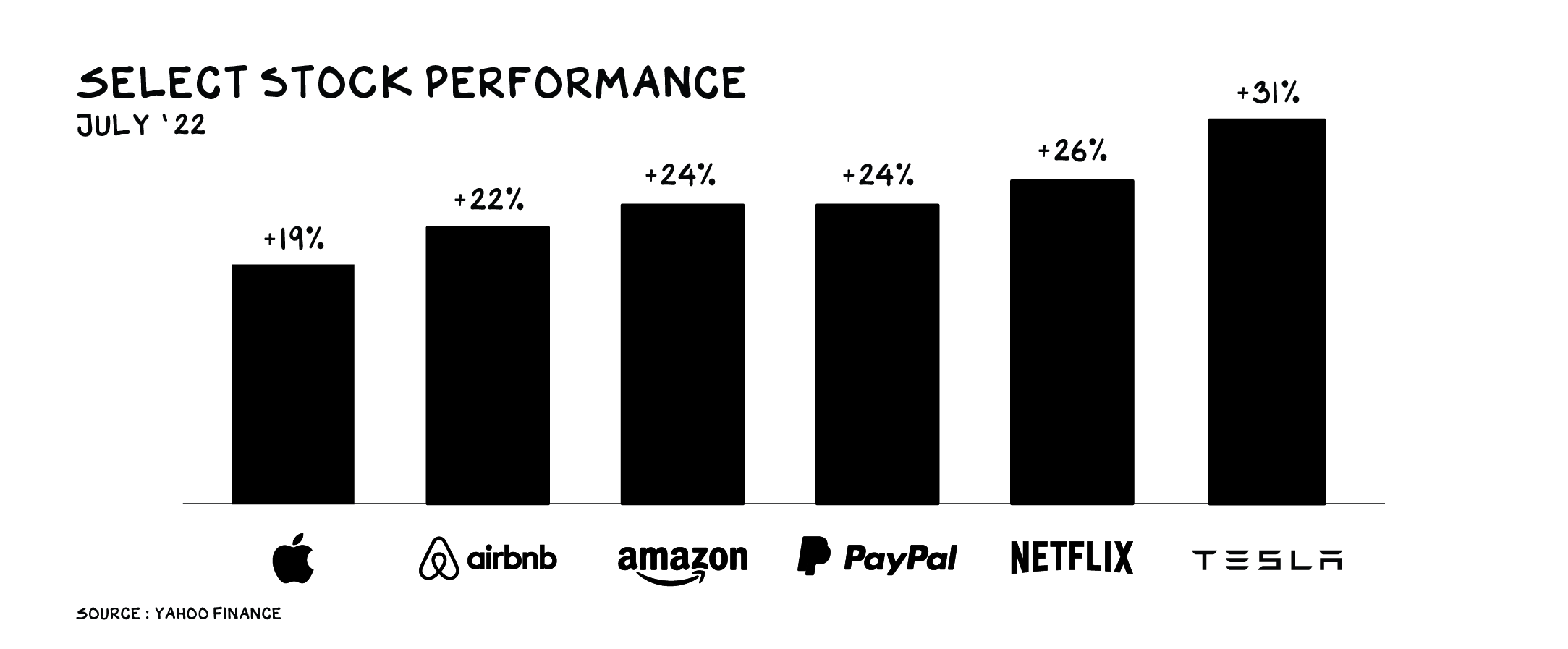

Within a year of the pandemic hitting, unprofitable tech stocks rose an average of 250%. These price movements made branded speculators, including Cathie Wood, wealthy. But the market’s mania for these sorts of equities was neither healthy nor normal. Most of these companies showed little-to-no evidence they could reach profitability, yet valuations promised sector domination, and many Web3 ventures were leveraged Ponzi schemes. The market’s apomorphine is fundamentals, and many companies, tokens, and platforms (e.g. Robinhood, most SPACS, all tokens sans BTC/ETH, and Celsius) were regurgitated by the market. This is healthy. And the healing may have begun: Many enduring tech companies just registered one of their best months in history.

Within a year of the pandemic hitting, unprofitable tech stocks rose an average of 250%. These price movements made branded speculators, including Cathie Wood, wealthy. But the market’s mania for these sorts of equities was neither healthy nor normal. Most of these companies showed little-to-no evidence they could reach profitability, yet valuations promised sector domination, and many Web3 ventures were leveraged Ponzi schemes. The market’s apomorphine is fundamentals, and many companies, tokens, and platforms (e.g. Robinhood, most SPACS, all tokens sans BTC/ETH, and Celsius) were regurgitated by the market. This is healthy. And the healing may have begun: Many enduring tech companies just registered one of their best months in history.

The pain we’re seeing in the stock market is the autoimmune response of a healthy, functioning economy. We thought we had an iron stomach, that we could digest anything — from synthetic shitcoin derivatives to Opendoor shares — but these were unwholesome, even pestilential.

Floor

In recent weeks, markets have rallied. The S&P 500 and Nasdaq hit lows in mid-July and have since risen 13% and 18%, respectively. Bitcoin appeared to hit a floor of $19,000 — it seems to have now stabilized at around $23,000. Ethereum’s up 50% for the month. The NFT market crashed spectacularly in early 2022; but I recently got an update from a crypto cold-storage company I’m invested in, Ledger: The company listed 10,000 NFTs for sale that will allow owners to get first access to a marketplace they’re launching — and sold out in 24 hours, generating more than $4 million.

Put another way, there’s still a market for many of these assets, which signals they’ll be enduring. Crypto and growth stock bubbles popped, but people still want Bitcoin and Ethereum and many tech companies are muscling through. Uber, for example, is a serially unprofitable business whose stock was halved between January and July. This week, however, the company posted positive free cash flow of $382 million in the most recent quarter — and the stock rebounded 20% in a day.

Digging in the Wrong Place

About a month ago I spoke with Ian Bremmer, President of Eurasia Group, on the Prof G Pod. Ian made a great point: We’ve all been talking about inflation and interest rates, but we’re focused on the wrong recession.

Ukrainian troops are camped along the front lines outside Kherson awaiting gunfire and airstrikes. Climate change is submerging or parching dense and developed regions all over the globe: The Rhine river is 14.5 inches away from being too shallow for cargo to pass through, half of the EU is at risk of drought, and the death toll from mass flooding in Kentucky is 37 and counting. Six in 10 Americans view members of the other political party not as political opponents, but as their enemy, and that number continues to climb. The greatest threat to our nation isn’t an economic recession, but losing the script re: what it means to be a country and a citizen. We have forgotten that Americans’ greatest allies will always be other Americans.

Our innovators shitpost the government when things are good and then expect a bailout when things get real. Just as the far right is attempting to conflate Christianity and masculinity with extreme conservatism, there is a dangerous smell of false equivalence emanating from the Valley, where a lack of respect for institutions and flouting any code of conduct correlates to innovation.

We each need our own stimulus, to be more enduring friends, neighbors, and citizens. To be kinder to each other, to realize our government is us, and to demonstrate more reverence for the most noble organization ever assembled, the U.S. government.

Rear Window

We’ve left the vet, headed home. Leia lays in the back, still queasy, and sulks for a few minutes. Unable to resist the open rear window, she soon has her ears flapping in the humid Florida breeze, taking breaks only to lay her head on the center console. Gas is $6, my stocks are down, and my sons’ socks no longer match. But Leia knows better — she’s focused on what’s important. I see her ears in the side-view mirror and have one thought: We’re going to be fine. We get back home, where the boys greet her and return to their devices. A sense of relief washes over me. Then Leia sprints up the stairs to my youngest’s room.

Life is so rich,

P.S. If you’re a product manager, you probably know Netflix’s Gibson Biddle — the guy who spearheaded many of the features that keep you glued to your couch. His next workshop, Measuring Product Success, is coming up on Tuesday. Don’t miss it.

29 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.

You know, while I find this blog to be cringingly condescending at times I also find it to be amazingly insightful and observant.

That said, this paragraph was indeed amazing:

“We each need our own stimulus, to be more enduring friends, neighbors, and citizens. To be kinder to each other, to realize our government is us, and to demonstrate more reverence for the most noble organization ever assembled, the U.S. government.”

-jack

I wish I understood the economy, I am an architect in a 100 person multiple disciplined firm. I currently have 14 active jobs, I typically have 6. Not one firm in our area went under due to Covid. If fact we couldn’t close because our engineers design public water, sewer and streets for municipalities.

Hi, I’ve tried 8 times to subscribe back to the newsletter but it’s not working. I used to get the email every week but now I don’t. Can you please help out? Thanks!

Scott, I am a big fan and have loved your generous content and the 2 sprints I have completed.

I seem to recall you saying (perhaps in earlier pod episodes) that you had previously taught university economics courses. Can you please share the textbook you used? In my teaching, I have used Krugman, Chiang, McConnell/Brue, Mankiw, and others. All of them define recession, usually in the opening sections on macro theory, as 2 consecutive quarters of declining RGDP.

Please share the textbook that doesn’t. And please have empathy for (and stop insulting) your countrymen who don’t have the luxury of defining recessions by their personal ability to spend $140 on entertainment.

Well done Scott. You’re really getting better as a writer!

Wait, hold on Scott, you forgot to mention in your rant “but we’re focused on the wrong recession”, the degeneration of humanity. Another man made war is happening but this one is against the integrity of humanity. The redefinition of who we are made and the value of a life deteriorating this nation. When a society no longer values life it will cease to operate civilly. We are creating killing machines that are taught a life is disposable, interchangeable, and expendable. Treating the symptom is not the solution to curing the cause.

“Disjunction between the data and the general vibe”

Excellent! This exact narrative regarding the stock market is being played in India. We saw some so called unicorns turn Popcorn and shares of a food delivery company called Zomato that raised a whopping amount… being sold for the price of tomato. The fact is none of this has fundamentally changed anything, its just market dynamics at its best. To say that we were not prepared for this is akin to going out on a cloudy day without an umbrella.

Hey man, I saw you jogging in Greenpoint Bklyn. a few months ago. Have you left NY for good, or vaca? Jeesh, seems like everyone’s leaving NYC. these days….

I agree with your “losing the script” but when you look at st louis fed non farm payroll and unemployment charts it seems it brightest right before the recession, right?

Life is certainly R I C H,,, thanks for reminding us

Excellent, insightful post, Scott. Wonder whether for many/most active retail investors (and perhaps a good number of the fundies too) the collective hubris of a rising market based on guess work, momentum trading and luck quickly turns into fear as they realise they actually don’t know what they are doing…but thought they did. This leads to emotional inaction and consolidates downturns.

Oh, where was my crystal ball when I needed it!

Can I turn in my homework using “Apomorphine” and “pestilential” in 3 sentences each on Thursday instead of Wednesday, Prog G?

Another great post, Scott. Yesssss, we’re a soundbite society that thinks the world IS binary. You can go left or right, up or down, but critical thinking and doing the work to bring more than one data point to the argument – no way! Unfortunately, that is also true of our media sources, who spend their energy fanning the flames of our fears, often without a great deal of effort devoted to the larger context, and hence, consumer sentiment. A motivational speaker once told a story of the Native Americans who worked the high steel in NYC and would walk 10” beams 30 feet 90 stories up without harnesses. He asked them how they did it. The answer was, “it’s simple, don’t look where you don’t want to go!” I’d argue that the media should do the same thing. Unless, of course, it’s willing to do a deeper dive and provide a richer context, that analyzes a larger and more nuanced data set and trust us to get it. Since won’t happen, Scott – keep up the good work!

While I do not agree exactly with your steadfastly optimistic outlook on the intestinal fortitude of the economy, it’s still nice to read. Cheers.

500,000 jobs filled, not added. Not new jobs just non-working people coming back to fill all those post-Covid vacancies.

That’s true, but the value to the larger economy is still real. Going from depleting savings and taking benefits to making money, and maybe paying some income tax, is one heck of a swing when comes to the burden on the taxpayer.

Great Article as always Scott – Keep up the great work

This PROF should take some anti-diarrhea cause what’s coming out of his mouth is sh*t.

To quote another commenter Yuri B: “Am I a pompous out of touch regime bootlicker?” YES, he is! My thoughts exactly about what this writer should ask himself, and do it PRONTO! GTFO with this only tech has a fundamentals problem in the market.

And a rule I have (I just made up), “always trust someone who asks Ian Bremmer what the situation is for the average person.”

People are starving all over the US. And this guy thinks the answer is the same as what contributed to a lot of this mess in the first place back in 2008. Looking down laughing at main street through a skewed lens of wall street.

It always amazes me when some elite professor tries to explain something that is obviously false. If Donald Trump was President and we had 2 down GDP quarters there would be no discussion about the meaning of “recession”. All the leftist professors would send a signed letter to the NYT saying the definition of “recession” is 2 quarters of declining GDP. Also, the way you try to show evenhandedness —-the ultra right , yada, yada, yada…..and to show fairness… the Valley does these bad things. Ultra right -vs- Valley. How about Ultra right, yada, yada, yada AND Ultra left, yada, yada yada. This type of sloppy “journalism” is a major reason that the Right will not trust the Left .

Great points Barry!

Thank you for your messaging about the financial environment that too many like to panic about with every up and down Wall street report. Just wish and hope real solutions to our biggest industry could be meaningfully started – medical industrial complex with only PROFIT being the guiding force, not compassion for people in pain, our injured, sick, or chronically ill. We either care for each other or end up the next one in line (regardless of one’s current place in the dwindling equity of health parameter) to be left abandoned outside a closed down community hospital or a profit driven major medical franchise doorway or if let in, put into bankruptcy when one’s insurance plan pulls its denial of service game.

Bro! John, this OP and his crony friends are the ones leaving people to be “left abandoned outside a closed down community hospital.” His message needs to be taken to the dump, cause it’s garbage.

@Giasone, You are just validating his point by your comments. At least you might want to provide some data, or even “alternative facts” to make your point 😀

@Ben by “his,” if his = @John M here or @Dr. Doyle or @Yuri B. Then, yes, I am validating their points, mostly. That is, minus @John saying “too many like to panic” as it seems he is letting OP off the hook, but John has compassion. It’s more than panic for people deciding whether to eat or get meds while OP buys $140 tickets and says there’s no recession or claiming tech is bad biz as a whole based on “fundamentals,” then revealing he invests in that “bad” tech later. Might as well be telling me his friend Jim Cramer told him what the price of milk is in Indiana. If a company goes public there is a product/market fit already established at some level.

Uber, huge demand for it, solves huge problem for people… yes, no positive cashflow until like yesterday as he said. But is that because there’s no demand or problem/solution? Or is it regulation, lobbying by special interest, and dinosaur thinking forcing companies to spew cash selling under market value until they get enough market share to compete? Or what is it? If a company gets enough traction for a solution to go public, there is something there… sure, there’s some problems and bad investments etc. I’m no pollyanna. OP is conflating a bunch of issues while telling mainstreet they are ok because wall street is doing better and that message is hot garbage.

Take your “alternative facts” insinuation of who I am to some other schumck, cause that ain’t me. Only pea brains can’t believe anyone but right wingers can call out a garbage click bait story when they see it.

Do you ever read what you write and think, “Am I a pompous out of touch regime bootlicker?” The definition of recession is 2 quarters of negative economic growth, yet you and Paul Krugman are quick to disregard that. Are you able to define what a woman is anymore?

Point is, there were several hour-plus lines in SoHo this past weekend so you could jump in ball pits, sample beauty products, or try on running shoes. Other anecdotal evidence: It’s become a foregone conclusion we were going into recession, which often means … we’re not.

I love your posts! One small quibble though: you hypothesize that the fact that there is still a market for NFTs, etc indicates that they are “enduring”. An alternative hypothesis is that the fact of there still being a market for some of this stuff indicates that the froth of easy Fed policy has not yet been fully wrung out of the system. Ie, that there is still downside below! Respectfully, Monty

As usual Scott, the current financial condition of the country depends on where you live, and your ‘place’ within the US economic system.

In other words, it’s Geography and your current economic Standing that matters.

Truthfully, most of the working class are fighting for their economic lives.

Recently, it was reported that US Credit Card debt is exploding. A new record high. Over 230 million new credit cards have been issued to Americans.

Americans cannot pay for their needs with their current wages.

The IMF stated that (53) nations are currently under tremendous financial stress. More will follow soon.

Inflation is undermining any increase in pay — throughout the world. Energy, Food and Rent costs continue to rise unabated.

Plus, many companies are quietly laying off workers, or have cut back in their hirings dramatically.

US gov’t reports 3.6% unemployment – it is closer to 12% (if you count ALL workers – whether or not they receive unemployment aid)

US GDP has decline two quarters in a row.

Two-thirds of the new jobs created over the past few months are “shit” jobs — those ‘service’ jobs that do not pay a living wage.

Climate change is getting increasingly nasty and devastating on all continents. Though, in America, we continue to ignore it because Corporate America is terrified of the prospect of having to pay for its resolutions.

Scott, I live in Middle America. Small towns and rural areas are being sacrificed. Jobs, medical care, education, and general standards of living are in steep decline.

Two Americas are developing — rapidly.

I believe that Nouriel Roubini and Jamie Dimond are right.

A financial “hurricane” is coming straight at us.

To think otherwise, is complete “delusional” thinking.

Too much debt — domestically and internationally. No real growth.

America needs to be told the truth.

Not the “interpretation” given to us by America’s 1% — through the Corporate Media.

But the truth as seen by those Americans who live on Main Street.

Thanks for a great letter and excellent perspective. I recently saw a chart somewhere that pointed to when Biden cancelled the oil pipeline and the ensuing increase in gasoline prices. Pipeline would have had no impact at this point but a great view about correlation not being causation–something that we need constant reminders about. Always easy to find something to pin on the guy you don’t like!