Gut vs. Emotion

My Esquire piece on big tech getting bigly (I know, I know…) is live online and hits newsstands next week.

What. A. Thrill.

Gut vs. Emotion

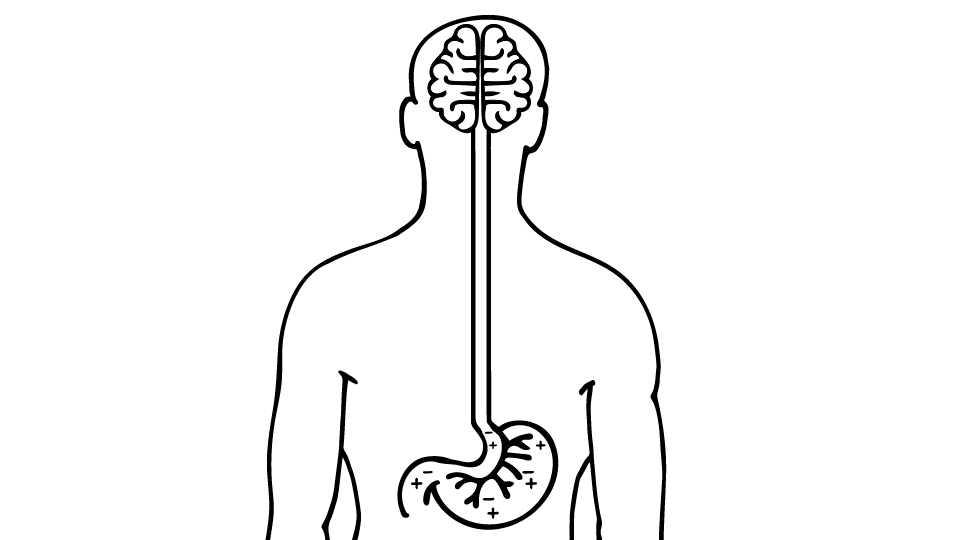

Instinct is powerful, and useful. We’re blessed with millions of years of experience that register a strong sense you shouldn’t pet a snake or eat things that smell foul. The heart is often linked to emotion. But it ends up the gut and the vagus nerve are the original gangsters, with a direct line to your brain, influencing how you feel and behave. Similar to the brain, a plethora of neurons form neurotransmitters in your gut. Supposedly the gray matter of a cat’s brain is nestled in your girth. The good-time hormones, serotonin and dopamine, spend more time hanging in your gut than your brain. So, the key to someone’s heart is in their gut.

It’s an upward journey via the brain-gut axis that originates from bacteria in your GI tract, moves past the heart via the vagus nerve, picks up momentum fueled by budding emotion, and then hits the TSA that is the brain — slow down, put all your emotions in a gray bin. You can leave your shoes on, and laptop in your bag, if you aren’t prone to wild mood swings (Pre-Check).

We need our emotions to run through a metal detector. Emotions are an important and rewarding part of life, but they’re often poor inputs to decision-making. It’s wonderful to feel love, but its ability to blur judgment, which informs good decisions, is the grist of war, child support, and other uber-bad outcomes.

DOWn

The Dow Jones puked a thousand points yesterday, after doing the same last week. Boom, the neurons in your gut start churning and sending signals that get emotion and momentum. I bought a retail stock three months ago, thinking it had been so badly beaten up, it was due for a pop. People would realize that, while the firm is in fact going out of business, it’s going to die more slowly than the market thinks. Btw, this is a decent descriptor of every old-media firm right now. This company’s stock, after yesterday’s close, is off 25%, and … that hurts my feelings. That is, if hurt were a mix of anger, embarrassment, and self-loathing. But I digress.

Not wanting more tears in the rain, my emotions tell me to sell, to limit my downside of hurt. But the TSA steps in and asks, if I hadn’t bought higher, and the stock was here now, sans the pain, how would I feel then? The answer is, I’d want to buy a bunch, instead of sell. Barry Ritholtz pointed out this phenomenon to me as the reason most retail investors have portfolios that underperform the market, and do worse than even the stocks in their portfolio. People let emotion get in the way. They sell when things have declined, and are good values, and fall in love with stocks that have skyrocketed, and may be overvalued. If you had opted to get off the roller coaster of the markets in March of ’08 (understandable), you’d have sold at a low, missed the short 14 months it took to recover all of it, and be much, much worse off.

Bishop

The markets are Bishop from Aliens. They move and reflect traits of the sentient, but have no heart. The market doesn’t feel sorry for you when you’re about to lose your home, nor is it jealous of you when you buy a jet — it doesn’t care at all. If the markets registered emotion, would Jeff Bezos have accrued a personal net worth higher than the GDP of Ukraine?

Sidebar: I wonder if AI is a step to artificial emotion, and what that might mean for us. The adaptation central to AI sounds to me like the process of when your brain and emotion begin to improve or worsen decisions. #deepthoughts

To be one with the markets, and be a great investor, you have to be somewhat synthetic. Your role model is the cold, mission-focused android officer of the Sulaco — Bishop, not Ripley.

For the last decade, the markets have rewarded, more than any human or synthetic, the only other true android investor … the market itself. The greatest reallocation of capital in history has been flows of capital out of active investors, like hedge funds, even bypassing the near-synthetic of quant funds, and going to full Bishop with ETFs, void of all humanity. ETFs are structured to balance and rebalance to mimic the market, or sector, with no gut or emotion getting in the way. Active managers as a profession could best be described, over the last decade, as awful … but expensive. Pension funds, sovereigns, and family offices have paid rich fees for the pleasure of underperforming the S&P by the amount of their fees, and then some.

Who is the Warren Buffet of our age? Bishop.

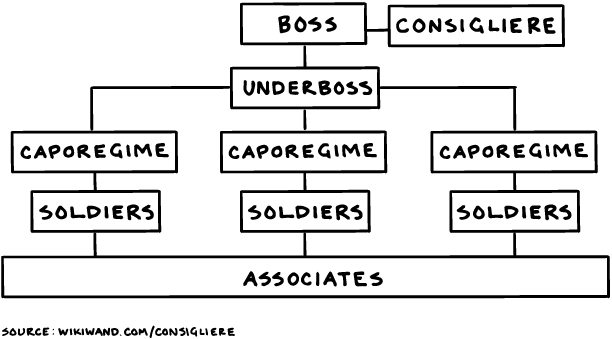

Consigliere

I’ve made my living as a trusted counselor and part of the power structure of the Calabrian Mafia, so to speak. I observe powerful people and their firms, and then tell them what they should do. They keep me around the seat of power and pay me well, as a consultant / director / teacher. There will always be a market for unvarnished counsel.

Before the age of 40, I was quick to offer advice, but slow to ask for it — a signal of immaturity and insecurity. Over the last decade I’ve recognized the importance of seeking others’ advice before making important decisions, and have also spent more time counseling others on non-business issues. Not because I have so many friends, or am especially empathetic, but because I bring a Bishop demeanor to the issue. Also, I enjoy it and volunteer it — offer to listen and provide no mercy / no malice thoughts to friends, students, and friends’ kids. A simple process: ask a ton of questions, let the vagus shoot straight to the brain, and offer your views — no adjectives … no embellishments … no heart.

What’s the one piece of advice to young people about the most important decision of their life? Btw, it’s not your career choice, but whom you decide to share your life with, full stop. Building a life with someone who loves you, and you love, near guarantees a life of reward interrupted by moments of pure joy. (Note: I don’t believe you need to be married to have a wonderful life.) Sharing your life with someone who’s unstable or has contempt for you is never being able to catch your breath long enough to relax and enjoy your blessings.

Young people need to try and override the emotion of scarcity. Let me explain. Key to evolution is trying to punch above your weight class and mix your DNA with someone who has better DNA — natural selection. People rejecting your overtures is a relatively accurate indicator you are in fact punching too high. You will, on a balanced scorecard, likely end up with someone in your weight class of character / success / looks / pedigree. Rejection is an immediate and credible message that the object of your affections has better DNA than you, and knows it. Problem is, you begin associating rejection with better DNA to a fault. I’m not suggesting people don’t reach beyond their weight class, and not ask out the tall guy with the great hair. But that young people learn how to do one simple thing:

Like someone who likes you.

Someone who thinks you’re great, is a feature … not a bug. I’ve found most young people don’t end up with people until there has been some form of rejection from the other … which is interpreted as a signal of superior DNA. My dog, Zoe, picks the person who loves her the most. She’s the Oprah of relationships. Yes, punch above your weight class … but don’t fall into the trap of believing someone is better because they’re not that into you. It also doesn’t mean they are not worthy because they think you’re the bomb.

Zoe, and all of us, reach contentment when we recognize a shortcut to happiness: finding someone who chooses you over everything, and everyone, else.

Life is so rich,

0 Comments

Need more Scott in your life?

The Prof G Markets Pod now has a newsletter edition. Sign up here to receive it every Monday. What a thrill.